Artificial intelligence (AI) has been one of the most significant catalysts behind the stock market’s rally over the past couple of years. With tech giants pouring billions into AI infrastructure and businesses across industries racing to adopt the technology, many AI-linked companies have seen their share prices surge. Yet, not every stock in this space has appreciated significantly. Some, despite strong AI-driven tailwinds, have struggled.

Marvell Technology (MRVL) is one such example. The semiconductor company, which specializes in providing custom infrastructure solutions for AI applications, has seen its stock decline by approximately 29% year-to-date. Notably, the demand for Marvell’s custom AI chips from data center operators has been strong, and that strength has been reflected in its financial performance. However, when management noted on its latest earnings call that overall data center revenue in the third quarter would likely remain flat compared to the second, the market punished the stock.

The company attributed the slowdown to the nonlinear nature of its AI chip business, where revenue can come in phases depending on how hyperscale customers build out their infrastructure. Marvell also emphasized that it expects a significantly stronger fourth quarter, which could help mitigate the volatility.

The uneven timing of orders is not unusual in a business tied closely to large-scale infrastructure projects. While investors tend to react sharply to near-term guidance, the bigger picture remains promising. Marvell’s core fundamentals remain intact, and the company is well-positioned to capture meaningful upside from the ongoing surge in AI adoption, which is likely to lead to a solid recovery in MRVL stock.

Marvell Focuses on Returning Value to Shareholders

Adding to the bullish case, Marvell’s management has demonstrated confidence in its future by committing to return capital to shareholders. The company recently announced a $5 billion stock repurchase program. It repurchased $540 million worth of stock through the first half of the current fiscal year. As of early August, roughly $2 billion remained under its prior authorization, and the company has already repurchased $300 million in the current quarter. Beyond that, Marvell entered into an accelerated share repurchase agreement worth $1 billion, which is another strong signal that management sees its shares as undervalued.

This combination of steady AI-driven demand, a robust balance sheet, and shareholder-friendly policies suggests Marvell is setting the stage for a comeback.

MRVL Stock: Growth Drivers in AI and Beyond

Looking ahead, Marvell will continue benefiting from robust demand for its custom XPU and XPU-attached solutions, alongside its fast-growing electro-optics interconnect portfolio. AI and cloud workloads remain the key revenue drivers in its data center business, while on-premise demand remains steady with an annualized run rate of about $500 million.

Marvell has made impressive progress with its 18 XPU and XPU-attached sockets, several of which are already in volume production. More importantly, its design win pipeline has expanded, representing multibillion-dollar lifetime revenue potential. As AI processors grow more complex, Marvell’s role as a full-service custom silicon provider positions it well to capture demand and deliver solid growth.

Marvell’s partnerships with hyperscale customers give it early insight into future data center architectures. This enabled the company to design Ethernet and UALink-based scale-up switches tailored to specific needs, positioning it to meet rising demand with custom solutions for next-generation AI data centers.

On the interconnect side, Marvell sees strong long-term growth as the industry transitions from copper to optical links to handle increasing bandwidth requirements. Its portfolio of DSPs, retimers, and silicon photonics is already seeing increasing adoption.

Custom silicon and electro-optics together now account for more than three-quarters of Marvell’s data center revenue. The rest comes from storage, switching, and security. All areas are showing renewed momentum. Storage sales have rebounded with healthier SSD and HDD markets, while adoption of Marvell’s next-generation switches is set to accelerate.

Outside the data center, Marvell is also seeing strength. Enterprise networking and carrier infrastructure revenue grew 43% year-over-year in the latest quarter, with further sequential growth expected as customers adopt refreshed product lines.

Wall Street’s Take on Marvell Stock

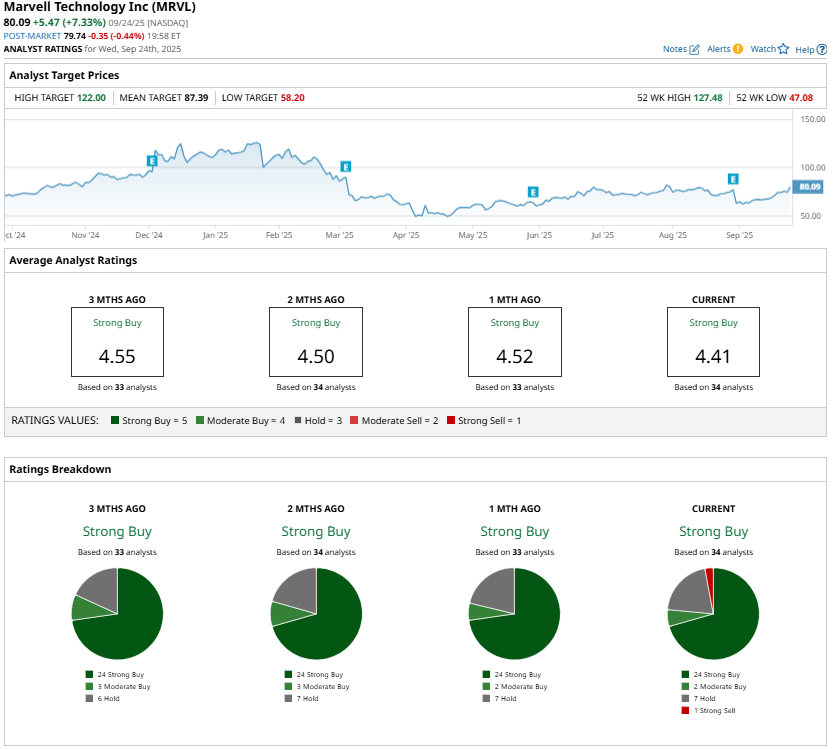

Analysts remain optimistic. Marvell carries a “Strong Buy” consensus rating, as the company is expected to benefit from AI-driven demand, design win momentum, and strategic positioning in next-generation data centers.

Conclusion: MRVL Stock Set for a Comeback

The decline in Marvell Technology’s stock price reflects near-term noise rather than a deterioration of its fundamentals. The company is benefiting from strong AI adoption, expanding its pipeline of custom solutions, and investing in long-term growth through electro-optics and next-generation interconnects. At the same time, its aggressive buyback program shows management’s confidence in the company’s future.

With AI workloads set to grow, this beaten-down AI stock is poised for a solid comeback, and the current weakness presents an attractive entry point.