/Tapestry%20Inc%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Tapestry, Inc. (TPR) is a global fashion powerhouse that manages a diverse mix of luxury brands, including Coach, Kate Spade, and Stuart Weitzman, producing a range of products from handbags to shoes. Based in New York City, the company thrives on blending tradition with fresh ideas and aims for excellence in every product it brings to market.

Tapestry’s international reach and innovative approach help shape the evolving fashion landscape. With a market capitalization of $24.17 billion, Tapestry is considered a “large cap” stock.

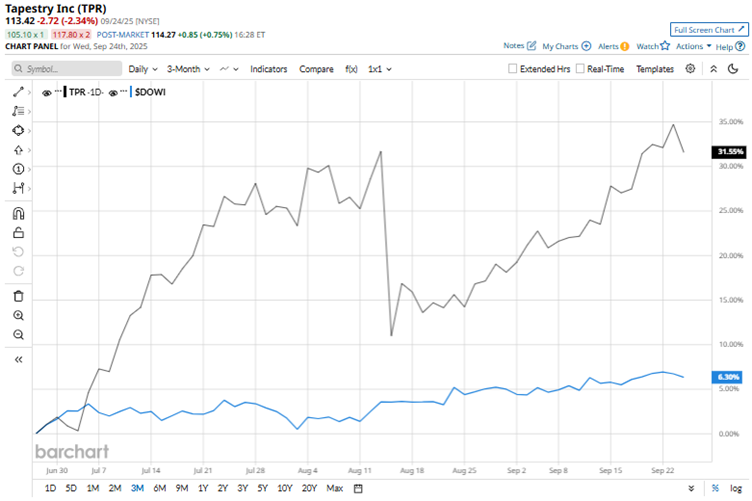

The stock reached a 52-week high of $117 on Sept. 24 as a result of the company announcing its “Amplify” growth strategy in the same month, but it is down 3.1% from this high. Based on solid financial performance, Tapestry’s stock has been up by 30% over the past three months. Over the same period, the broader Dow Jones Industrial Average ($DOWI) has gained 7%, indicating that Tapestry is outperforming the broader market.

Over the longer term, this outperformance persists. Over the past 52 weeks, Tapestry’s stock jumped by 149.8%, while it is up 73.6% year-to-date (YTD). On the other hand, the Dow Jones Industrial Average gained 9.3% and 8.4% over the same periods, respectively. The stock is currently hovering near its 50-day moving average and has been trading above its 200-day moving average since late 2024.

On Aug. 14, Tapestry reported better-than-expected fourth-quarter results for fiscal 2025 (the quarter that ended June 28). The company’s net sales increased by 8.3% year-over-year (YOY) to $1.72 billion, surpassing the $1.68 billion that Wall Street analysts had expected.

Revenue was primarily driven by a 14% increase in revenue from its Coach brand, reaching $1.43 billion for the quarter. For Q4, Tapestry also acquired 1.5 million new customers in North America, driven by strong interest from the millennial and Gen Z populations. The company’s adjusted EPS increased from $0.92 in the year-ago quarter to $1.04. The EPS figure was higher than the $1.01 that Wall Street analysts had expected.

Despite the results topping estimates, Tapestry’s stock declined by 15.7% on Aug. 14, before gaining 5.3% on Aug. 15. This was due to the company providing a subdued outlook, expecting the negative impact of incremental tariffs and duties.

We compare Tapestry’s performance with that of another luxury brand stock, diamond jewelry retailer Signet Jewelers Limited (SIG), which has declined 2.6% over the past 52 weeks and gained 19.9% YTD. Therefore, Tapestry is the clear outperformer here.

Wall Street analysts are moderately bullish on Tapestry’s stock. The stock has a consensus rating of “Moderate Buy” from the 21 analysts covering it. The mean price target of $116.95 indicates a 3.1% upside compared to current levels. However, the Street-high price target of $142 indicates a 25.2% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.