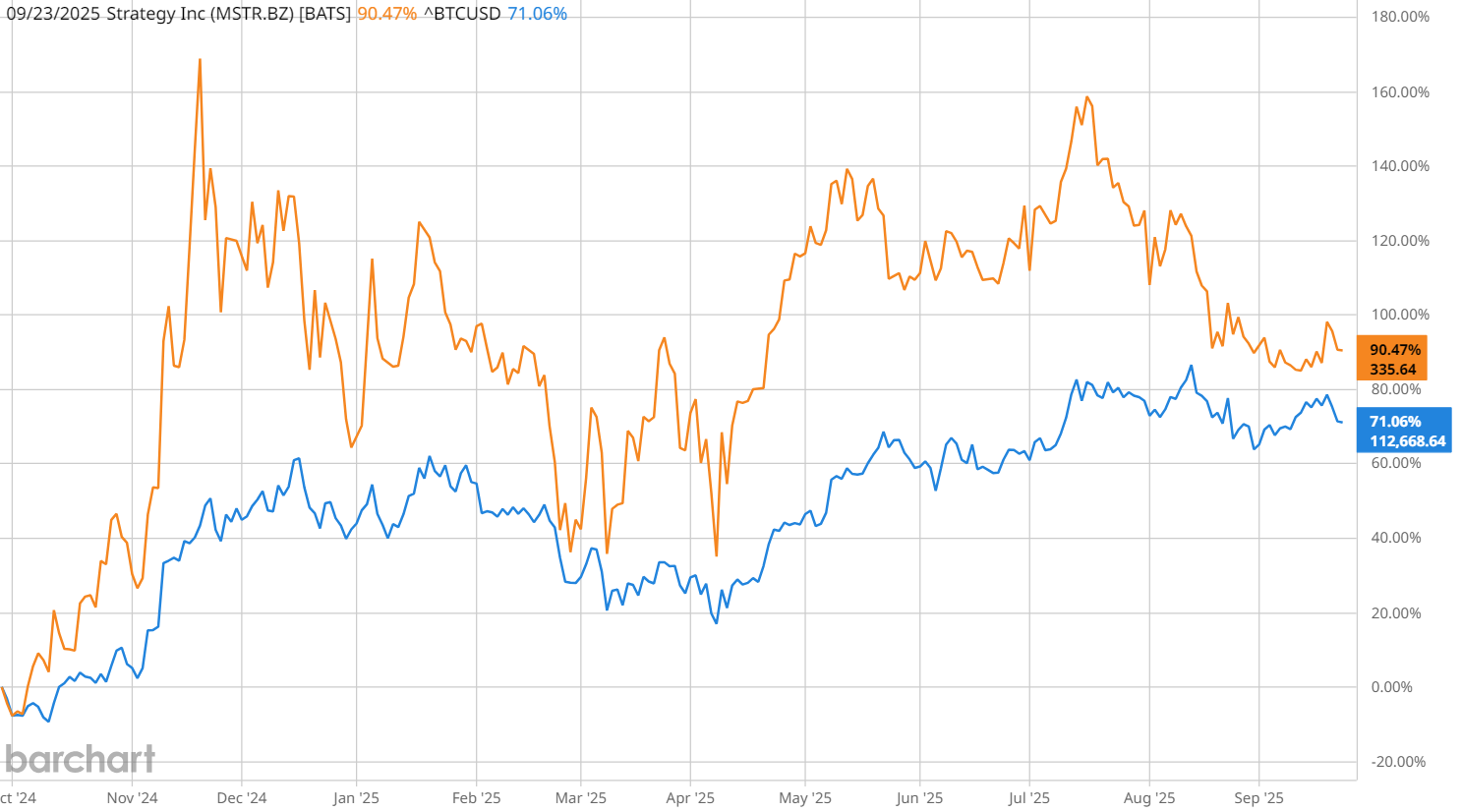

Not long ago, buying Strategy (MSTR), the crypto treasury company formerly known as MicroStrategy, was like buying Bitcoin (BTCUSD) at a 3x premium. But lately, that premium has been sliding — fast.

During last Friday’s Market on Close livestream, John Rowland, CMT, broke down the numbers:

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.

- Holdings: MicroStrategy owns 638,985 BTC.

- Math check: At ~$116,917 per coin (price at recording), the treasury value works out to about $261 worth of Bitcoin per share.

- Premium: What used to be 3x BTC’s value is now closer to 1.3x.

Why It Matters

- Mean reversion: John predicted earlier this year that MicroStrategy’s stock price would eventually converge toward the value of its actual Bitcoin actual holdings. That process is happening now.

- Proxy play: At a 3x premium, MSTR looked stretched. At around 1.3x, it’s starting to look like a reasonable Bitcoin proxy.

- Buying window? If you believe in Bitcoin long-term but prefer equities over direct crypto exposure, MicroStrategy is suddenly a much closer match.

Tools to Track This Story

- MSTR Interactive Chart → track RSI, MACD, and moving averages to confirm momentum.

- Crypto Market Overview → watch Bitcoin’s moves alongside other major cryptocurrency.

- Comparison Tool → set up side-by-side comparisons of BTC vs. MSTR price action.

The Bottom Line

MicroStrategy isn’t Bitcoin — but at today’s reduced premium, it may finally be a fair proxy. John Rowland thinks it’s closer than ever to being a legitimate way to get BTC exposure through the stock market.

Watch the clip from Market on Close to hear John’s take:

Stream the full episode for more insights on crypto equities and market movers.