With a market cap of $91.1 billion, The Sherwin-Williams Company (SHW) is a leading global manufacturer and distributor of paints, coatings, and related products. Founded in 1866 and headquartered in Cleveland, Ohio, the company serves professional, industrial, commercial, and retail customers.

Companies worth $10 billion or more are generally described as “large-cap stock,” Sherwin-Williams fits this bill perfectly. It operates through three main segments: The Americas Group, which manages its extensive paint store network across North and South America; Consumer Brands Group, which provides branded and private-label products through major retailers; and Performance Coatings Group, which delivers industrial coatings worldwide. The company’s global presence, substantial brand equity, innovation in coatings, and expansive distribution network position it as a leader in the industry.

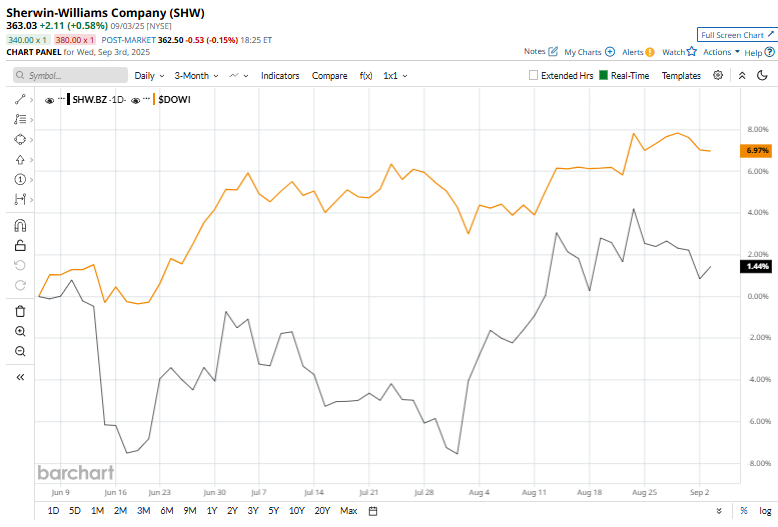

SHW stock touched its 52-week high of $400.42 on Nov. 27, 2024, and is currently trading 9.3% below that peak. Over the past three months, SHW has surged 1.5%, lagging behind the broader Dow Jones Industrial Average’s ($DOWI) 6.5% rise during the same time frame.

SHW has dipped marginally over the past 52 weeks, notably underperforming $DOWI’s 10.6% surge over the past year. But, in 2025, SHW is up 6.8%, slightly outpacing $DOWI’s 6.4% gains on a YTD basis.

SHW shares have been trading above both its 50-day and 200-day moving averages since early August, indicating a recent uptrend.

On Jul. 22, Sherwin-Williams shares dropped marginally after releasing its second-quarter earnings. The company reported marginal year-over-year sales growth to $6.31 billion, but profits fell sharply, with adjusted EPS down 8.6% to $3.38, missing estimates. The quarter also saw $59 million in restructuring charges and $40 million in building-related costs, prompting the company to lower its full-year adjusted EPS guidance to $11.20–$11.50 and forecast flat to low-single-digit sales change.

Sherwin-Williams has notably outperformed its competitor, PPG Industries, Inc.’s (PPG) 14.7% drop in stock prices over the past 52 weeks and an 8.6% decline on a YTD basis.

Among the 28 analysts covering the SHW stock, the consensus rating is a “Moderate Buy.” Its mean price target of $384.09 suggests a 5.8% upside from current price levels.