Restaurant Brands International (QSR) has a dividend yield of 3.7% and is trading at a discount to its historical valuations. Despite being one of the largest fast-food chains with a presence in over 120 countries, QSR is an overlooked name. In this article, we’ll examine whether the stock is a buy for dividend investors given its healthy dividend yield.

To begin with, let’s understand QSR’s business. The company was formed in late 2014 when Burger King and Tim Hortons merged. In 2017, it added Popeye’s to its fold, and in 2021, it acquired Firehouse Subs. Apart from these four segments, QSR also has an International segment. It also separately reports the results of Carrols Burger King restaurants and the Popeyes Louisiana Kitchen (PLK) China restaurants under the Restaurant Holdings segment. Earlier this year, the company acquired the remaining equity in Burger King China and has held that business for sale as it seeks a new controlling shareholder.

Restaurant Brands International Is Growing Modestly

Tim Hortons is the company’s biggest segment by revenue, but is also the slowest growing. Popeyes and Firehouse Subs both delivered double-digit organic revenue growth last year, but the growth is coming from a low base. The International segment also achieved nearly 10% revenue growth last year.

While QSR is not exactly a growth name, it is also not a business that’s past its peak, as is often the case with high dividend stocks. Despite the expected weak start to the year, the company is optimistic about delivering organic adjusted operating income growth of “at least 8%” this year.

Last year, Restaurant Brands unveiled its five-year growth outlook that targets annual sales growth of 8%, which includes 3% organic sales growth and 5% net restaurant growth. The company is also targeting an average annual adjusted operating income (AOI) growth of over 8% over the period. Analysts are modelling earnings growth of 10.2% this year and 8.2% in 2026.

QSR’s Dividend Policy

Dividends rank quite high in QSR’s capital allocation policy, and the company’s intent is “consistently growing its dividend with earnings," targeting a payout ratio between 40%-60% over the long term. Last year’s payout ratio was higher than the targeted range as the company increased its dividend despite the fall in earnings.

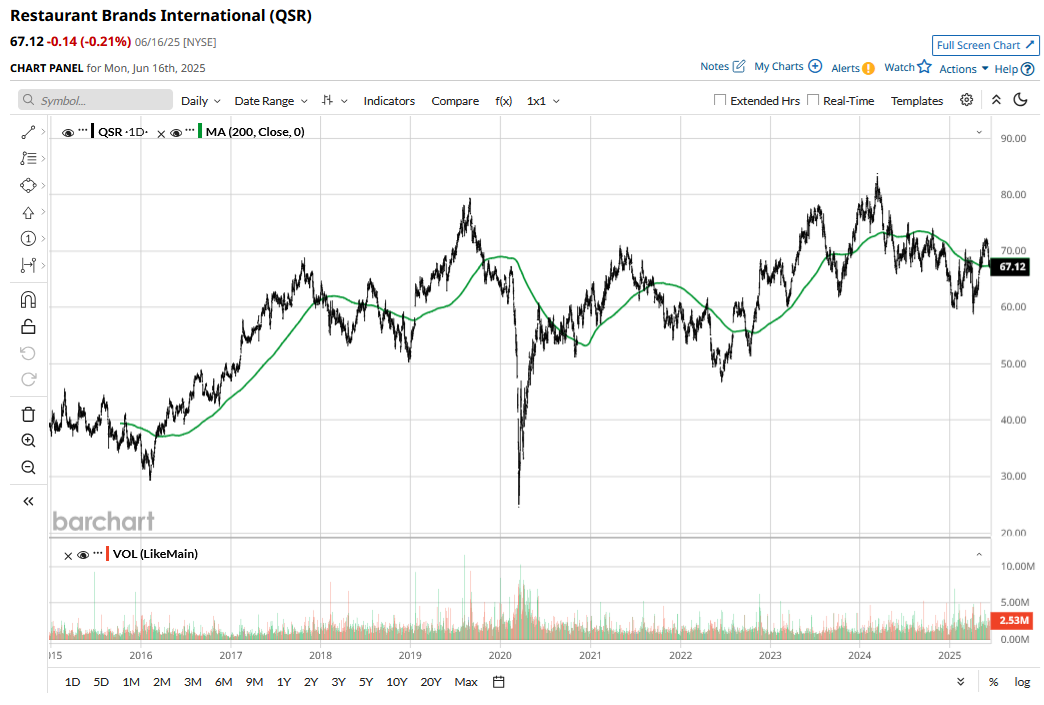

While Restaurant Brands’ dividend yield looks mouthwatering, the dividend growth has been quite tepid, and the payout has increased at an annualized pace of 3.6% over the last five years. Moreover, the stock’s capital gains have been modest at best, and even after accounting for dividends, its long-term returns trail the S&P 500 Index ($SPX).

QSR Stock Forecast

Of the 27 analysts covering QSR, 17 rate it as a “Strong Buy” and one as a “Moderate Buy.” Eight analysts rate the stock as a “Hold,” while 1 as a “Moderate Sell.” It has a mean target price of $76.70, which is 14.3% higher than the June 16 closing price.

Should You Buy QSR Stock?

QSR trades at a forward price-earnings (P/E) multiple of 18.3x, which is a discount to what the stock has historically traded at. It also trades at a discount to other companies in the industry, including McDonald’s (MCD), Starbucks (SBUX), and Chipotle Mexican Grill (CMG). The stock's dividend yield is also higher than the industry average.

While QSR has a stable business that continues to generate healthy cash flows, its debt levels can be concerning for some, given the high debt-equity ratio of 2.83x. The company has been growing inorganically and last year acquired Carrols Restaurant Group, which was the largest Burger King franchisee in the U.S. These acquisitions have added to the company's debt pile.

As for buying QSR stock, the stock wouldn’t appeal to a growth investor. However, the stock would fit the bill for someone seeking a high dividend stock and is comfortable with modest stock price appreciation over the medium term, with relative safety. The stock's valuations look reasonable, and there is scope for re-rating if the company can deliver on the long-term algorithmic growth that it has outlined.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.