/Regions%20Financial%20Corp_%20office-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Birmingham, Alabama-based Regions Financial Corporation (RF) is a financial holding company that provides banking and bank-related services to individual and corporate customers. With a market cap of $19.4 billion, the company provides consumer and commercial banking, wealth management, credit life insurance, leasing, commercial accounts receivable factoring, specialty mortgage financing, and securities brokerage services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and RF perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the regional banks industry. The company boasts a strong regional presence, diversified revenue streams, and improved efficiency. Its robust capital position enhanced digital capabilities, and diversified loan portfolio supports long-term growth. RF's experienced management, disciplined risk management, and customer-centric approach further solidify its competitive edge.

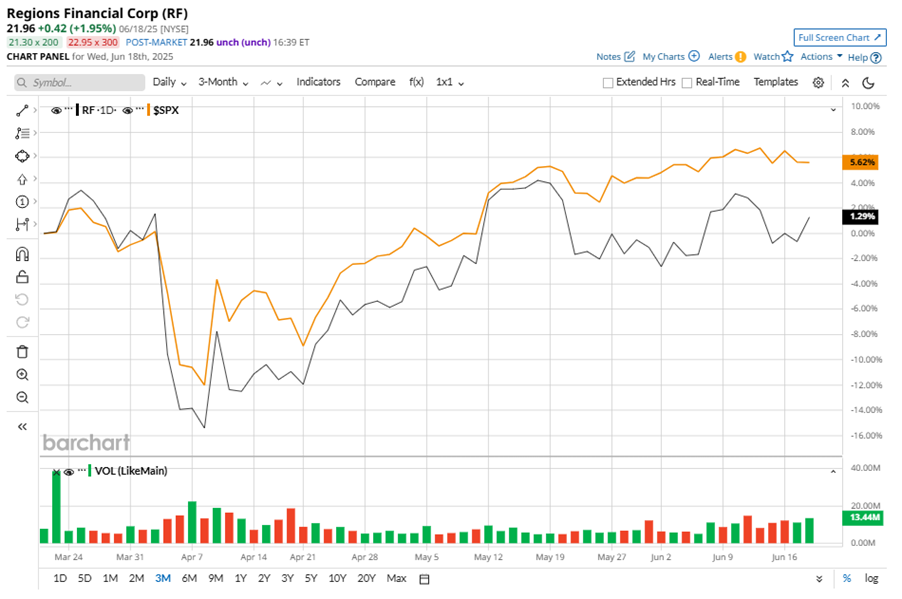

Despite its notable strength, RF shares slipped 21.5% from their 52-week high of $27.96, achieved on Nov. 25, 2024. Over the past three months, RF stock has gained 2.2%, underperforming the S&P 500 Index’s ($SPX) 6.5% rise during the same time frame.

In the longer term, shares of RF dipped 6.6% on a YTD basis, underperforming SPX’s YTD gains of 1.7%. However, the stock climbed 15.7% over the past 52 weeks, outperforming SPX’s 9% returns over the last year.

To confirm the bullish trend, RF has been trading above its 50-day moving average since early May. However, it has been trading below its 200-day moving average since early March.

RF has outperformed due to its strong presence in growing regional economies, with over 30% of deposits coming from noninterest-bearing sources. The stock is up nearly 145% in the last five years, and stands to benefit from deregulation under the Trump administration, allowing for more lending and potential mergers and acquisitions in the regional bank space.

On Apr. 17, RF shares closed up marginally after reporting its Q1 results. Its adjusted EPS of $0.54 beat Wall Street expectations of $0.51. The company’s adjusted revenue was $1.81 billion, missing Wall Street forecasts of $1.82 billion.

RF’s rival, PNC Financial Services Group, Inc. (PNC) shares lagged behind the stock, with a 9.1% downtick on a YTD basis and a 13.5% gain over the past 52 weeks.

Wall Street analysts are moderately bullish on RF’s prospects. The stock has a consensus “Moderate Buy” rating from the 25 analysts covering it, and the mean price target of $24.74 suggests a potential upside of 12.7% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.