/Qualcomm%2C%20Inc_%20logo%20on%20pc%20and%20website%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $173.4 billion, QUALCOMM Incorporated (QCOM) is a top player in wireless technology development and commercialization. The San Diego, California-based company operates through three main segments: Qualcomm CDMA Technologies; Qualcomm Technology Licensing; and Qualcomm Strategic Initiatives.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Qualcomm fits this criterion perfectly. Qualcomm’s flagship offerings include Snapdragon chipsets, FastConnect wireless solutions, and a range of Qualcomm-branded cellular and IoT products, with a strategic emphasis on embedding on-device generative AI throughout its portfolio.

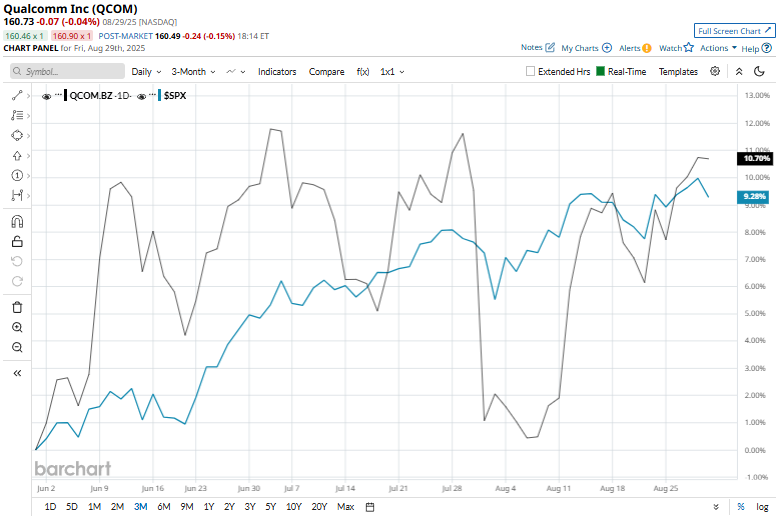

Shares of QCOM declined 11.7% from its 52-week high of $182.10 touched on Nov. 7. QCOM stock has surged 8.4% over the past three months, underperforming the S&P 500 Index ($SPX), which has returned 9.3% over the same time frame.

In 2025, QCOM shares have risen 4.6%, lagging behind the S&P 500's 9.8% rally over the same period. However, QCOM's shares have decreased 6.5% over the past year, lagging behind the $SPX’s 15.5% rise,

QCOM shares have recently been trading above both its 50-day and 200-day moving averages since the end of August, indicating a recent uptrend.

On Jul. 30, QCOM released its mixed Q3 results, and its shares dwindled 7.7% in the trading session. Fueled by its diversification into different areas and growth in IoT revenues, the company’s total revenues for the quarter surged 10.3% year-over-year to $10.4 billion, surpassing the consensus estimates. However, the company’s handset revenues of $6.3 billion and automotive revenues of $984 million both fell short of Street expectations, which likely unsettled investor confidence.

In comparison, rival NVIDIA Corporation (NVDA) has outperformed QCOM considerably, gaining 38.7% over the past 52 weeks and 29.7% on a YTD basis.

The stock has a consensus rating of “Moderate Buy” from the 32 analysts covering it, and its mean price target of $179.88 represents a premium of 11.9% from the prevailing market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.