Regency Centers Corporation (REG), based in Jacksonville, Florida, owns, operates, and develops shopping centers that live in suburban trade areas with compelling demographics. Its portfolio is anchored by leading grocers and complemented by restaurants, service providers, and top-tier retailers, creating vibrant hubs of neighborhood commerce with strong demographic appeal.

Regency is a fully integrated real estate company and a qualified REIT. With a market capitalization floating around $13 billion, Regency stands tall in the “large-cap” club, a league where the market’s heavyweights, those valued at $10 billion or more, sit.

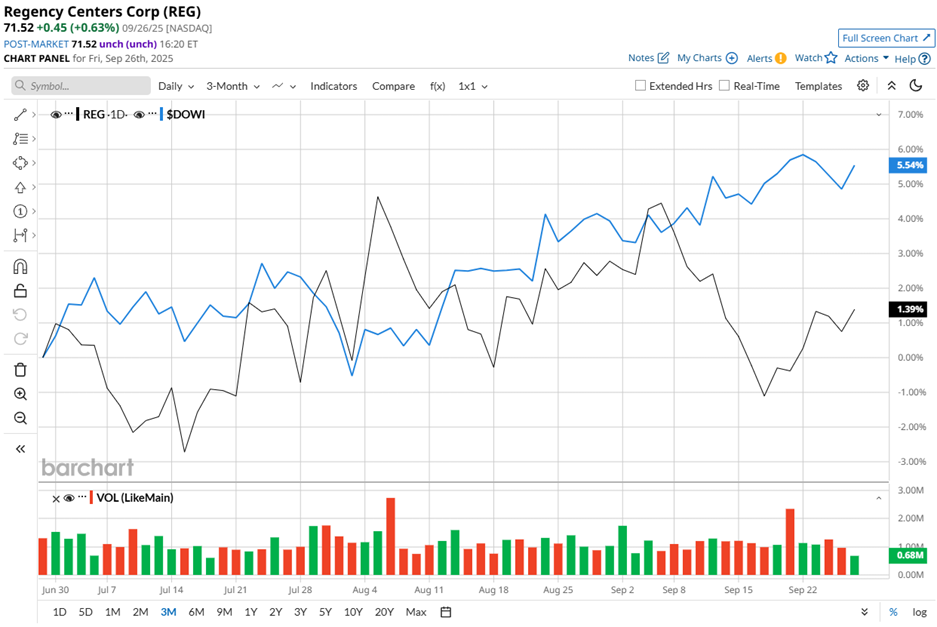

However, the scene in market terms is more candid than coy. Shares of Regency fell 8.5% from its 52-week high of $78.18 in March. Yet REG stock has eked out a 1.4% gain over the past three months. To put that into perspective, the Dow Jones Industrial Average ($DOWI) waltzed higher by 6.6% in the same stretch.

Stretching that timeline to 52 weeks, REG has barely managed to inch forward. Year-to-date (YTD), the stock is down 3.3%. In contrast, DOWI has rallied 9.7% in the past year and 8.7% YTD.

REG trades at $71.52, caught in a tug-of-war. Over the past year, the stock repeatedly crossed both the 50-day and 200-day moving averages, flashing mixed signals. The 50-day MA swings have sparked short-lived rallies, but repeated rejections near the 200-day MA since April 2025 cap upside strength. Over the past year, price action has oscillated between bullish surges and bearish pullbacks, leaving the stock in a technically indecisive zone.

But not all is dull. On July 29, REG stock jumped 2.5% after Q2 2025 bottom line exceeded Wall Street’s estimates. Revenue clocked in at $369.85 million, up 6.6% year-over-year. Nareit FFO landed at $1.16, up 9.4% from last year’s quarter and ahead of consensus estimates.

The cherry on top was the guidance, though. Regency’s management raised its full-year FFO and earnings forecast. The company now expects fiscal 2025 Nareit FFO per share between $4.59 and $4.63, nudging higher from its earlier range of $4.52 to $4.58.

Annual core operating EPS are forecasted between $4.36 and $4.40, compared to its previous guidance of $4.30 to $4.36. Rising rental rates and strong leasing demand at its grocery-anchored shopping centers gave management the courage to look investors squarely in the eye.

Rivalry is the spice of markets, and Agree Realty Corporation (ADC) makes for a fair comparison. Over the past year, ADC stock is down 4.2% but has managed a 1.2% gain on a YTD basis.

Despite the sluggish price action, Wall Street remains cautiously upbeat thanks to management’s guidance. Out of 20 analysts covering REG stock, the consensus rating is a “Moderate Buy.” The mean price target sits at $79.74, which represents premium of 11.5% to current levels.