/Royal%20Caribbean%20Group%20sign%20by-%20JHVEPhoto%20via%20iStock.jpg)

Miami-based Royal Caribbean Cruises Ltd. (RCL) operates as a global cruise vacation company. With a market cap of $93.8 billion, the company operates cruise brands like Royal Caribbean International, Celebrity Cruises, Azamara, and Silversea Cruises and holds interests in TUI Cruises, Pullmantur, and SkySea Cruises.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Royal Caribbean fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the cruise industry.

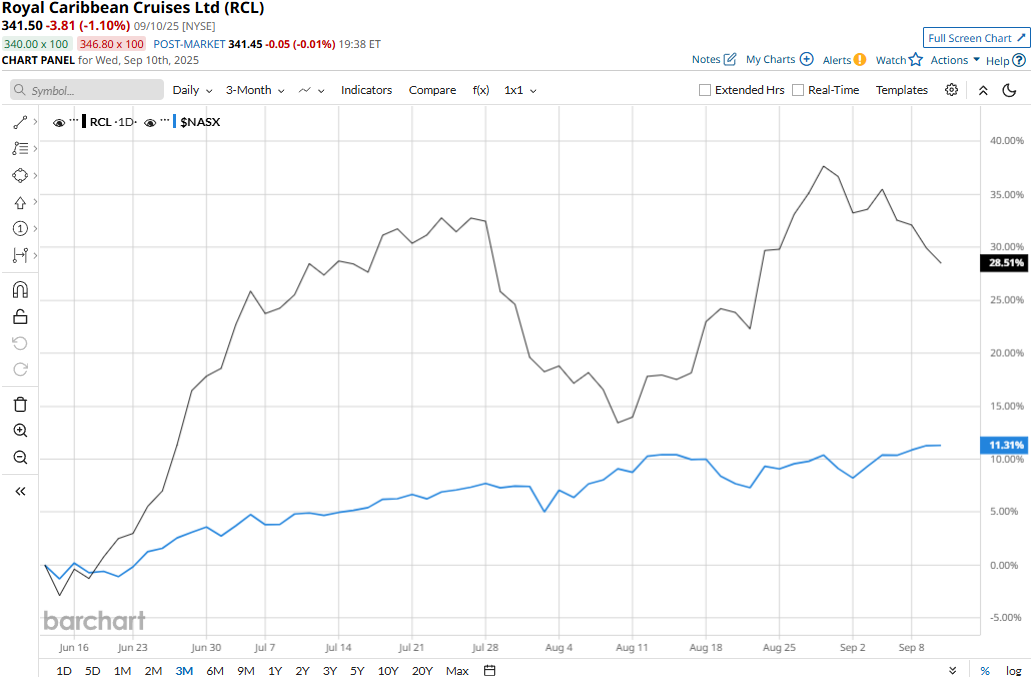

RCL touched its all-time high of $366.50 on Aug. 29 and is currently trading 6.8% below that peak. Meanwhile, RCL stock has soared 26.6% over the past three months, notably outperforming the Nasdaq Composite’s ($NASX) 11% gains during the same time frame.

RCL’s performance looks even more impressive over the longer term. The stock has surged 48% on a YTD basis and 115.7% over the past 52 weeks, significantly outperforming NASX’s 13.3% gains in 2025 and 28.6% surge over the past year.

Except for March and April, RCL has traded mostly above its 50-day and 200-day moving averages over the past year, underscoring its bullish trend.

Royal Caribbean Cruises’ stock prices dropped more than 5% in the trading session following the release of its mixed Q2 results on Jul. 29. Driven by continued growth in ticket sales and onboard and other revenues, the company’s overall topline for the quarter grew by a solid 10.4% year-over-year to $4.5 billion. However, the figure missed the Street’s expectations by a tiny margin. Given RCL's outperformance over the past year and its high beta, this triggered profit booking among investors.

Nonetheless, its overall performance remained more than impressive. RCL’s adjusted net income increased 36.3% year-over-year to $1.2 billion, and its adjusted EPS of $4.38 exceeded the consensus estimates by 6.8%. Further, its operating cash flows grew 16.3% year-over-year to $3.4 billion.

RCL has also outperformed its peer, Carnival Corporation & plc’s (CCL) 25.8% gains on a YTD basis and 94.3% surge over the past 52 weeks.

Among the 25 analysts covering the RCL stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $354.79 suggests a modest 3.9% upside potential from current price levels.