Valued at a market cap of $24.2 billion, Steel Dynamics, Inc. (STLD) is a steel producer and metal recycler based in Fort Wayne, Indiana. It produces hot-rolled, cold-rolled, coated sheet steel, structural beams and rails, specialty steel, while also running extensive metals-recycling operations, downstream steel fabrication, and aluminum production.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and STLD fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the steel industry. With a broad product portfolio, significant steel-making capacity, and a vertically integrated business model, the company stands out as a major U.S. player in steel & industrial materials.

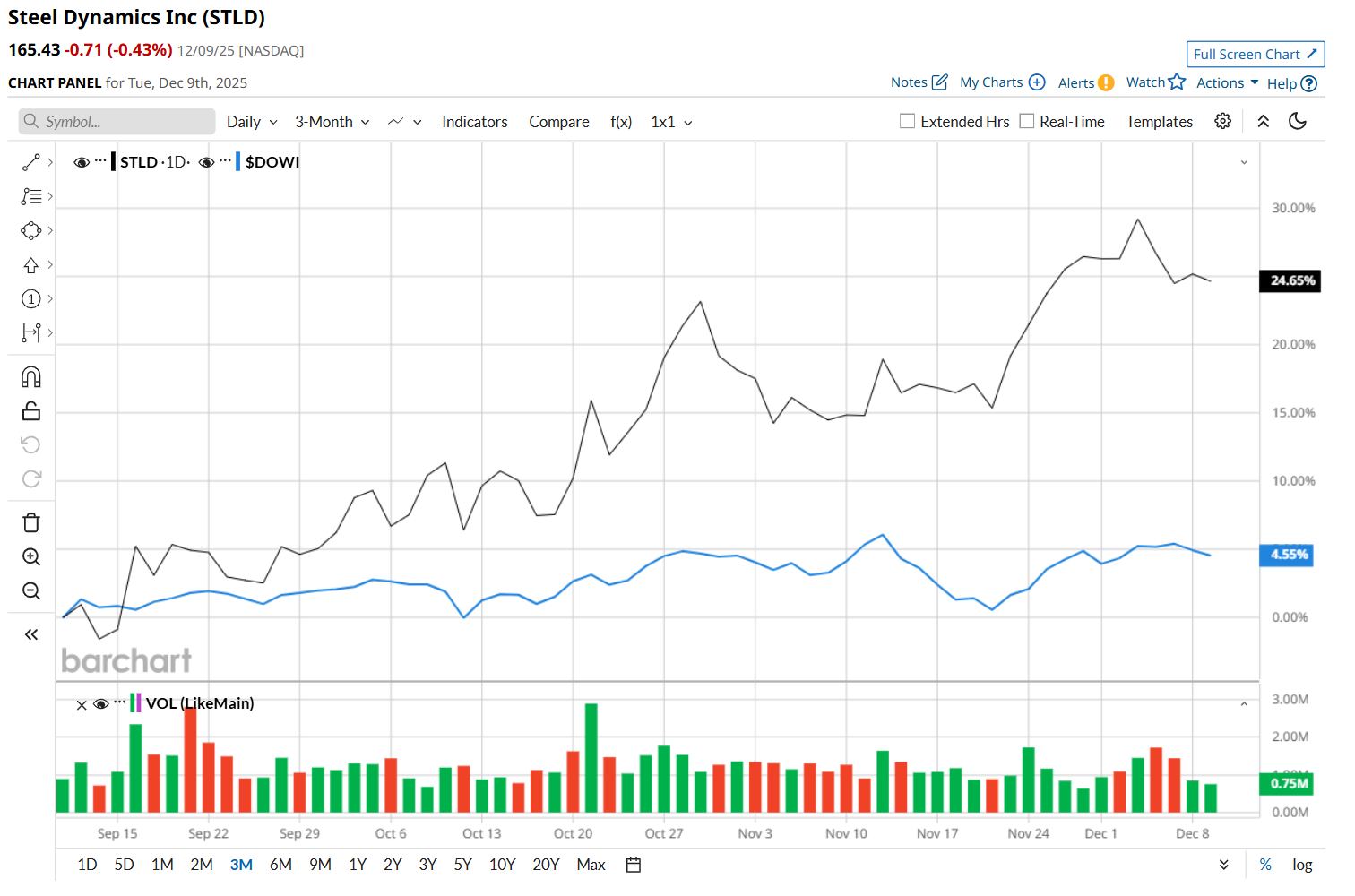

This steel company is currently trading 4.3% below its 52-week high of $172.94, reached on Dec. 3. Shares of STLD have rallied 27% over the past three months, outperforming the Dow Jones Industrial Average’s ($DOWI) 4% rise during the same time frame.

In the longer term, STLD has soared 19.7% over the past 52 weeks, outpacing DOWI’s 7.1% uptick over the same time frame. Moreover, on a YTD basis, shares of STLD are up 45%, compared to DOWI’s 11.8% return.

To confirm its bullish trend, STLD has been trading above its 200-day and 50-day moving averages since late August.

On Oct. 20, shares of STLD surged 2.5% after reporting better-than-expected Q3 results. The company’s net sales increased 11.2% year-over-year to $4.8 billion, surpassing consensus estimates by 3%. Moreover, its EPS of $2.74 improved 33.7% from the year-ago quarter, topping analyst expectations of $2.66.

STLD has also outpaced its rival, Nucor Corporation (NUE), which gained 9.4% over the past 52 weeks and 35.5% on a YTD basis.

Given STLD’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 13 analysts covering it, and the mean price target of $172 suggests a 4% premium to its current price levels.