/Regions%20Financial%20Corp_%20office-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $24 billion, Regions Financial Corporation (RF) is a financial holding company that provides banking and bank-related services to individual and corporate customers. The Birmingham, Alabama-based company offers consumer and commercial banking, wealth management, credit life insurance, leasing, commercial accounts receivable factoring, specialty mortgage financing, and securities brokerage services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and RF perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the regional banks industry.

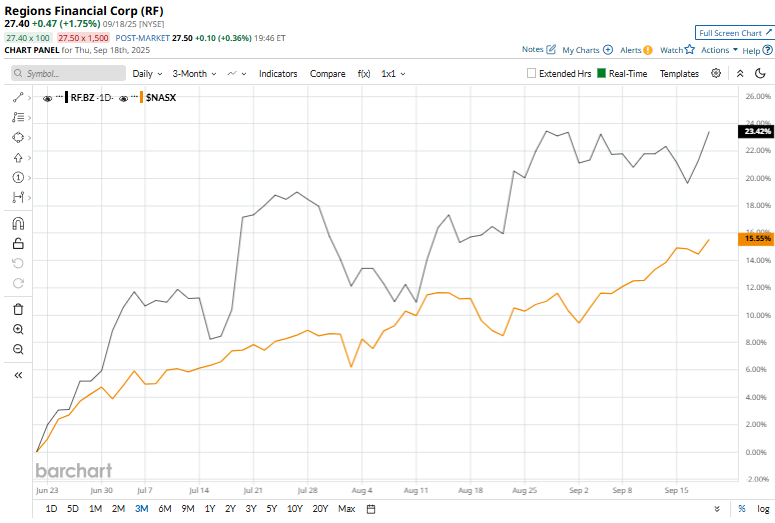

RF shares are currently trading 2% below their 52-week high of $27.96, achieved on Nov. 25, 2024. Over the past three months, RF stock has gained 24.8%, surpassing the broader Nasdaq Composite’s ($NASX) 15% rise over the same time frame.

RF has surged 20.6% over the past 52 weeks, underperforming $NASX’s 27.9% gains. However, RF stock has increased 16.5% on a YTD basis, slightly outperforming $NASX’s 16.4% uptick in 2025.

To confirm the bullish trend, RF has been trading above its 50-day moving average since early May. The stock has been trading over its 200-day moving average since late June.

On Sept. 16, Regions Bank announced a cut to its prime lending rate, lowering it to 7.25% from 7.50% effective Sept. 18, 2025. Investors welcomed the move, sending the shares up 1.4% in the next trading session.

RF’s rival, PNC Financial Services Group, Inc. (PNC) shares lagged behind the stock, with a 7% return on a YTD basis and a 13% gain over the past 52 weeks.

Wall Street analysts are moderately bullish on RF’s prospects. The stock has a consensus “Moderate Buy” rating from the 27 analysts covering it, and the mean price target of $28.64 suggests a potential upside of 4.5% from current price levels.