With a market cap of $283.6 billion, T-Mobile US, Inc. (TMUS) is a leading national wireless service provider offering voice, messaging, data, and high-speed internet services across the United States, Puerto Rico, and the U.S. Virgin Islands. Headquartered in Bellevue, Washington, T-Mobile is a subsidiary of Deutsche Telekom AG and a pioneer in 5G network deployment.

Companies worth more than $200 billion are generally labeled as “mega-cap” stocks, and T-Mobile US fits this criterion perfectly. Operating under the T-Mobile, Metro by T-Mobile, and Mint Mobile brands, the company provides wireless devices, accessories, and financing solutions through retail stores, apps, and third-party distributors.

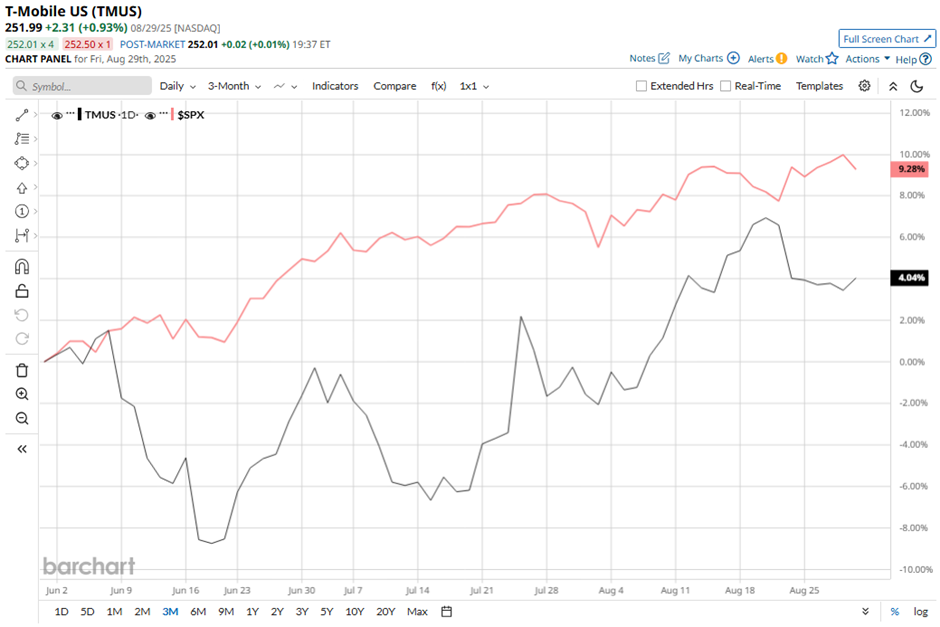

Shares of T-Mobile US have dipped 8.9% from its 52-week high of $276.49. The stock has risen 5.3% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 9.3% gain over the same time frame.

In the longer term, TMUS stock is up 14.2% on a YTD basis, outperforming SPX’s 9.8% return. Moreover, shares of the wireless carrier have surged 25.1% over the past 52 weeks, compared to SPX’s 15.5% increase over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 50-day and 200-day moving averages since last year.

Shares of T-Mobile climbed 5.8% following its Q2 2025 results on Jul. 23. The company reported EPS of $2.84 and revenue of $21.1 billion, both above expectations. The company raised its full-year postpaid net customer addition forecast to 6.1 million - 6.4 million, after adding 830,000 postpaid phone customers in the quarter. Strong uptake of its new Experience plans, bundled with Netflix and Apple TV+ and chosen by about 60% of new accounts, further boosted investor confidence.

Nevertheless, TMUS stock has lagged behind its rival, AT&T Inc. (T). AT&T stock has soared 47.8% over the past 52 weeks and 28.6% on a YTD basis.

Despite outperforming the SPX over the past year, T-Mobile carries a “Moderate Buy” consensus rating from the 29 analysts covering the stock. The mean price target of $271.55 is a premium of 7.8% to current levels.