/S%26P%20Global%20Inc%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $149.6 billion, S&P Global Inc. (SPGI) is a leading provider of credit ratings, benchmarks, analytics, and workflow solutions across global capital, commodity, and automotive markets. The company operates through five key segments: Market Intelligence, Ratings, Energy, Mobility, and S&P Dow Jones Indices.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and S&P Global fits this criterion perfectly. Its offerings range from multi-asset-class data platforms and enterprise software solutions to independent credit ratings, commodity price benchmarks, and automotive industry insights.

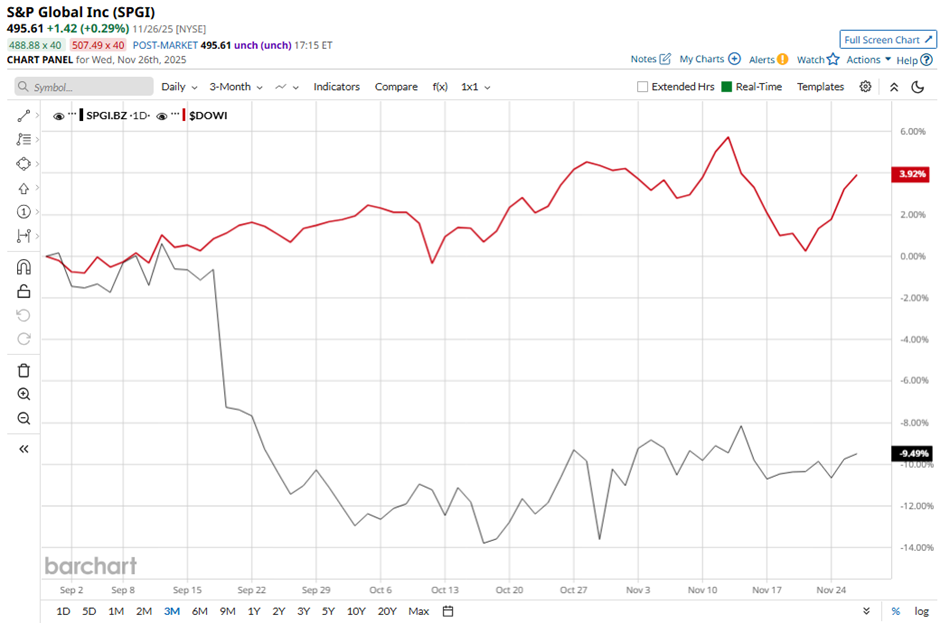

Shares of the New York-based company have declined 14.4% from its 52-week high of $579.05. Over the past three months, its shares have decreased 10.3%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 4.4% rise during the same period.

Longer term, SPGI stock is down marginally on a YTD basis, lagging behind DOWI's 11.5% gain. Moreover, shares of the independent ratings and analytics provider have dipped 5.1% over the past 52 weeks, compared to DOWI’s 5.7% increase over the same time frame.

Despite a few fluctuations, the stock has been trading below its 50-day and 200-day moving averages since mid-September.

Shares of S&P Global rose 3.9% on Oct. 30 after the company reported stronger-than-expected Q3 2025 adjusted EPS of $4.73 and revenue reaching $3.89 billion. Investors were further encouraged by a 12% surge in Ratings segment revenue, fueled by robust bond issuance and by the company raising its full-year outlook to 7% - 8% revenue growth and $17.60 - $17.85 in adjusted EPS.

In comparison, rival Berkshire Hathaway Inc. (BRK.B) has outperformed SPGI stock. BRK.B stock has returned 12.8% YTD and 6.8% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain strongly optimistic about its prospects. SPGI stock has a consensus rating of “Strong Buy” from 25 analysts in coverage, and the mean price target of $610.43 is a premium of 23.2% to current levels.