With a market cap of $24.2 billion, SoFi Technologies (SOFI) is a fintech company that provides banking, lending, investing, and financial planning services through a single app. SoFi reported an exceptionally strong second quarter, with explosive growth in member acquisition, revenue, profitability, and platform capabilities. After delivering seven consecutive quarters of profitability and doubling down on a diversified, capital-light revenue model, SoFi is giving investors more reason to believe in its long-term growth potential.

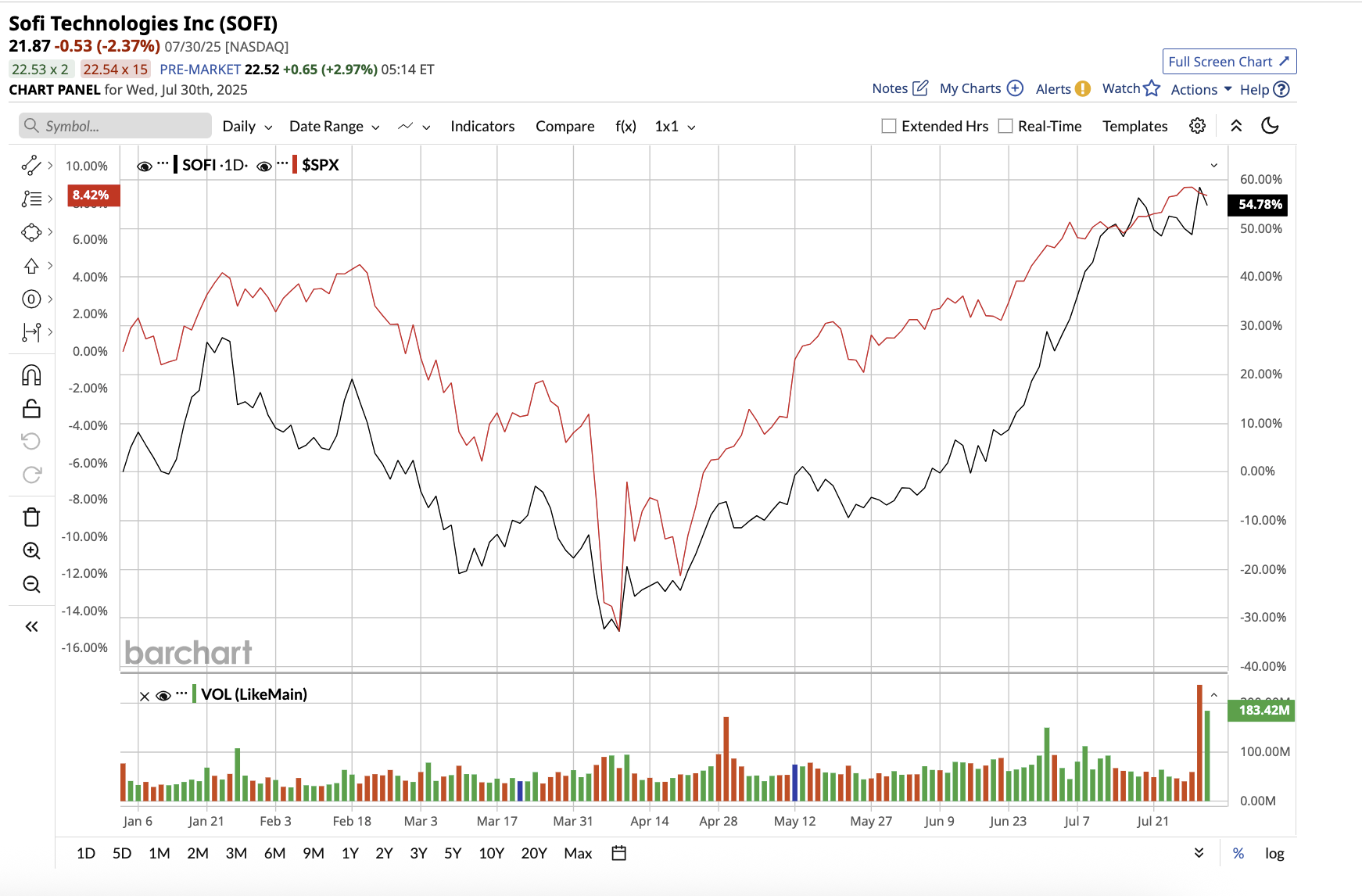

While SOFI stock has skyrocketed 52% year-to-date, compared to the S&P 500 Index’s ($SPX) modest gain of 8.7%, it is still down 7% from its 52-week high. Let’s find out if the stock is a buy now.

SoFi Reported Blockbuster Growth in Q2

In the second quarter, SoFi reported adjusted net revenue of $858 million, up 44% year-over-year (YoY), the company’s fastest growth in over two years. Both member and product growth c’limbed by 34%, with fee-based revenue rising 72% to a record $378 million. SoFi added a record 850,000 new members in the second quarter, up 34% year over year, bringing its total membership to 11.7 million. It also added 1.3 million new products, a 34% increase, totaling 17 million products.

Interestingly, 35% of new products were adopted by existing members, indicating strong cross-selling dynamics. YoY. Additionally, tangible book value increased by more than $1 billion, reaching $5.3 billion. Adjusted earnings increased from $0.01 per share the previous year to an outstanding $0.08 per share. These staggering numbers can be attributed to SoFi’s diverse product ecosystem, rapid member and product growth, and an increasingly capital-light business model.

SoFi’s Loan Platform Business (LPB), which powers third-party originations and loan referrals, is growing rapidly. In the second quarter, LPB brought in $131 million in adjusted net revenue. In just one year, this segment has originated over $9.5 billion in loans and generated more than $500 million in high-margin, fee-based revenue. What is more interesting is that LPB is now larger than SoFi’s original business (student loan refinancing). Management anticipates the Loan Platform’s revenue could soon reach $1 billion. Despite being SoFi’s oldest division, the Lending segment had its best quarter yet, generating $447 million in adjusted net revenue, up 32% year on year. The company’s Financial Services and Technology segment generated $472 million, a 74% YoY increase, and now accounts for 55% of overall revenue.

One of SoFi’s quiet superpowers is its ability to fund loan originations with member deposits, lowering its cost of capital compared to many competitors. Total deposits increased by $2.3 billion to $29.5 billion, while total cash and equivalents stood at $2.7 billion at the end of the second quarter. In the Q2 earnings call, management discussed how SoFi is considering a bold move to tokenize its loans in the future. This aims to fractionalize ownership and allow investors to purchase loan assets in the same way that they would equities. If successful, it would increase SoFi loan accessibility, liquidity, and transparency.

Driven by a stellar first half, SoFi raised its full-year guidance. Adjusted net revenue is expected to increase by 30% to $3.375 billion, driven by a 30% increase in new members of more than $3 million. Adjusted earnings per share could reach $0.31, up from $0.15 in 2024.

Analysts who cover SoFi stock anticipate revenue and earnings in line with management’s projections. Analysts expect revenue to rise by 21.9% to $4.1 billion in 2026, followed by a 76% increase in earnings to $0.53 per share. Trading at 41 times forward 2026 estimated earnings, SoFi stock appears expensive while also reflecting investors’ confidence in the company’s long-term growth potential.

What Does Wall Street Say About SOFI Stock?

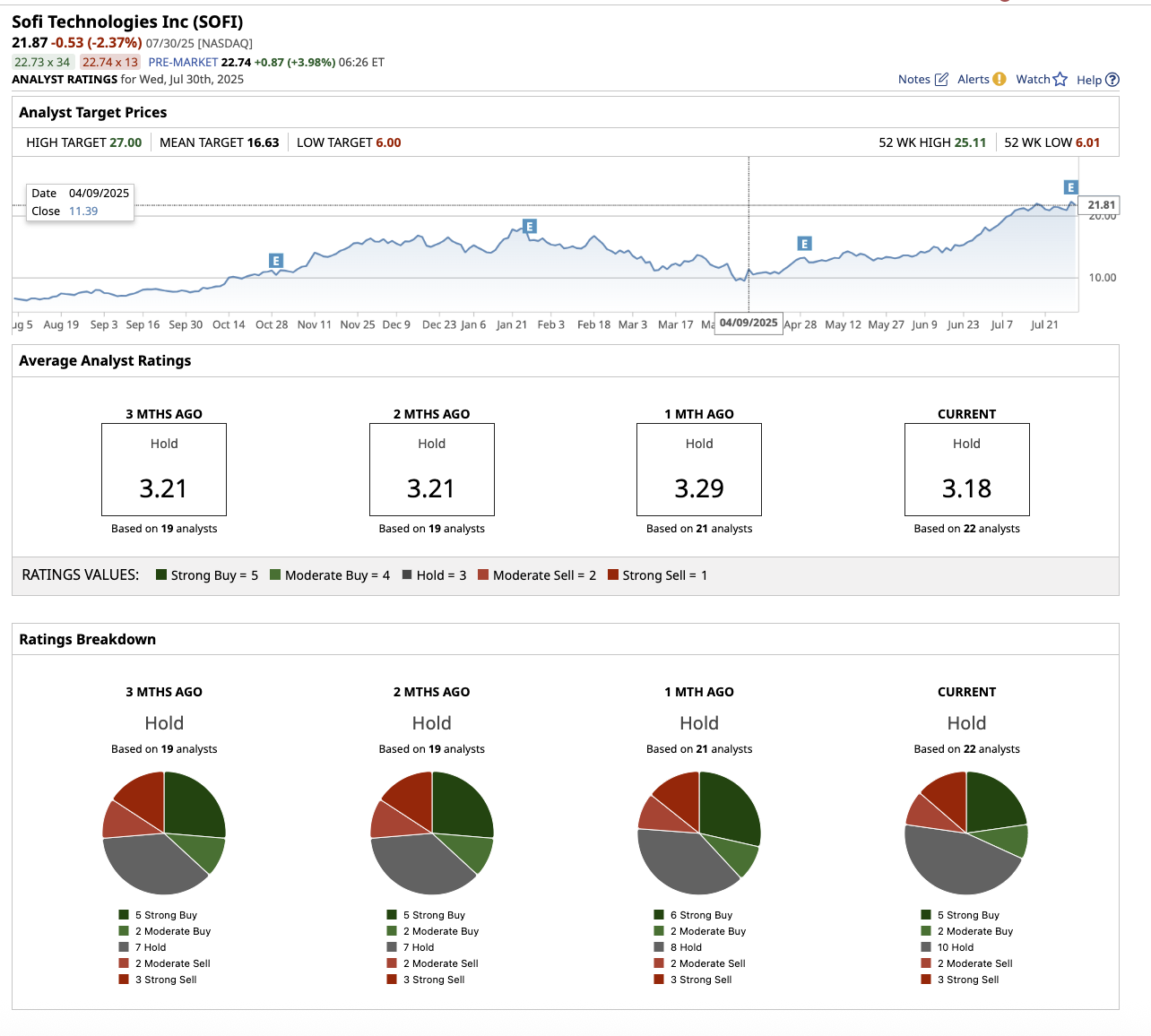

Overall, Wall Street has rated SOFI stock a “Hold.” Out of the 22 analysts covering the stock, five have a “Strong Buy” recommendation, two rate it a “Moderate Buy,” 10 suggest a “Hold,” two analysts suggest a “Moderate Sell,” and three recommend a “Strong Sell.” The stock has surpassed its average price target of $16.63. However, the Street-high target price of $27 implies potential upside of 18% from current levels.

The Bottom Line on SoFi Stock

SoFi’s second-quarter results show its position as a high-growth, tech-forward financial powerhouse. As CEO, Anthony Noto stated, “Despite the significant growth we have achieved to date, we are just getting started.”

With a clear focus on innovation, particularly in crypto, artificial intelligence (AI), and a member-first product ecosystem, SoFi is set for a stronger future, making it one of the best fintech stocks to buy now. That said, given that the stock is trading at a premium, cautious investors may prefer to build positions gradually around the $13 to $15 range to maintain a margin of safety.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.