/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Tesla (TSLA) will report its third-quarter earnings on Oct. 22 after the market closes. While Tesla stock has been on a rollercoaster ride this year, it has gained momentum following the news of CEO Elon Musk’s $1 trillion pay package and his subsequent purchase of $1 billion worth of Tesla stock. Additionally, Tesla announced its Q3 deliveries earlier this month, which totaled 497,009 vehicles, representing a 7.4% year-over-year increase.

While TSLA is up a more modest 7.5% year-to-date, it has surged 35% over the last three months. As investors brace for the third quarter earnings, let’s take a step back into its second quarter results and assess whether TSLA is a compelling buy ahead of the Q3 report.

Q2 Showed Resilience Amid Regulatory Turbulence

In the second quarter, Musk emphasized the company’s bold progress in artificial intelligence (AI), autonomy, the early commercial rollout of its robotaxi service, a rapidly expanding energy business, and steady work on humanoid robotics. However, he warned that the company may face a few hard quarters in the near future, owing to tariff problems, expired EV credits, and shifting regulatory policies.

Total revenue fell nearly 12% year over year to $22.5 billion, marking one of the steepest declines in recent quarters. Vehicle deliveries, the backbone of Tesla’s business, dropped 13.5% to 384,122 units, indicating that competitive pressures and pricing adjustments continue to weigh on demand.

Profitability also deteriorated. Adjusted net income plummeted 23% year on year, while GAAP gross margins decreased to 17.2%. The margin compression reflected continued price reduction intended to sustain demand, rising input costs from raw materials and tariffs, and significant investment in developing initiatives such as Full Self-Driving (FSD) and the Optimus humanoid robot project.

Tesla reported an additional $300 million in tariff-related charges during the quarter, with nearly two-thirds of that burden landing on its automotive segment and the remainder affecting its energy business. Automotive revenue decreased 16%, and the energy generation and storage segment, which previously served as a cushion for the drop in car sales, fell 7%. The services and other businesses performed well, growing 17% year on year due to improved performance in supercharging, insurance, and car servicing.

Tesla’s capital-intensive expansion into AI infrastructure and new product development weighed heavily on free cash flow, which fell 89%.

Betting on Autonomy, AI, Humanoid Robots, and Energy

Despite a challenging quarter for the core business, Musk showcased the company’s ambitious push into autonomy and robotics, with the debut of its first robotaxi service in Austin in June, marking a significant milestone for Full Self-Driving (FSD) technology. Musk outlined plans to expand robotaxis to cover half of the U.S. population by year-end, but regulatory permits and safety validations remain significant obstacles.

Along with this, Tesla is expanding its humanoid robot project, Optimus, with the next prototype, Optimus 3, expected by the end of the year, and production scaling planned for 2026, with a goal of one million units per year within five years.

Looking Ahead to Q3

Tesla has been disappointing investors for the last few quarters, reflecting the struggle of its core automotive business. Management acknowledged that the company is entering a period of transition where pricing, demand, and cost structures are in flux.

Furthermore, Musk warned of a “few rough quarters” ahead during the Q2 earnings call. However, management has made it clear that they see these challenges as temporary. The company’s strategic base, which includes autonomy, AI, energy storage, and robots, remains intact and expanding.

Given the backdrop in Q2, Tesla needs to show not just hope, but signs of stabilization or turnaround in the third quarter. Analysts predict revenue to increase by 5.6% to $26.5 billion, but earnings could be around $0.44 per share, down from $0.62 in the year-ago quarter.

Wall Street Remains Cautious

Musk’s vision of Tesla being a key player in AI-powered mobility and energy infrastructure could take years before it becomes a reality. While Q3 deliveries improved, the current business is struggling. Tesla’s forward price-earnings multiple of 174x doesn’t seem justified, even though analysts predict a 43% increase in earnings in 2026.

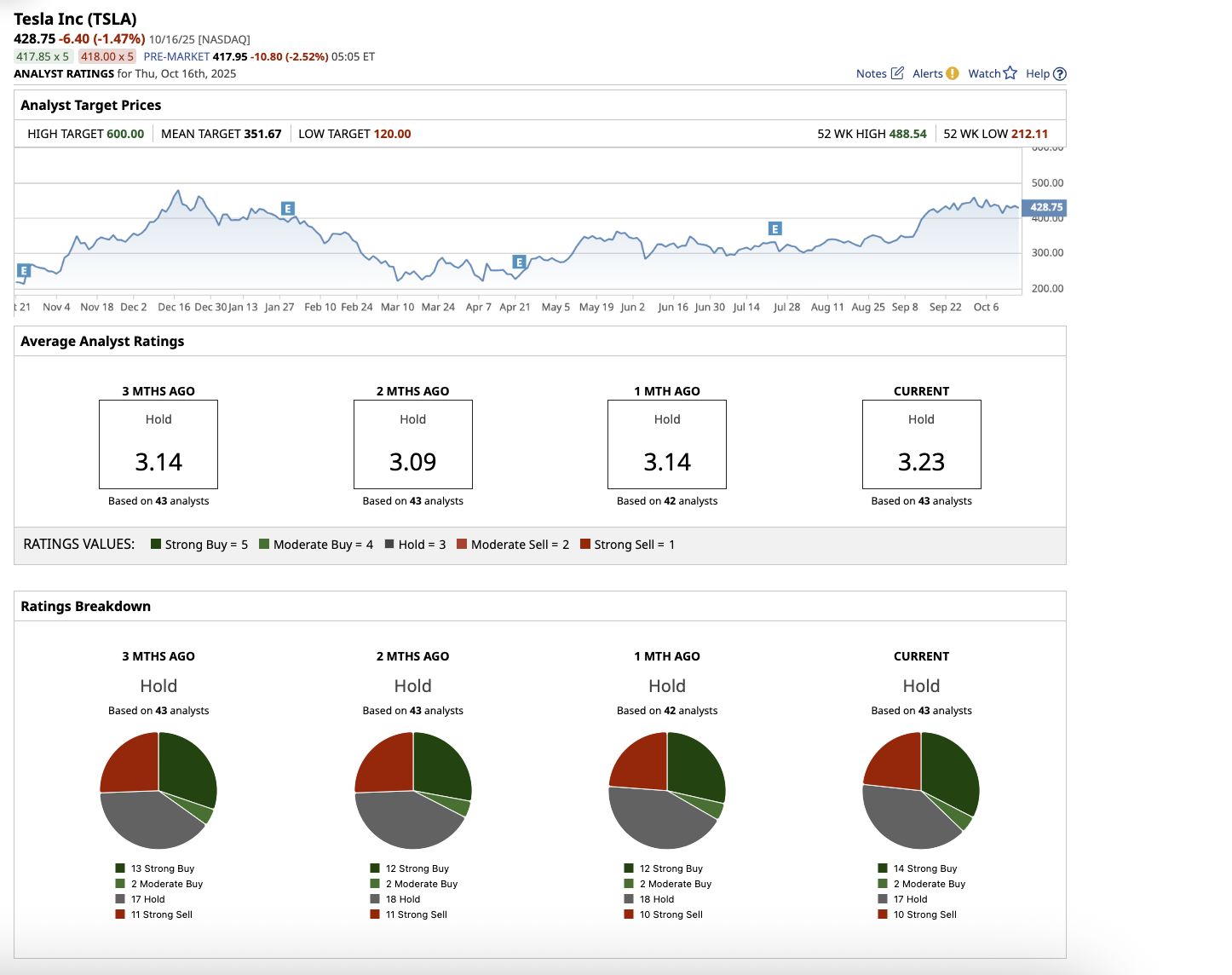

This sky-high valuation has analysts skeptical. Overall, Wall Street rates the stock a “Hold.” Of the 43 analysts covering the stock, 14 recommend it as a “Strong Buy,” two as a “Moderate Buy,” 17 as a “Hold,” and 10 as a “Strong Sell.” Tesla has surpassed its average analyst target price of $351.67. The high price estimate of $600 implies that the stock can rise by 38% in the next 12 months.

Long-term investors who can handle the short-term volatility might want to hold on to the stock, given the company’s growth prospects in AI, robotics, and energy. However, risk-averse investors might want to watch Tesla’s progress in the third quarter before making any investment decisions.