/Teradyne%2C%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $18.1 billion, Teradyne, Inc. (TER) is a leading supplier of automated test equipment (ATE) and industrial automation solutions, headquartered in North Reading, Massachusetts. Founded in 1960, the company provides products and services that help ensure the quality and reliability of semiconductors, electronics, and industrial systems.

Companies valued at $10 billion or more are generally labeled as “large-cap” stocks, and Teradyne fits this criterion perfectly. Its diversified portfolio across semiconductor test, system test, wireless test, and industrial automation provides multiple growth drivers, reducing reliance on any single market. The company is also well-positioned to capitalize on secular trends such as the expansion of AI-driven chips, 5G adoption, and the rising demand for robotics and factory automation through its Universal Robots and MiR businesses.

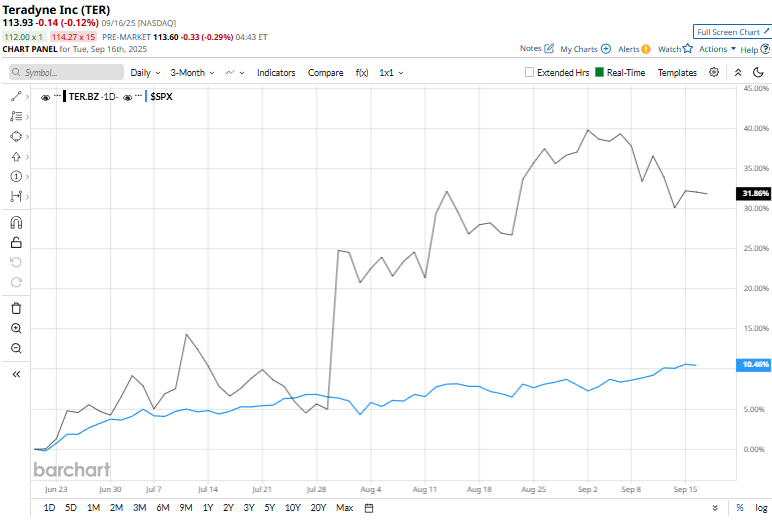

However, shares of TER touched its 52-week high of $144.16 on Jan. 7, and have plunged 21% from the peak. Shares of TER have surged 29.9% over the past three months, surpassing the S&P 500 Index ($SPX), which has returned 9.5% over the same time frame.

TER has fallen 9.5% on a YTD basis, trailing $SPX's 12.3% rise. In addition, shares of Teradyne have dipped nearly 11% over the past 52 weeks, compared to $SPX’s 17.3% rally over the same time frame.

The stock has been trading above its 200-day moving average since late July and has edged over its 50-day moving average since early June, indicating an uptrend.

On Aug. 25, Teradyne shares surged 1.5% after the company declared a quarterly cash dividend of $0.12 per share, payable on September 29, 2025.

Meanwhile, its top rival, ACM Research, Inc. (ACMR), has outpaced TER. ACMR shares have soared 104.9% on a YTD basis and 89% in the last 52 weeks.

Despite TER’s underperformance over the past year, analysts are moderately optimistic about its prospects. TER has a consensus rating of “Moderate Buy” from the 18 analysts covering the stock. Its mean price target of $117.38 implies an upside potential of 3% from the prevailing price levels.