Live and feeder cattle futures have been bullish, no pun intended, since reaching bottoms in April 2020. The cattle futures rose to new record highs. While lean hog futures have rallied from the 2020 pandemic-inspired lows, they have not reached the same all-time high milestone as the cattle futures markets.

In an August 31 Barchart article, I asked, “What does the end of the 2023 grilling season mean for cattle futures?” I concluded the article with the following:

Meanwhile, live and feeder cattle futures have shown no signs of turning lower. However, the potential for a long-overdue correction is high at record levels. Anyone shorting live or feeder cattle should use tight stops as the trends remain bullish. In all commodities, the cure for high prices is always high prices as producers increase output, consumers reduce purchases, inventories build, and prices turn lower. Time will tell if cattle markets have reached unsustainable prices or if the bullish stampede will continue throughout the 2023/2024 offseason that begins next Monday, on Labor Day.

In late September 2023, the cattle rally took prices to new highs.

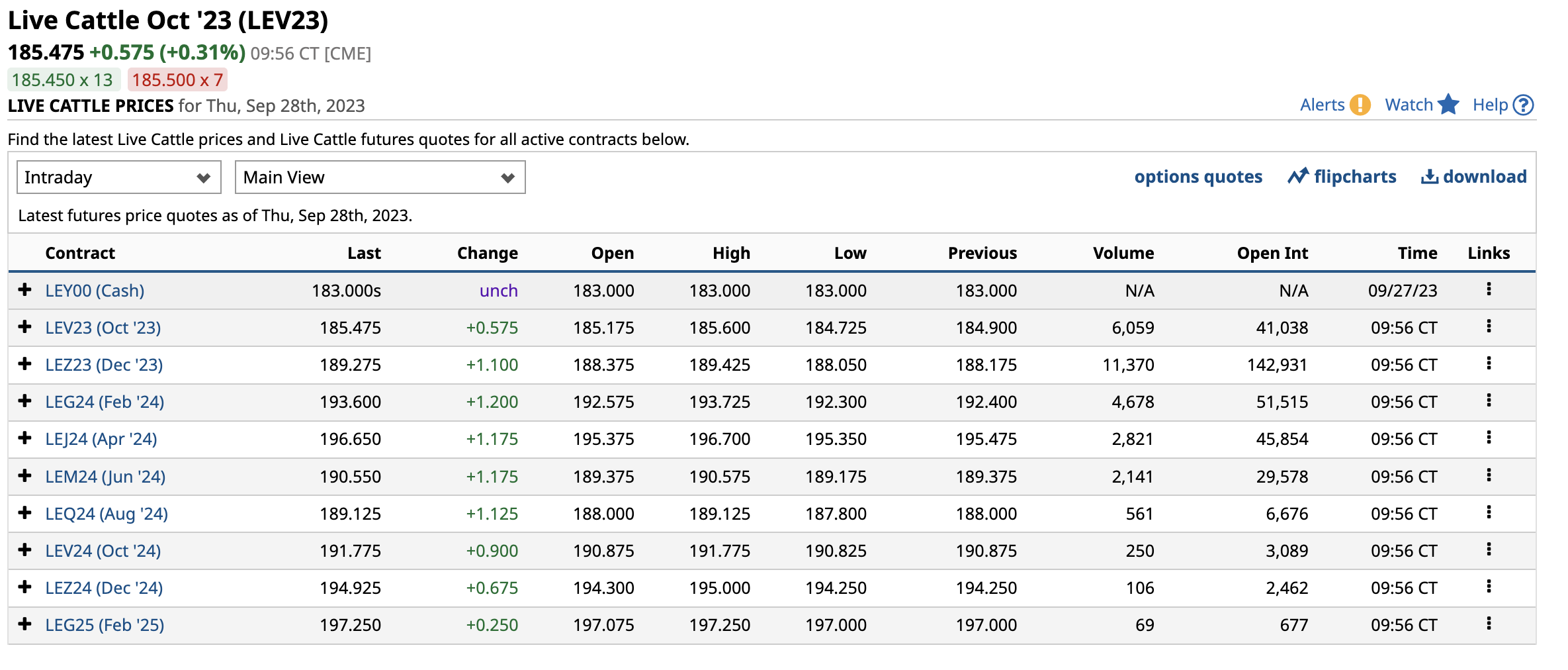

Live cattle: The trend and forward curve remains bullish

While live cattle futures prices have pulled back a touch, the bullish trend remains firmly intact.

The nine-month December live cattle futures chart displays the pattern of higher lows and higher highs that took the December contract to a $1.9205 per pound high on September 19. The continuous futures contract reached a record $1.8745 per pound high in September, and the December contract rose to an even higher high.

At new highs, futures markets often experience backwardation where the prices for deferred delivery are lower, indicating that an increase in production and declining demand will take prices lower over the coming months.

The forward live cattle curve indicates some seasonality, but the higher deferred prices suggest that the bull market will likely continue.

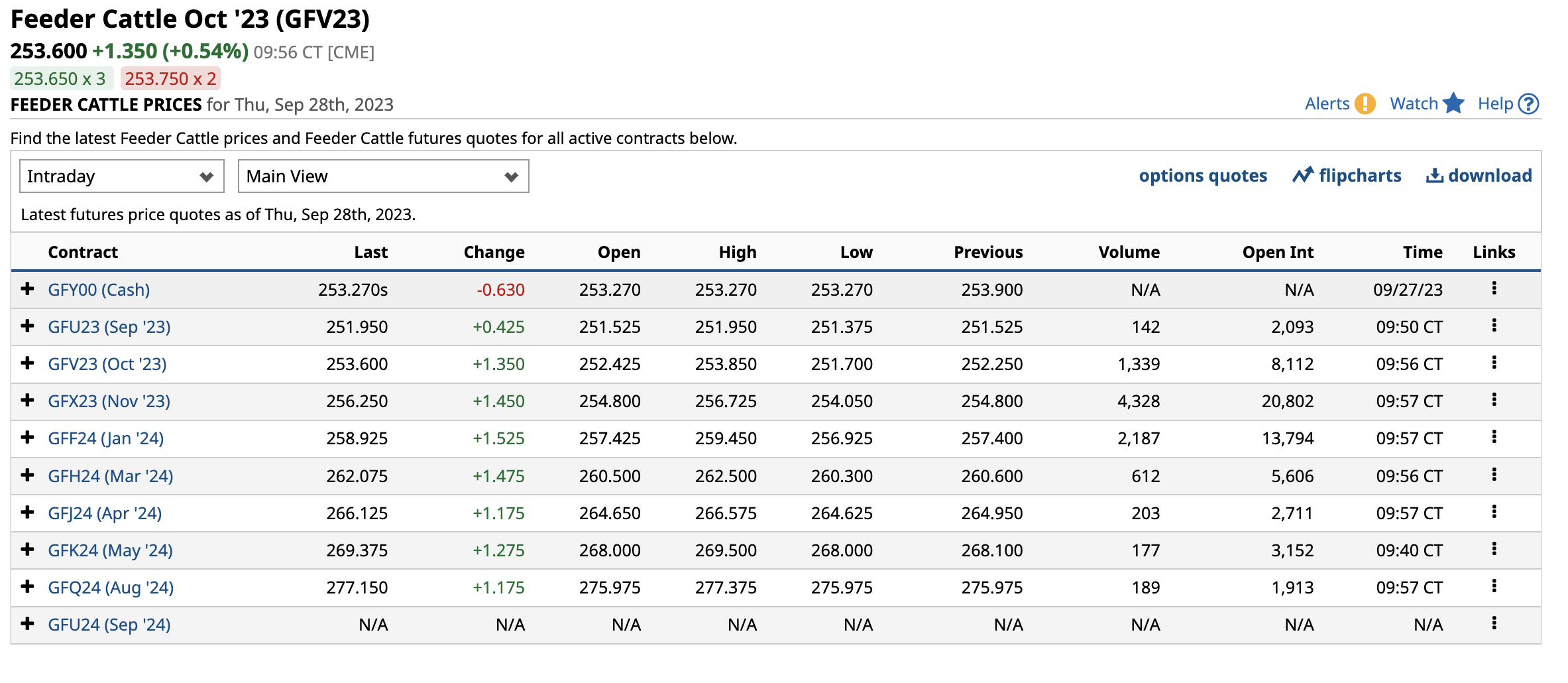

The feeder cattle also show no sign of a downside correction

The feeder cattle futures prices have pulled back more than the live cattle, but the bullish trend in feeders also remains intact in late September.

The nine-month November feeder cattle futures chart displays the pattern of higher lows and higher highs that took the November contract to a $2.6825 per pound high on September 15. The continuous futures contract reached a record $2.5750 per pound high in September, and the November contract rose to an even higher high.

The forward feeder cattle curve displays higher deferred prices until August 2024, indicating that the bull market will likely continue.

Seasonal factors could cause prices to correct from the current lofty levels, but beef prices are likely to remain high.

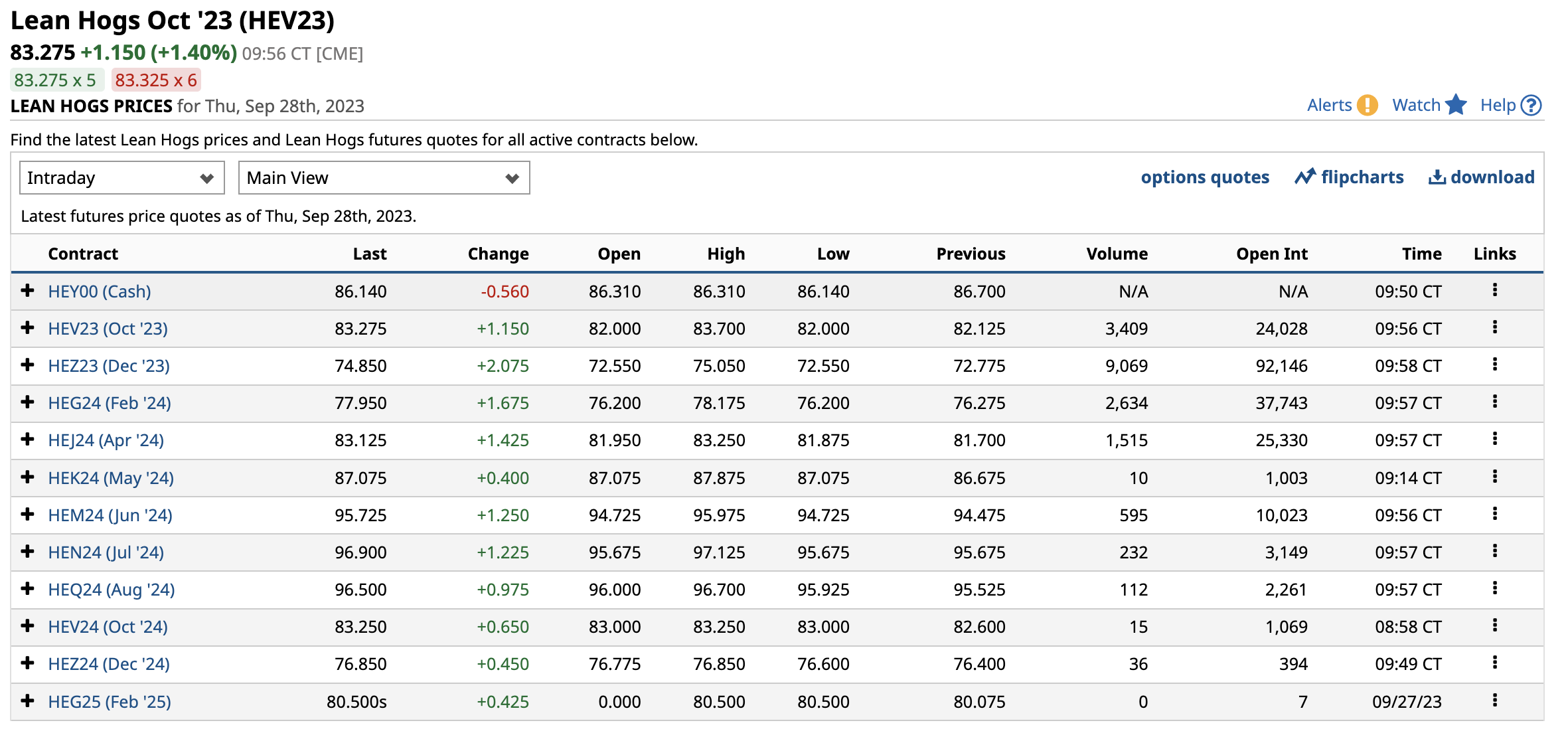

Hogs are another story: October-December spreads reflect seasonality

Cattle prices remain at record peaks, but hogs are a different story in late September 2023.

The nine-month December lean hog futures chart reflects the sideways trading over the past months and the decline to the low end of the trading range at the start of the offseason for demand.

The hog futures forward curve displays seasonal factors. However, pork remains far less expensive than beef, with prices below the $1 per pound level.

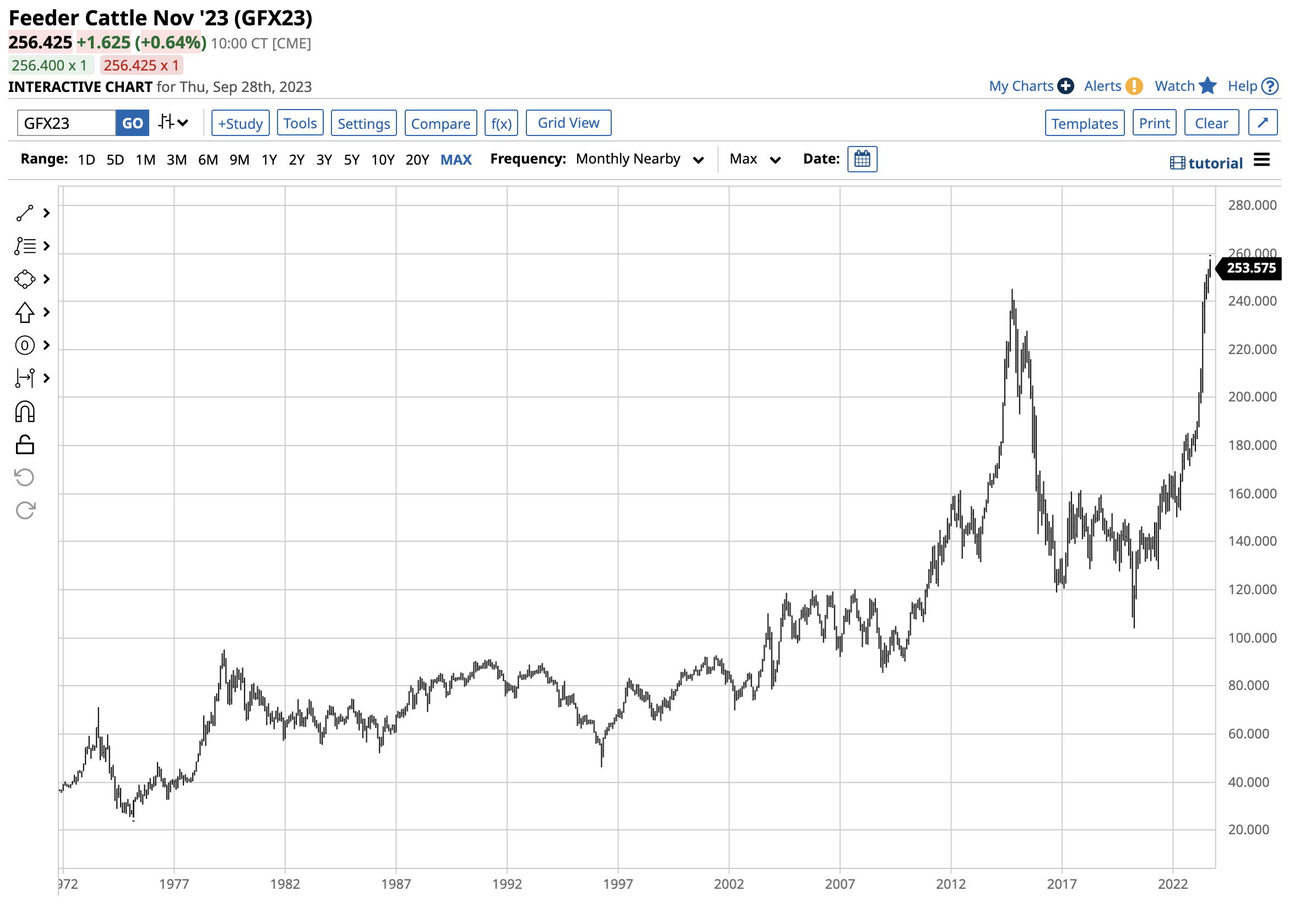

Cattle futures have been a one-way street since the 2020 lows

Cattle have been rallying since reaching the 2020 pandemic-inspired lows.

The long-term live cattle chart dating back to 1970 highlights the bullish trend since April 2020, when prices found a bottom at 81.45 cents per pound, the lowest level since December 2009. In 2023, live cattle eclipsed the 2004 record high and remained above that price in late September.

The long-term feeder cattle chart dating back fifty-three years displays a bullish trend since April 2020, when prices found a bottom at $1.0395 per pound, the lowest level since March 2010. In 2023, feeder cattle rose above the 2004 record high and remained above that price in late September. Live and feeder cattle futures have more than doubled since April 2020.

The 2020 bottoms were a divergence, providing a critical clue that massive rallies in cattle were on the horizon

One of the crucial factors to consider was that the 2020 lows impacted producers, while consumers suffered from shortages and much higher prices caused by meatpacking plant shutdowns during the pandemic. The 2020 lows were a divergence as they reflected producer and not consumer price levels.

The pandemic produced the conditions that created today’s inflationary pressures as central bank liquidity and government stimulus flooded the financial system. Today, consumers continue to pay sky-high prices for beef, while producers have much higher production costs. The odds favor continuing higher beef prices over the coming months, while pork prices seem set to reflect seasonal supply and demand fundamentals.

The bottom line is that cattle prices will likely remain high for the coming years, and new record peaks could be on the horizon.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.