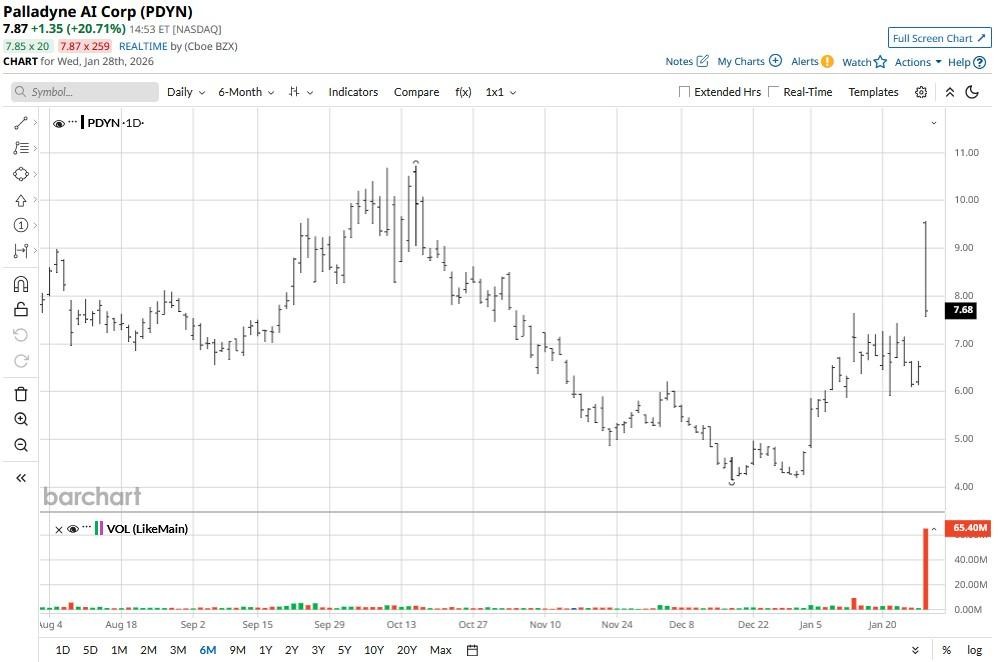

Palladyne AI (PDYN) stock soared roughly 50% on Jan. 28 after the defense and robotics software company said it has secured a new contract from the U.S. Air Force Research Laboratory (AFRL). According to PDYN’s press release today, AFRL has picked it for its project HANGTIME, aimed at advancing satellite-enabled swarming autonomy across air, land, sea, and space domains.

While Palladyne shares have reversed much of their gains in recent hours, they were trading at a year-to-date high of $9.52 on Wednesday morning.

Why AFRL Contract Doesn’t Warrant Buying Palladyne Stock

While the AFRL news is positive — even making believers wonder if PDYN stock could be the next Palantir (PLTR) — its financial reality exposes a sobering truth.

Investors are cautioned against chasing the rally in Palladyne AI, as the company is burning through cash with a net margin of -953%.

And yet, the stock is trading at a price-to-sales (P/S) multiple of about 56x currently, hardly leaving any room for a hiccup, much less an error.

Additionally, Palladyne’s standard relative strength index (14-day) sits north of 66 at the time of writing, indicating the upward momentum is approaching exhaustion.

PDYN Shares Remain a Speculative Bet in 2026

Palladyne shares also remain unattractive to own because the company’s recently filed $54 million shelf registration essentially means a dilution cliff is ahead.

What’s also worth mentioning is that defense contracts like the one PDYN won from AFRL today are often milestone-based as opposed to a lump-sump payment. Unless the contract translates to high-margin recurring revenue for Palladyne AI, the stock remains more speculative than fundamentals backed in 2026.

Furthermore, options contracts expiring mid-April have the lower price set at $5.19 only, indicating PDYN could tumble another 35% from here over the next three months.

How Wall Street Recommends Playing Palladyne AI

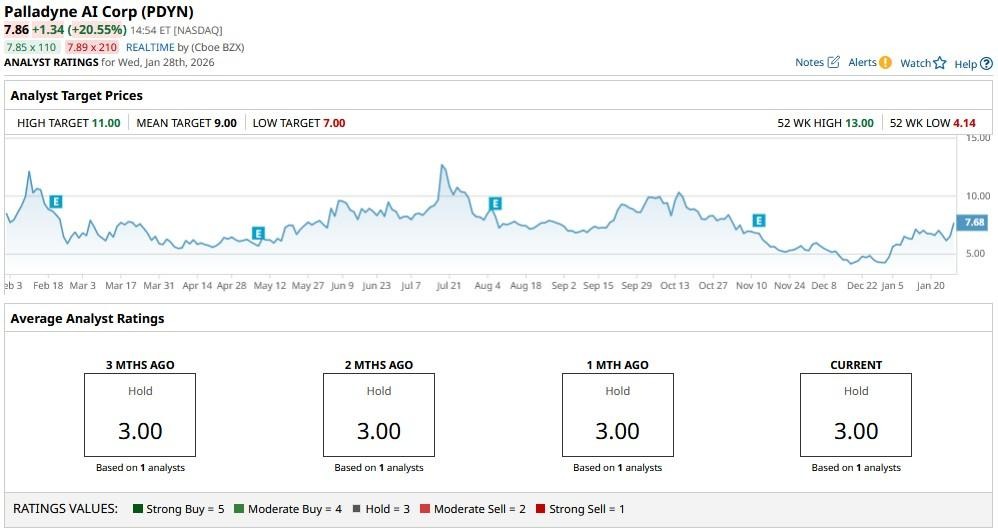

Investors should also note that Wall Street firms aren’t particularly constructive on PDYN shares either.

The consensus rating on Palladyne AI sits at a “Hold,” with price targets as low as $7, indicating potential downside of 11% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.