/Textron%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shuuerstock.jpg)

Valued at a market cap of $14.9 billion, Textron Inc. (TXT) is a diversified industrial conglomerate headquartered in Providence, Rhode Island. Founded in 1923, the company operates across six primary segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Textron fits this description perfectly. Textron's diversified portfolio positions the company strategically across various high-growth sectors, including aerospace, defense, and electric aviation, enabling it to leverage synergies and mitigate risks associated with market fluctuations.

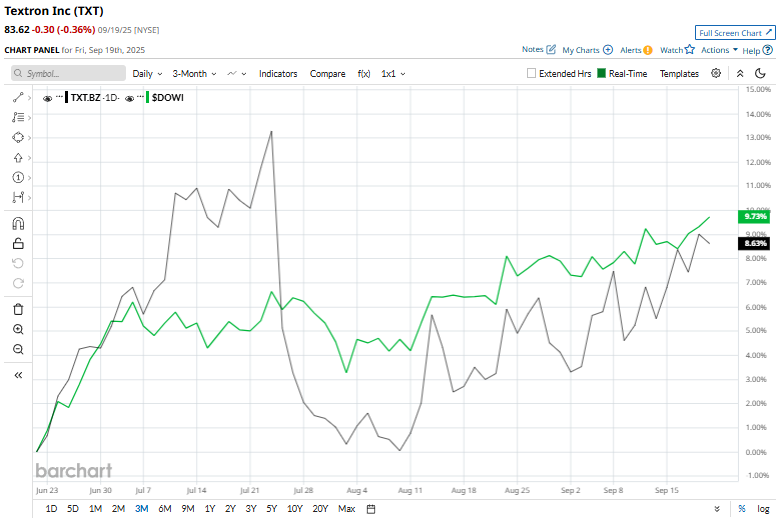

Textron stock has declined 8.4% from its 52-week high of $91.30. TXT stock has risen 9.2% over the past three months, slightly lagging the broader Dow Jones Industrial Average’s ($DOWI) 9.8% rise during the same time frame.

In the longer term, TXT stock has increased 9.3% on a YTD basis, outperforming Dow Jones’ 8.9% return. However, shares of Textron have dropped 6% over the past 52 weeks, compared to $DOWI’s 10.2% rise over the same period.

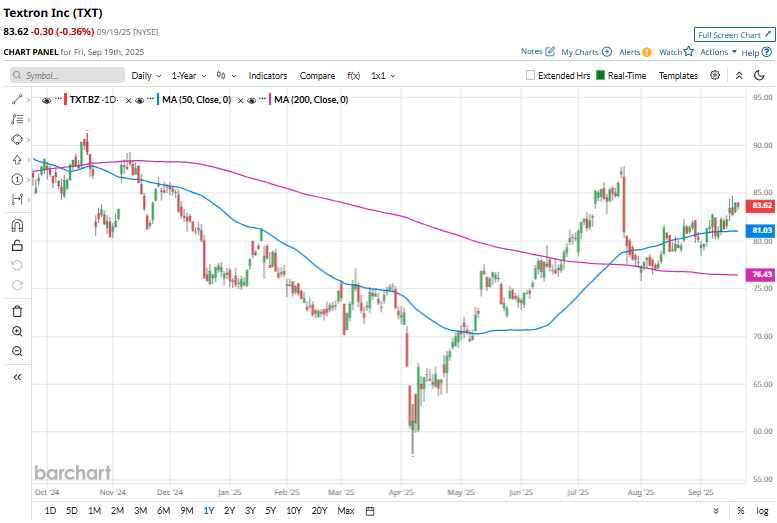

The stock has been trading above its 200-day moving average since the end of June and has been over its 50-day moving average since early September, implying an uptrend.

On Jul. 24, Textron reported Q2 2025 results, and its shares dipped 7.2%. The company posted revenue of $3.7 billion, a 5% increase year-over-year. Its adjusted EPS of $1.55 came slightly above estimates, thanks to substantial contributions from Bell and Aviation. The company reaffirmed its full-year EPS outlook but raised its manufacturing cash flow guidance, underscoring continued operational strength and investor confidence.

Its top rival, L3Harris Technologies, Inc. (LHX), has outperformed TXT. LHX stock has increased 23.2% over the past 52 weeks and 35% on a YTD basis.

Among the 14 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $92 implies a premium of 10% from the prevailing price levels.