/Raymond%20James%20Financial%2C%20Inc_%20location-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Valued at $33.9 billion by market cap, Saint Petersburg, Florida-based Raymond James Financial, Inc. (RJF) operates as a diversified financial holding company. It provides asset management, banking, research, and other services to individuals, institutions, and government entities in North America and Europe.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Raymond James fits right into that category, with its market cap exceeding the threshold, reflecting its substantial size, dominance, and influence in the asset management industry.

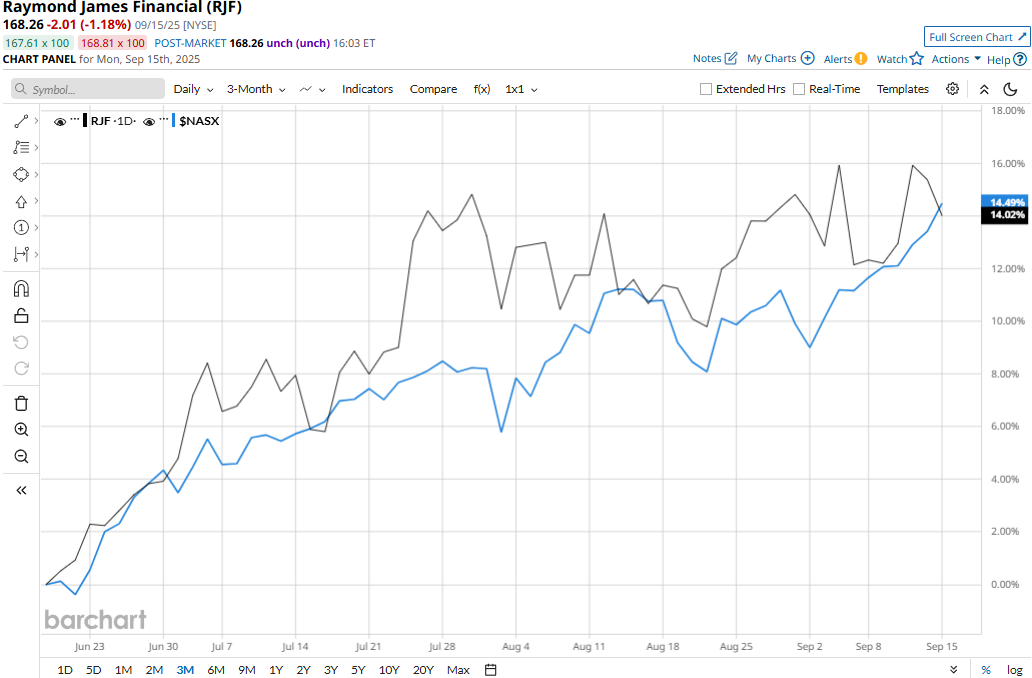

RJF touched its all-time high of $174.32 on Jan. 29 and is currently trading 3.5% below that peak. Meanwhile, the stock has surged 15.6% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 15.2% gains during the same time frame.

Over the longer term, RJF’s performance has remained mixed. RJF stock has gained 8.3% on a YTD basis and soared 42.7% over the past 52 weeks, lagging behind NASX’s 15.7% gains in 2025, but significantly outperforming NASX’s 26.4% surge over the past year.

Meanwhile, the stock has traded consistently above its 200-day and 50-day moving averages since early May, underscoring its bullish trend.

Raymond James’ stock prices gained 3.7% in the trading session following the release of its mixed Q3 results on Jul. 23. Q3 marked the 150th consecutive quarter of profitability for the company. Moreover, it registered record net revenues and pre-tax income for the first nine months of the fiscal year. The company's topline for the quarter increased 5.3% year-over-year to $3.4 billion, exceeding the Street expectations by 1.1%. However, the company’s adjusted EPS for the quarter dropped 8.8% year-over-year to $2.18, missing the consensus estimates by 8%.

When compared to its peer, RJF has lagged behind State Street Corporation’s (STT) 14.2% surge in 2025, but significantly outperformed STT’s 34.6% gains over the past year.

Among the 15 analysts covering the RJF stock, the consensus rating is a “Moderate Buy.” Its mean price target of $174.92 suggests a modest 4% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.