In early 2016, NYMEX palladium futures fell to a $451.50 per ounce low. Palladium made higher lows and higher highs for over six years, reaching $3,380.50 per ounce on the nearby NYMEX palladium futures contract in March 2022. Palladium’s peak coincided with Russia’s invasion of Ukraine.

Palladium is a platinum group metal, and its composition, heat resistance, and density make it a critical ingredient in automobile catalytic converters that clean toxins from the environment. The 2022 price explosion became an implosion, with the most recent decline taking palladium below the $1,000 per ounce level for the first time since 2018. The Aberdeen Physical Palladium ETF product (PALL) moved higher and lower with the metal’s price.

An ugly decline

After reaching a $160 per ounce bottom in 2008, palladium futures made higher lows and higher highs, surpassing the $1,000 level in 2018.

The twenty-year NYMEX palladium futures chart shows the explosive move that took palladium futures to a $3,380.50 per ounce high in March 2022.

The spike high occurred when Russian troops invaded Ukraine, and sanctions on Russia threatened worldwide supplies. However, the futures market ran out of upside steam at the March 2022 peak, and an implosive trend followed the record high. In November 2023, palladium’s price probed below the $1,000 per ounce level, over one-third the price at the March 2022 high.

Russia and South Africa are the critical suppliers

The overwhelming percentage of worldwide palladium supplies come from two countries. In 2022, approximately 210 metric tons, or 6.75 million ounces of palladium, were extracted from the earth’s crust.

Source: Statista

The chart highlights that Russia and South Africa dominate global palladium production. Russia produced 88 tons in 2022, or 41.9% of supplies. South Africa was a close second with 80 tons of production, amounting to 38%. While deteriorating relations between Russia and the U.S./Europe pushed palladium prices to record highs in early 2022, South Africa is a BRICS bloc member, further threatening supplies in a bifurcated world.

Meanwhile, palladium prices rose to a level where consumers turned to other less expensive metals like platinum for catalytic converters and other industrial applications. The elasticity of demand at the record high prices in 2022 weighed on palladium, igniting the price implosion that took the precious metal below the $1,000 level at the most recent low.

The lowest price since 2018

Palladium’s bull market lasted from 2008 through 2022.

The ten-year NYMEX palladium futures chart shows the decline took the price to a $974.90 per ounce low in November 2023, the lowest price in over five years since September 2018.

Platinum has been a substitute, and the Pt-Pd spread narrowed

Palladium and platinum are platinum group metals, along with rhodium, ruthenium, iridium, and osmium. Platinum and palladium are the only platinum group metals that trade on futures exchanges. Rhodium, ruthenium, iridium, and osmium only trade in the physical market as they are far less liquid than the leading PGMs.

While gold, silver, and copper trade on the Chicago Mercantile Exchange’s COMEX division, platinum and palladium trade on the CME’s NYMEX division along with the leading traditional energy commodities because platinum and palladium are critical for energy production, refining, and automobile catalytic converters. Moreover, oil refineries processing raw petroleum into gasoline and distillate products use platinum and palladium in the refining catalysts because of the metal’s high heat resistance.

Platinum and palladium have many similar characteristics and compositions, making them interchangeable. Meanwhile, South Africa and Russia lead the world in platinum mine output.

The palladium-platinum spread monitors the metal’s price relationship.

The chart ({PAZ23}-{PLF24}) shows platinum rose to an over $1,500 per ounce premium to palladium in 2008 when platinum reached its all-time high at over $2,300 per ounce. Industrial consumers turned to palladium, substituting the metal for platinum over the following years. As the demand for palladium in automobile catalytic converters rose, palladium prices moved to a premium to platinum in 2017, and the premium increased to over $1,750 per ounce in April 2022.

Over the past months, palladium’s premium shrunk to below $155 per ounce at the most recent low, given the palladium bear market and platinum’s relative price stability. The move in the spread tells us industrial users have been substituting platinum for palladium for cost reasons.

PALL is an ETF to buy after the price carnage

While the spread continues to narrow, it has declined to a level where palladium prices should stabilize. Moreover, Russian, and South African dominance in platinum group metals production threatens worldwide supplies in the current bifurcated political landscape.

Platinum and palladium prices have declined, but palladium’s fall has been far more dramatic. Bear markets can take volatile commodity prices to illogical, irrational, and unreasonable prices that defy supply and demand fundamentals. However, they can create compelling opportunities for patient investors searching for undervalued assets.

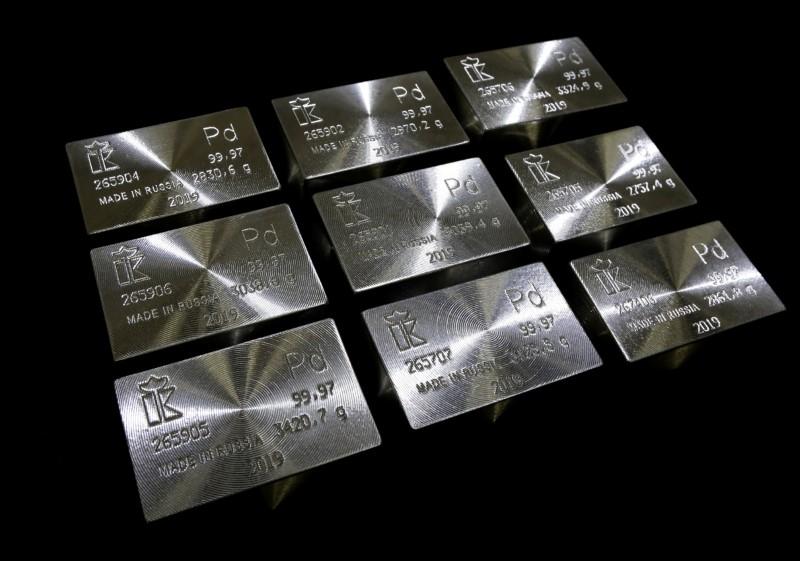

The most direct route for a palladium investment is via the physical market for palladium bars and coins. However, limited production and industrial demand make physical premiums high for buyers. Each NYMEX palladium futures contract contains 100 ounces of metal and has a delivery mechanism. Meanwhile, the Aberdeen Physical Palladium ETF product (PALL) is a liquid alternative to the futures arena for investors seeking palladium exposure without leverage or margin.

At the $97.13 per share level on November 22, PALL had just over $202.7 million in assets under management. PALL trades an average of 44,767 shares daily and charges a 0.60% management fee.

After reaching a $948.50 low on November 13, the active month December NYMEX palladium futures contract recovered 16.1% to $1,101.50 on November 21.

Over the same period, the PALL ETF rose 14.1% from $88.07 to $100.49 per share. PALL could miss highs or lows when the stock market is not operating, as palladium futures trade around the clock.

So far, the move below the $1,000 level could have been a spike blow-off low that created a golden buying opportunity in the rare industrial and precious metal. The most bullish factor facing palladium and the other platinum group metals is most of the production comes from two BRICS countries that are at odds with the U.S. and Europe.

I believe the plunge in palladium is a buying opportunity, and PALL is an ETF that could have a significant upside over the coming months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.