Cincinnati, Ohio-based The Kroger Co. (KR) operates as a food and drug retailer. The company operates a combination of food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. With a market cap of $44.7 billion, Kroger operates as one of the world's largest food retailers.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Kroger fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the grocery store industry.

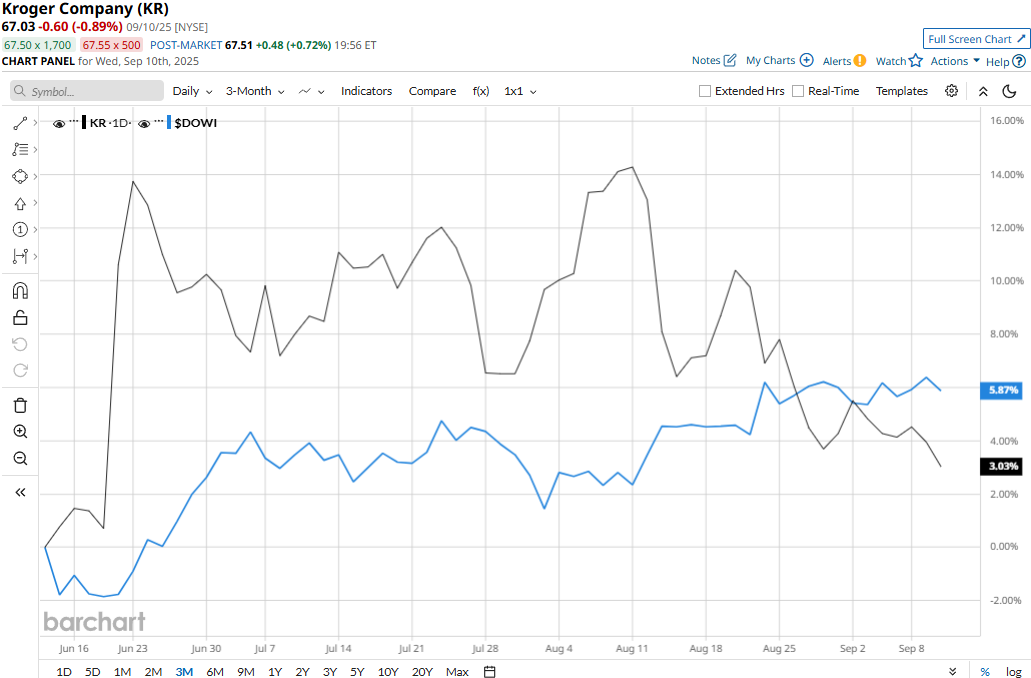

Kroger touched its all-time high of $74.90 on Aug. 11 and is currently trading 10.5% below that peak. Meanwhile, KR stock has gained 2.5% over the past three months, lagging behind the Dow Jones Industrial Average’s ($DOWI) 6.1% gains during the same time frame.

Kroger’s performance has been much more impressive over the longer term. KR stock prices have surged 9.6% on a YTD basis and 28.2% over the past 52 weeks, outpacing the Dow’s 6.9% gains in 2025 and 11.7% returns over the past year.

KR stock has traded consistently above its 200-day moving average over the past year and dropped below its 50-day moving average in recent weeks, highlighting its overall bullish trend and recent downturn.

Kroger’s stock prices soared 9.8% in a single trading session following the release of its Q1 results on Jun. 20. The quarter was marked with strong sales led by pharmacy, e-commerce, and fresh. The company made progress on streaming its operations, enhancing customer focus, and improving the shopping experience. Excluding fuel, Kroger Specialty Pharmacy, and adjustment items, its sales increased 3.7% compared to the year-ago quarter. Overall, its sales came in at $45.1 billion, slightly below Street expectations. Meanwhile, its adjusted EPS grew 4.2% year-over-year to $1.49, surpassing the consensus estimates by a notable margin.

Meanwhile, Kroger has outperformed its peer, Sprouts Farmers Market, Inc.’s (SFM) 5.5% gains in 2025, but underperformed SFM’s 32.1% surge over the past year.

Among the 21 analysts covering the KR stock, the consensus rating is a “Moderate Buy.” Its mean price target of $77.26 suggests a 15.3% upside potential from current price levels.

.jpg?w=600)