/State%20Street%20Corp_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $31.3 billion, State Street Corporation (STT) is a leading financial services and bank holding company headquartered in Boston, Massachusetts. Founded in 1792, it is one of the oldest financial institutions in the United States. The company primarily operates through its subsidiary State Street Bank and Trust Company, which is among the world’s largest custodian banks.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and STT perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the asset management industry. The company’s broad global presence across more than 100 markets, combined with its integrated offering of custody, fund administration, data analytics, and investment management solutions, allows it to serve institutional clients end-to-end and maintain a durable competitive edge against peers.

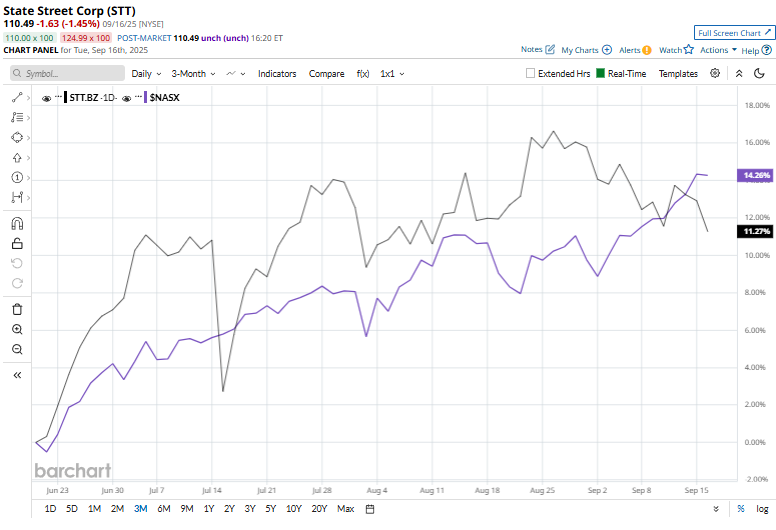

State Street shares have retreated 5.1% from their 52-week high of $116.37, achieved on Aug. 27. Shares of STT gained 13.4% over the past three months, matching the broader Nasdaq Composite’s ($NASX) 13.4% rise over the same time frame.

Year-to-date, shares of STT have climbed 12.6%, trailing the Nasdaq’s 15.7% gain. Over the past 52 weeks, however, the stock has rallied 29.3%, outpacing the $NASX’s 27% return.

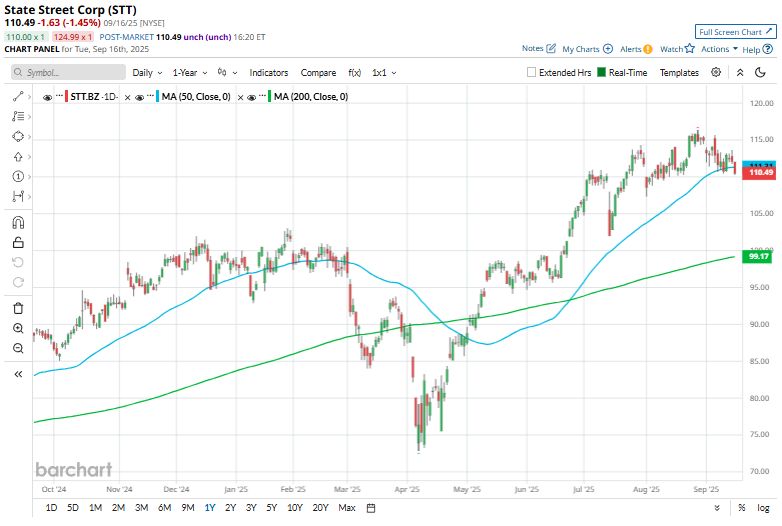

Reinforcing this positive momentum, STT has remained above its 50-day and 200-day moving averages since early May.

On July 15, State Street posted Q2 2025 results, with revenue rising about 9% year-over-year to $3.45 billion, driven by strong fee income growth and higher assets under custody and assets under management. Adjusted EPS came in at $2.53, up from last year. The company also secured $1.1 trillion in new servicing mandates and saw $82 billion of net inflows at State Street Global Advisors.

Despite a modest decline in net interest income from lower rates, which initially drove the stock down 7.3% post-release, shares quickly rebounded more than 5% over the following two sessions, as investors refocused on the company’s strong fee momentum, investment inflows, and operating leverage that underscore the resilience of its core businesses.

STT’s rival, Blackstone Inc. (BX) shares lagged behind, with a 6.6% rise on a YTD basis and an 18.9% gain over the past 52 weeks.

Wall Street analysts are moderately bullish on STT’s prospects. The stock has a consensus “Moderate Buy” rating from the 18 analysts covering it, and the mean price target of $117.70 suggests a potential upside of 6.5% from current price levels.