I asked if the VIX was still too low in a late October 2024 Barchart article. After rising to the 65.72 level on August 5, 2024, the VIX fell below the 19 level when I concluded:

VIXY could be a valuable tool over the coming weeks as the current uncertainty remains bullish for the VIX and could cause the implied volatility of put and call options on S&P 500 stocks to soar. At the 20 level, the VIX could still be too low in the current environment.

The VIX fell to 12.70 in December 2025 before exploding to over 60 again in April 2025. With the volatility index back under 20, it could be back in the buy zone in June 2025.

The VIX measures implied volatility

The VIX measures the implied volatility of put and call options on the S&P 500 stocks. Implied volatility is the primary determinant of option prices, which serve as a form of price insurance on stocks. The demand for price insurance tends to rise when stock prices are falling and vice versa.

The chart illustrates the bullish trajectory of the SPY ETF, which tracks the S&P 500 index. SPY fell to a tariff-inspired 481.80 low on April 7, 2025, before rallying to over 600 in mid-June. The SPY has formed higher lows and higher highs, moving toward a challenge of the February 2025 record high of 613.23.

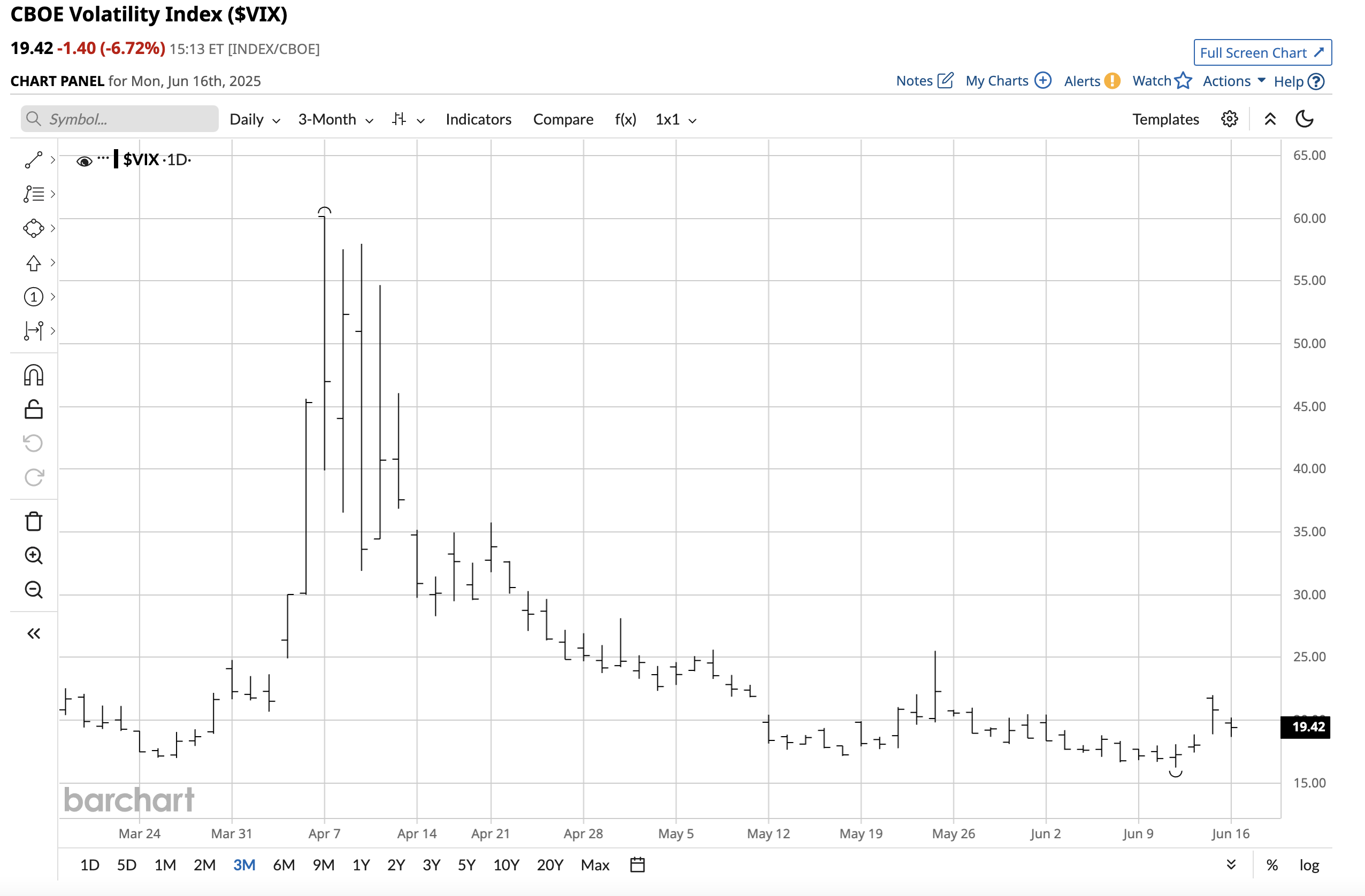

The daily VIX chart highlights the inverse relationship between the VIX and S&P 500. The VIX reached a high of 60.13 on April 7 and has since made lower highs and lower lows, falling below the 20 level in mid-June 2025.

The economic and geopolitical landscapes remain uncertain

Markets reflect the economic and geopolitical landscapes. The following factors suggest that the VIX could be too low at below the 20 level in June 2025:

- The war between Israel and Iran could escalate, leading to higher crude oil prices and increasing inflationary pressures weighing on the stock market. Moreover, any escalation in hostilities that causes Iranian or Israeli allies to join the battle could have far-reaching consequences, leading to market volatility across all asset classes, and the U.S. stock market is no exception.

- The war in Ukraine remains a clear and present danger to world peace. The bifurcation of the world’s nuclear powers has a significant impact on the global economy.

- The Trump administration’s trade policies caused significant stock market volatility in April and may continue to cause periodic price fluctuations as trade barriers ripple through the global economy.

- The declining U.S. dollar index signals an erosion in the faith and credit of the world’s leading fiat currency. Gold has surpassed the euro as the world’s second-leading reserve currency. A falling dollar could impact demand for U.S. equities, potentially increasing the volatility index.

- U.S. long-term interest rates remain elevated, making fixed-income assets attractive compared to stocks.

Several factors are influencing the U.S. stock market in mid-June 2025.

Surprises tend to cause the most volatility

The highest stock market price variance tends to come from events that shock the system, as we learned during the 2008 global financial crisis, the 2020 worldwide pandemic, and Russia’s 2022 invasion of Ukraine. While the VIX rose to the third-highest level in history at 65.73 in August 2024, as the U.S. election approached, it reached a lower high of 60.13 in April 2025, following U.S. tariffs that caused a stock market correction. The VIX only managed to climb to a 22 high on June 13, 2025, when Israel attacked Iran’s nuclear infrastructure. The volatility index quickly returned below the 20 level after reaching its most recent high.

Surprises that blindside the stock market will continue to have the most significant impact on the VIX as they cause market participants to seek price insurance to protect investment risk positions.

A wide range in 2025

The VIX volatility index has displayed substantial price variance in 2025.

The daily year-to-date chart highlights the 14.58 to 60.13 range in 2025. At just over 19 on June 16, the volatility index is a lot closer to the year’s low than its high, despite the Middle East conflict. Any surprises, escalation in conflicts, trade issues, or other factors that blindside investors could cause a significant increase in the VIX index in the blink of an eye. The bottom line is that the VIX’s downside is limited while the upside is explosive in mid-June 2025. When it comes to the issues facing the stock market and the VIX, we should expect elevated price variance in markets across all asset classes, and commodities are no exception. Commodities are global assets, which makes their prices susceptible to high price variance in the current environment.

VIXY is a short-term trading tool

The ProShares VIX Short-Term Futures ETF (VIXY) is a short-term trading tool that tracks the VIX index, moving higher and lower in tandem. At $49.81 per share, VIXY had over $79.1 million in assets under management. VIXY trades an average of over 1.27 million shares daily and charges a 0.85% management fee.

The three-month chart illustrates the VIXY’s rallies on April 8, reaching a high of $89.14 when the VIX exploded during the early days of tariff announcements. Meanwhile, VIXY followed the VIX on June 13, rising to a high of $54.68 per share, before pulling back below the 50 level on June 16 as stocks rallied and the VIX retreated below 20.

VIXY can be a valuable short-term trading tool on price weakness in the VIX as the economic and geopolitical landscapes remain a hornet’s nest of potential problems. However, the most substantial upside potential will likely occur if market surprises emerge over the coming days and weeks. Moreover, as liquidity declines during the summer, the potential for sudden volatility increases. Be careful in markets during the coming weeks and months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.