/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)

Tesla (TSLA), one of the most talked-about stocks in the market, released its third-quarter earnings on Wednesday, Oct. 22. CEO Elon Musk opened Tesla’s Q3 earnings call with a mix of confidence and urgency, stating, “We are at a critical inflection point.” Musk sees 2025 as the year Tesla transforms from an automotive firm to an artificial intelligence (AI)-powered technology and energy powerhouse. Musk mentioned record vehicle sales, a massive energy-storage business, big plans for humanoid robots, new AI chip partnerships, and so on.

However, a closer look at the results reveals that behind all of the shine is a more mixed picture, one that may be masked by Tesla’s emphasis on the future over the present.

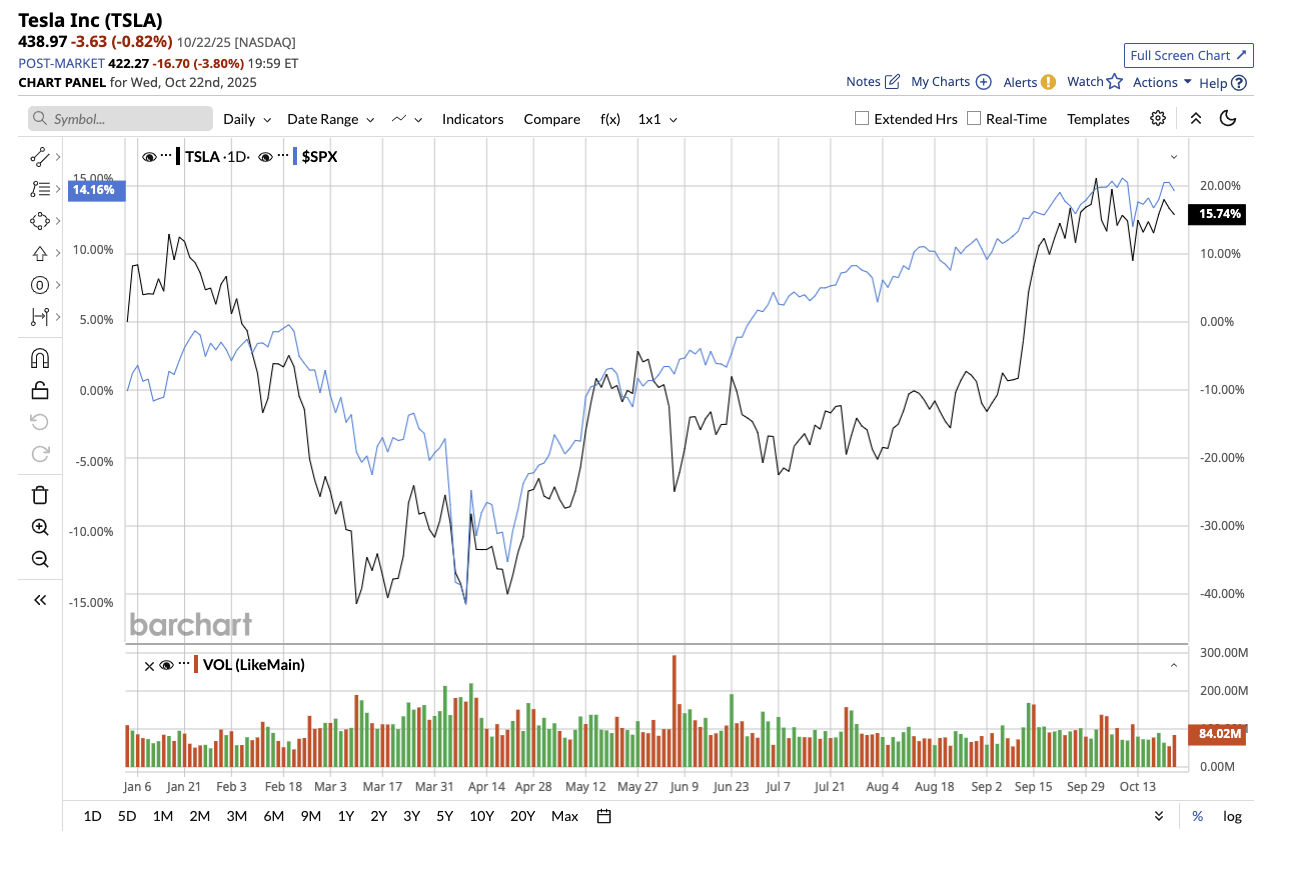

Tesla stock is up 6.6% year-to-date, compared to the S&P 500 Index ($SPX) gain of 14.3%.

Let’s dig in to know more.

The Numbers Don’t Lie — Yet the Spotlight Is Elsewhere

In the third quarter, Tesla reported revenue of about $28.1 billion, up roughly 12% year-on-year. Deliveries surged 7.4% year-over-year to 497,009 vehicles. However, operating income plunged, down 40% to about $1.6 billion, resulting in an operating margin of only 5.8%. While Tesla’s top-line growth was notable, profitability and margins in its core electric vehicles (EVs) and energy businesses shrank. Adjusted earnings per share fell 31%, to $0.50, missing consensus estimates. Gross margin of 18% came in lower than 19.8% the year before, as the company relied on price cuts to sustain demand. Competition in EVs from China and traditional automakers is heating up as rivals offer identical technology at lower costs.

Nonetheless, these concerns received little attention, as Musk’s discussions drifted abruptly toward the future rather than the present. He boasted of “Grok 5,” a massive xAI model that can only run on GV300 chips, and promised to make cars that “feel like living creatures” under Tesla’s AI 4 and AI 5 systems. He also indicated that Tesla’s approach to full self-driving (FSD) is still guided by a careful, data-driven deployment. Tesla will maintain safety drivers in new cities for approximately three months. Regarding the company’s humanoid robot, Optimus, Musk disclosed that Tesla plans to begin production next year, with an ambitious goal of producing up to a million units per year once scaling starts. Tesla’s capital expenditures are likely to increase significantly in 2026 as the company scales AI chip design, Optimus production, and FSD infrastructure. The company ended the quarter with $41.6 billion in cash balance and free cash flow of $3.9 billion.

Tesla prepares for a critical shareholder vote in November on Musk’s compensation and influence. Musk stated that if shareholders reaffirm their support on Nov. 6, Tesla’s next chapter, defined by AI, autonomy, and embodied intelligence, may arrive even faster than anyone expects.

Why You Shouldn’t Ignore The Present

No doubt, record deliveries, surging revenue growth, a huge cash balance on the balance sheet, and real-world AI integration into vehicles, humanoids, and voice systems are all powerful optics. However, I believe these are keeping investors’ focus on the future upside. If we look at Tesla’s current business (EVs and energy), it faces margin pressure, headwinds from credits and tariffs, and a more competitive environment.

With analysts forecasting a 31% decline in earnings in 2025, Tesla’s forward price-to-earnings multiple of 234x appears unjustified. This points to investors’ bullish views of Tesla’s future, which hinge on Musk’s big bet on a robotic future. However, these enormous bets may take some time to pay off before they become a viable profit-generating reality. Investors who trust in Musk’s vision may want to hold on to the stock.

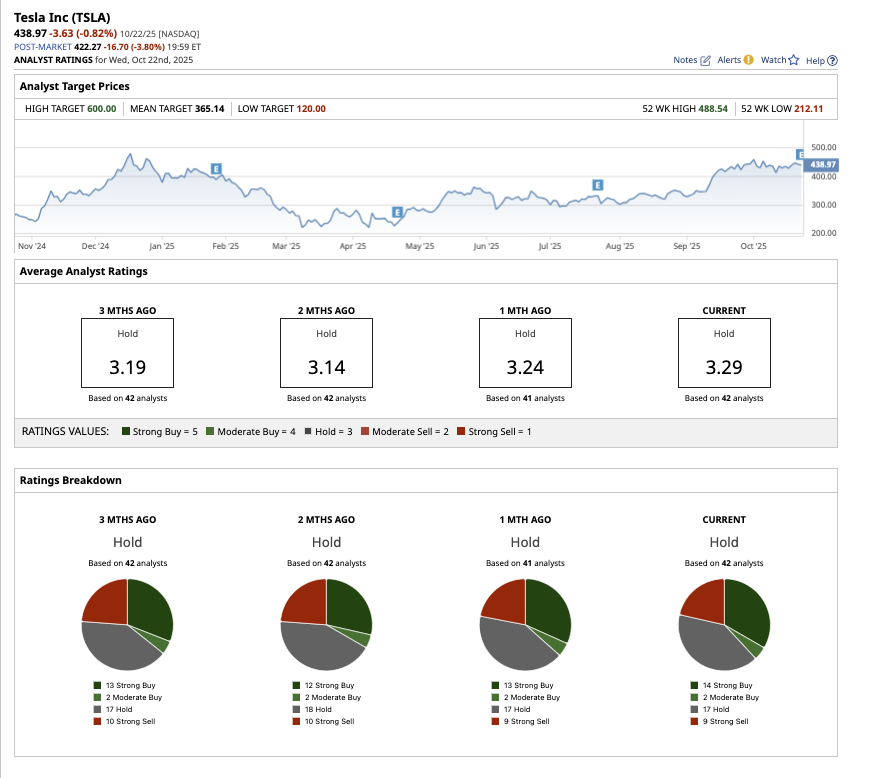

What Are Analysts Saying About Tesla Stock?

Analysts are noting that Tesla’s core auto business is under pressure, even as the company shifts the narrative toward robotics and autonomy. Notably, JPMorgan, UBS, and Wells Fargo have issued a “Sell” rating for the stock, while Barclays, Needham, and Evercore ISI suggest holding onto the stock.

Overall, Wall Street remains skeptical due to Tesla’s steep valuation and continues to rate the stock a “Hold.” Of the 42 analysts covering the stock, 14 recommend it as a “Strong Buy,” two as a “Moderate Buy,” 17 as a “Hold,” and nine as a “Strong Sell.” Tesla has surpassed its average analyst target price of $365.14. The high price estimate of $600 implies that the stock can rise by 37% in the next 12 months.