/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Salesforce (CRM) stock is down about 26% year-to-date, lagging the broader market and many of its tech peers that have benefited from the ongoing artificial intelligence (AI) boom. However, there might be a glimmer of hope on the horizon. During its 2025 Dreamforce conference, Salesforce announced a new long-term revenue target that reignited some market optimism, pushing the stock up about 4.5% in the morning session.

The company’s management struck an upbeat tone, emphasizing the growth potential of its Data Cloud and AI-driven products. Management sees a significant opportunity to boost annual recurring revenue (ARR) as these technologies gain traction. But can this optimism lead to a turnaround in CRM stock?

Here’s Why Salesforce Stock Underperformed

Despite heavy investment in AI, Salesforce hasn’t yet delivered the kind of explosive growth investors had hoped for. Much of the excitement around Salesforce’s AI initiatives, particularly its Agentforce platform for building and deploying AI agents, was based on the idea that these tools could meaningfully lift its average revenue per user (ARPU). While Agentforce is positively impacting CRM’s performance, the traction has been slower than the market expected.

For instance, Salesforce reported revenue of $10.24 billion for Q2 of fiscal 2026, up 10% from a year earlier and slightly ahead of Wall Street expectations. Earnings per share (EPS) also topped forecasts. However, the company’s guidance for the third quarter fell short of expectations, signaling a slower momentum.

Adding to the pressure, investors are concerned that AI could disrupt the broader software industry in ways that don’t necessarily benefit Salesforce. While AI has propelled many tech stocks to new highs, Salesforce, as of now, hasn’t received a significant boost.

Data Cloud and AI to Accelerate CRM’s Growth

Salesforce’s Dreamforce event gives reasons for optimism. The cloud software giant projects revenue of more than $60 billion by 2030, comfortably ahead of Wall Street’s expectations. The revenue target excludes the impact of its pending acquisition of Informatica and reflects a strong 10%-plus organic annual growth rate between fiscal 2026 and 2030.

Salesforce expects data and AI offerings to be the major catalyst supporting this growth. Notably, the company’s Data Cloud and AI ARR surged to $1.2 billion in the second quarter, marking a 120% year-over-year increase. Further, its total agentic AI ARR in Q2, including Agentforce, was approximately $440 million. During the Q2 conference call, Salesforce highlighted that the number of customers moving from pilot projects to full-scale production jumped 60% quarter over quarter, reflecting growing adoption of its offerings.

The traction extends to big-ticket deals as well. Salesforce said data and AI products were part of 60 deals worth over $1 million each, reflecting growing enterprise demand. More than 12,000 customers have now adopted Agentforce. This could give a lift to its ARR and ARPU.

To accelerate growth, Salesforce is realigning its resources and doubling down on data and AI investments. The company’s consumption-based model, where customers pay based on usage, appears to be resonating. Over 40% of new Data Cloud and Agentforce bookings in Q2 came from existing customers expanding their usage, highlighting the stickiness of its ecosystem. To further drive adoption, Salesforce introduced flexible payment options such as pay-as-you-go and expanded its Flex Credits program, which already accounts for 80% of new Agentforce bookings.

Salesforce is also bolstering its innovation pipeline through targeted AI-focused acquisitions. These deals bring in specialized talent and technology that should strengthen Salesforce’s AI and data capabilities, and, in turn, accelerate its growth.

The Bottom Line

Salesforce’s long-term revenue target and expected acceleration in the adoption of its Data Cloud and AI products signal that its multi-year transformation strategy may finally be gaining traction. If Salesforce can continue to monetize its AI offerings, the company could see acceleration in growth, and its stock could regain upward momentum in the quarters ahead.

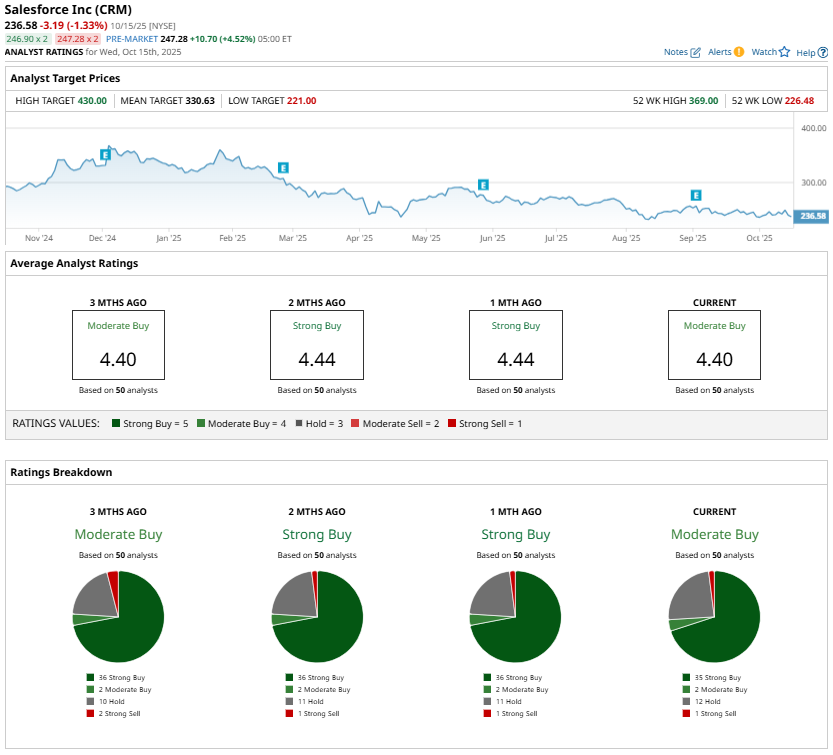

However, Wall Street is cautiously optimistic about Salesforce stock and has a “Moderate Buy” consensus rating. This implies that until the company’s AI strategy translates into tangible top- and bottom-line acceleration, investors may remain on the sidelines.