Dublin, Ireland-based Smurfit Westrock Plc (SW) is a global leader in sustainable packaging solutions, formed through the merger of Smurfit Kappa and WestRock. With a market cap of $19.7 billion, SW operates across diverse industries, offering innovative and eco-friendly packaging products that cater to the evolving needs of businesses worldwide.

Companies worth $10 billion or more are generally described as "large-cap stocks." SW fits perfectly into this category, reflecting its significant presence and influence in the packaging and materials industry. The company continues to drive sustainability and innovation, setting benchmarks for environmentally responsible practices and delivering value to its customers and stakeholders.

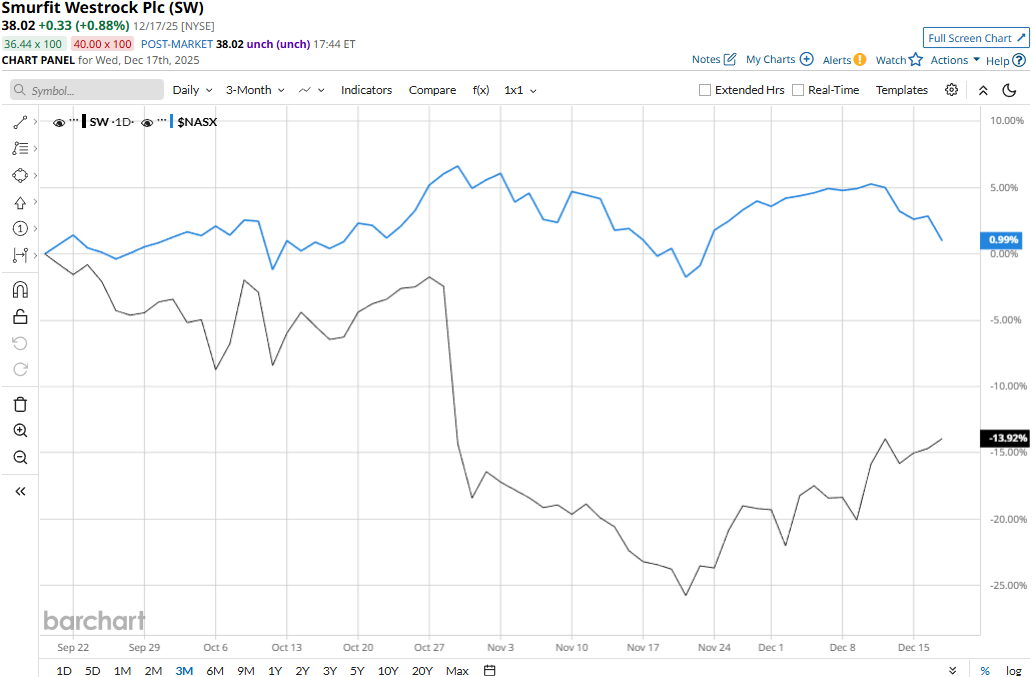

Despite its notable strengths, SW stock prices have plunged 32.2% from its 52-week high of $56.05 touched on Jan. 24. Meanwhile, SW stock prices have declined 13.7% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 1.9% uptick during the same time frame.

The stock’s performance has remained grim over the longer term as well. SW stock prices have declined 29.4% on a YTD basis and 29.5% over the past year, lagging behind the Nasdaq’s 17.5% surge in 2025 and 12.9% returns over the past 52 weeks.

SW stock has traded mostly below its 50-day and 100-day moving averages since early March, with some fluctuations, underscoring its bearish trend.

Smurfit Westrock’s stock prices plummeted 12.2% in a single trading session following the release of its mixed Q3 results on Oct. 29. The company’s net sales for the quarter increased 4.3% year-over-year to $8 billion, beating the Street’s expectations by 32 bps. However, the company has continued to struggle with profitability. While its adjusted EPS inched up 9.4% year-over-year to $0.58, it missed the consensus estimates by 14.7%. Further, on a GAAP basis, SW maintains a thin net margin of 3.1%.

When compared to its peer, SW has notably underperformed Packaging Corporation of America’s (PKG) 10.1% decline on a YTD basis and 13% plunge over the past year.

Among the 17 analysts covering the SW stock, the consensus rating is a “Strong Buy.” As of writing, its mean price target of $52.47 suggests a 38% upside potential from current price levels.