The argument continues to be made that the global soybean supply and demand table continues to tighten.

-

Seasonally, some tightening does tend to occur during the fall and winter due to China pulling all it can from Brazil.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. However, our reads on the soybean market's real supply and demand situation (cash price, basis, futures spreads) continue to tell us the global balance sheet is not tight.

I saw a piece recently talking about how the US soybean market had turned the corner, due in part to a “tight global balance sheet”. Uh-huh. All those who believe this, raise your hands. Okay. I see you. Now, to those of you with your hand raised, I’ve got a mountain top villa in south central Kansas to sell you.

I’m not saying someone promoting the idea of tight global soybean supplies is wrong…Who am I kidding. That’s exactly what I’m saying. I know, everyone can believe what they want, that’s what makes a market. And for those that believe this little jewel, well, it simply increases the advantage of those of us who don’t.

The author of the piece based his conclusion on two sources:

- A price chart for the January futures contract, and

- USDA numbers before the US government was shut down

Note there is nothing about real supply and demand to this conclusion. No study of the economic Law of Supply and Demand, no discussion of basis, no evaluation of the commercial outlook for Brazil’s 2026 crop. None of this. It was based on the interpretation of a price chart, a more questionable source with each passing year, and made-up government numbers.

Okay, since the subject has come up, let’s once again talk about what the market is showing us regarding real supply and demand, both in the US and globally. That sounds fun, right? I thought so. Let’s start with…

The Law of Supply and Demand

I still have to laugh at how many “economists” refuse to use what was learned in Econ 101 back at university. It truly is simplicity itself: Market price is the point where the quantity demand equals quantities available creating a market equilibrium. Therefore, if we want to understand the real relationship between supply and demand – and I don’t care if you subtract, divide, or use some other math function – all we have to do is study market price.

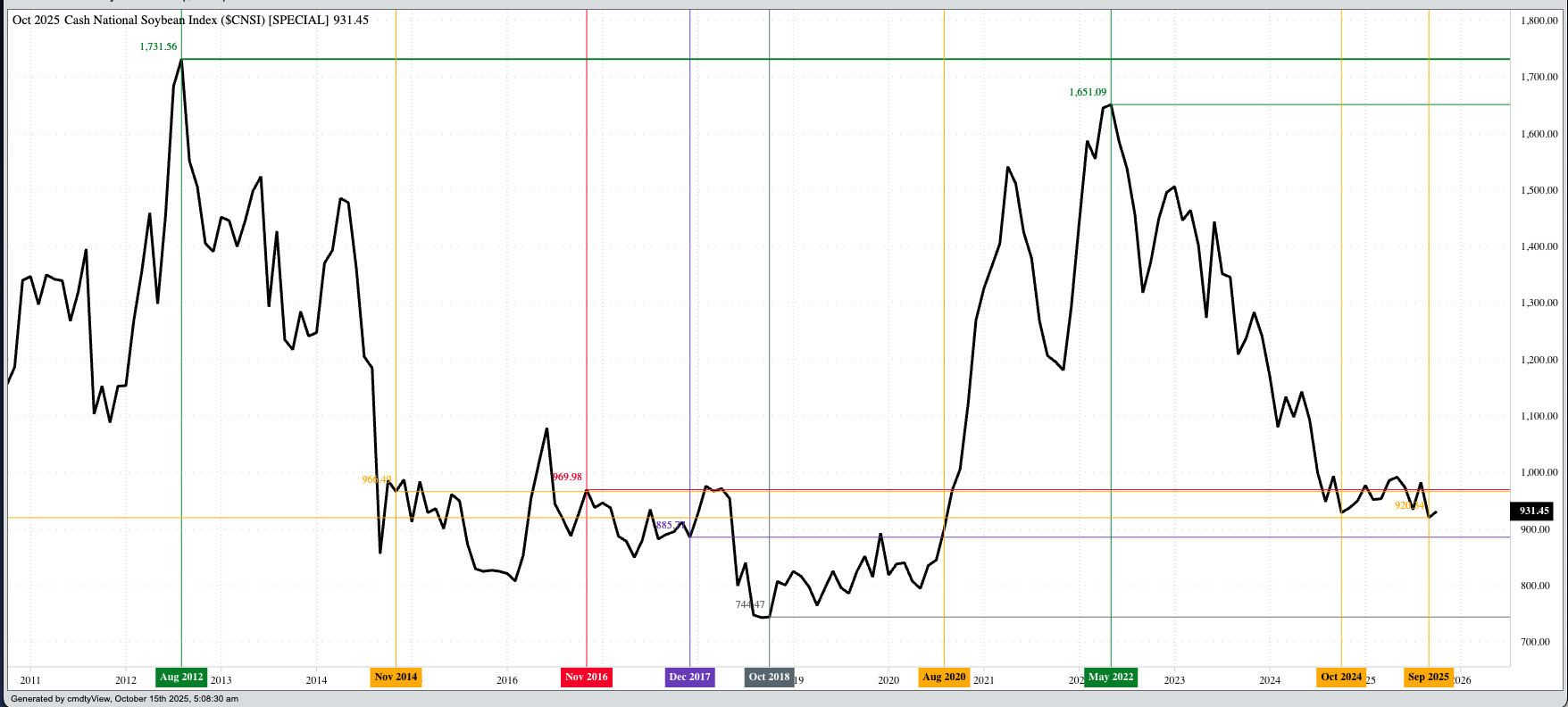

At the end of September, the National Soybean Index ($CNSI), the national average cash price and US market’s intrinsic value was calculated at $9.2034, its lowest month-end value since August 2020. What does that tell us? US supplies were at their largest in relation to demand in over five years. Did we know what the imaginary supply and demand numbers were? No. But we never have known the actual numbers. But by studying market price we can see the relationship between real supply and demand, and the US wasn’t running out of soybeans any time soon.

National Average Basis

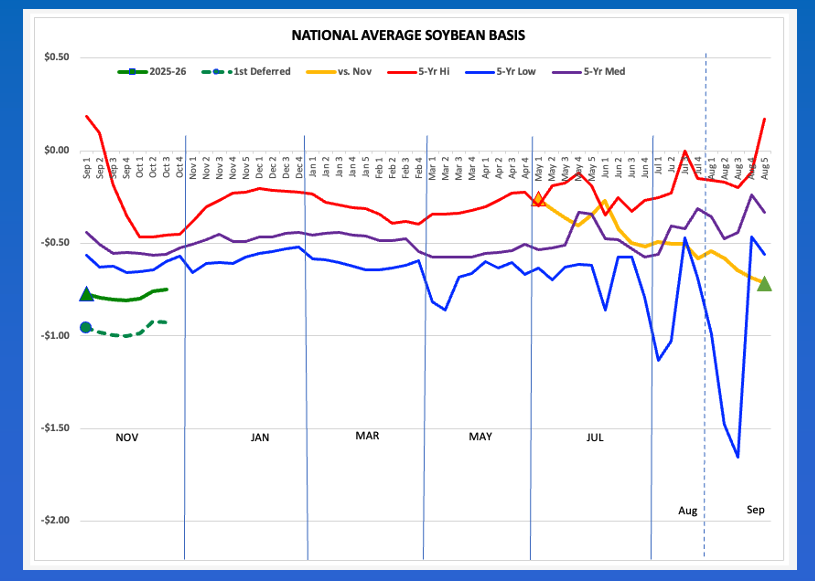

Basis is the difference between the National Index and futures market. This is as good a read (usually) on immediate demand (local, regional, national) as any. Going back again to the end of September, the last weekly close came in at 81.0 cents under November futures (ZSX25) as compared to the previous 5-year low weekly close for that week of 65.75 cents under November. Think about that for a moment. Despite what we already knew about the 2025 US soybean crop (fewer planted acres based on the Nov25 soybean/Dec25 corn futures spread, decreased production based on the trend of the Nov-Jan soybean futures spread; more on this in a moment), the Index was running well below previous 5-year lows.

However, I’m sure you’ve noticed national average basis has firmed during the first half of October, the latest calculation coming in at 75.0 cents under November. Some of this is seasonal, due in part to the November futures contract moving into delivery at the end of this month. Therefore, let’s look out to the January contract (ZSF26). Here we see the latest basis calculation came in at 92.75 cents under as compared to the previous 5-year low weekly close for the first week of November at 66.0 cents under, and the previous 10-year low weekly close for the same week at 90.0 cents under January.

Futures Spreads

Yes, I hear the mutterings across the interverse, “The National Soybean Index and national average basis reflect the immediate-term US situation, and the topic du jour has to do with the long-term global balance sheet.” True, but if the world supply and demand table was tightening, the world’s largest buyer would be more interested in the US as its secondary supplier. (No, the US soybean industry has not been made great again by the ongoing trade war with China.) Since the comment has been made, let’s talk about what we know regarding the long-term global balance sheet.

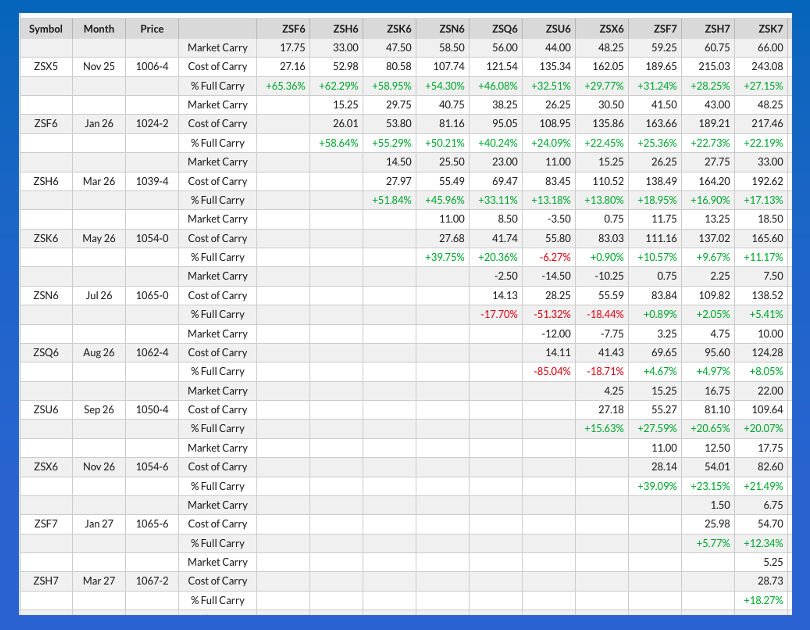

If global supply and demand was tightening beyond the seasonal norm (this is the time of year Brazil’s supply of soybeans has been dramatically decreased by demand from China), the commercial side of the market would be pushing nearby futures contracts in relation to deferred in an attempt to source supplies to fill demand. That isn’t happening, at least outside of what we tend to see during this time of year.

- The November-January futures spread covered 65% calculated full commercial carry at the end of July, 65%, at the end of August, 71% at the end of September, and 65% at the close on Tuesday, October 13.

- The November-July forward curve (all 2025-2026 futures spreads combined, excluding the Jar Jar Binks contracts August and September) has held steady at about 54% since the last weekly close of July.

- The January-March spread (the US last hope for demand gaining on supplies) closed Tuesday covering 59%, down slightly from its end of September settlement covering 61%, but far from indicating a tight supply and demand situation.

- And finally, the South American driven March-May spread covered 52% at Tuesday’s close as compared to the end of September 51% and the end of August 42%. This tells us there is a growing confidence in increased supplies from south of the equator in early 2026.

Is the global soybean balance sheet tightening, really? All the reads on real market supply and demand say “no”. But reality has never stopped folks from believing otherwise. After all, how many in the industry still go around repeating the mantra, “Trade wars are good and easy to win”? Enough said.