/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock(1).jpg)

With a market cap of $1.1 trillion, Tesla, Inc. (TSLA) is the leading electric vehicle manufacturer in the United States, holding about 70% of the EV market with its flagship Model 3 as the top-selling model. Headquartered in Austin, Texas, Tesla operates globally, combining direct sales, servicing, and charging to differentiate itself from traditional automakers.

Companies worth more than $200 billion are generally labeled as “mega-cap” stocks and Tesla fits this criterion perfectly. Beyond automobiles, the company has expanded into energy generation and storage, positioning itself as a clean energy innovator.

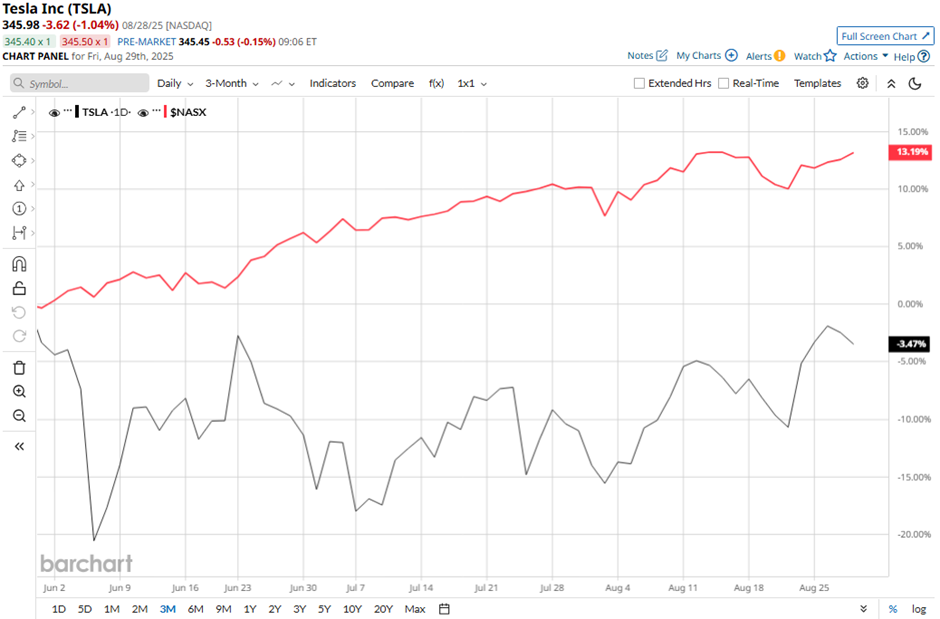

Despite this, shares of Tesla have declined 29.2% from its 52-week high of $488.54. The stock has dipped 3.6% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 13.6% increase over the same time frame.

In the longer term, TSLA stock is down 14.4% on a YTD basis, lagging behind NASX’s 12.4% gain. Moreover, shares of the company have surged over 68% over the past 52 weeks, compared to NASX’s 23.6% return over the same time frame.

TSLA stock has been trading above its 50-day and 200-day moving average since early August.

Tesla shares tumbled 8.2% following its Q2 2025 results on Jul. 23 as investors focused on narrowing margins and weak forward signals despite revenue of $22.5 billion slightly beating forecasts and EPS of $0.40 meeting expectations. Automotive gross margin excluding regulatory credits dropped to 14.6%, below expectations, reflecting steep price cuts, restructuring charges, and rising AI-driven expenses.

In contrast, rival General Motors Company (GM) has outpaced TSLA stock on a YTD basis, rising 9.6%. However, GM stock has gained 19.1% over the past 52 weeks, lagging behind TSLA.

Due to the stock’s underperformance, analysts remain cautious on Tesla. The stock has a consensus rating of “Hold” from 42 analysts in coverage, and as of writing, TSLA stock is trading above the mean price target of $299.28.