/PulteGroup%20Inc%20phone%20and%20lapton%20by-%20rafapress%20via%20Shutterstock.jpg)

Atlanta, Georgia-based PulteGroup, Inc. (PHM) is one of the largest homebuilders in the U.S., designing and constructing single-family homes, townhomes, and condominiums across a wide range of price points. Valued at a market cap of $24.3 billion, the company operates through well-known brands including Pulte Homes, Centex, Del Webb, DiVosta, John Wieland Homes & Neighborhoods, and American West.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and PHM fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the residential construction industry. With a diversified geographic footprint and a consumer-targeted product mix, the company continues to benefit from favorable demographic trends and sustained demand for new construction homes in the U.S.

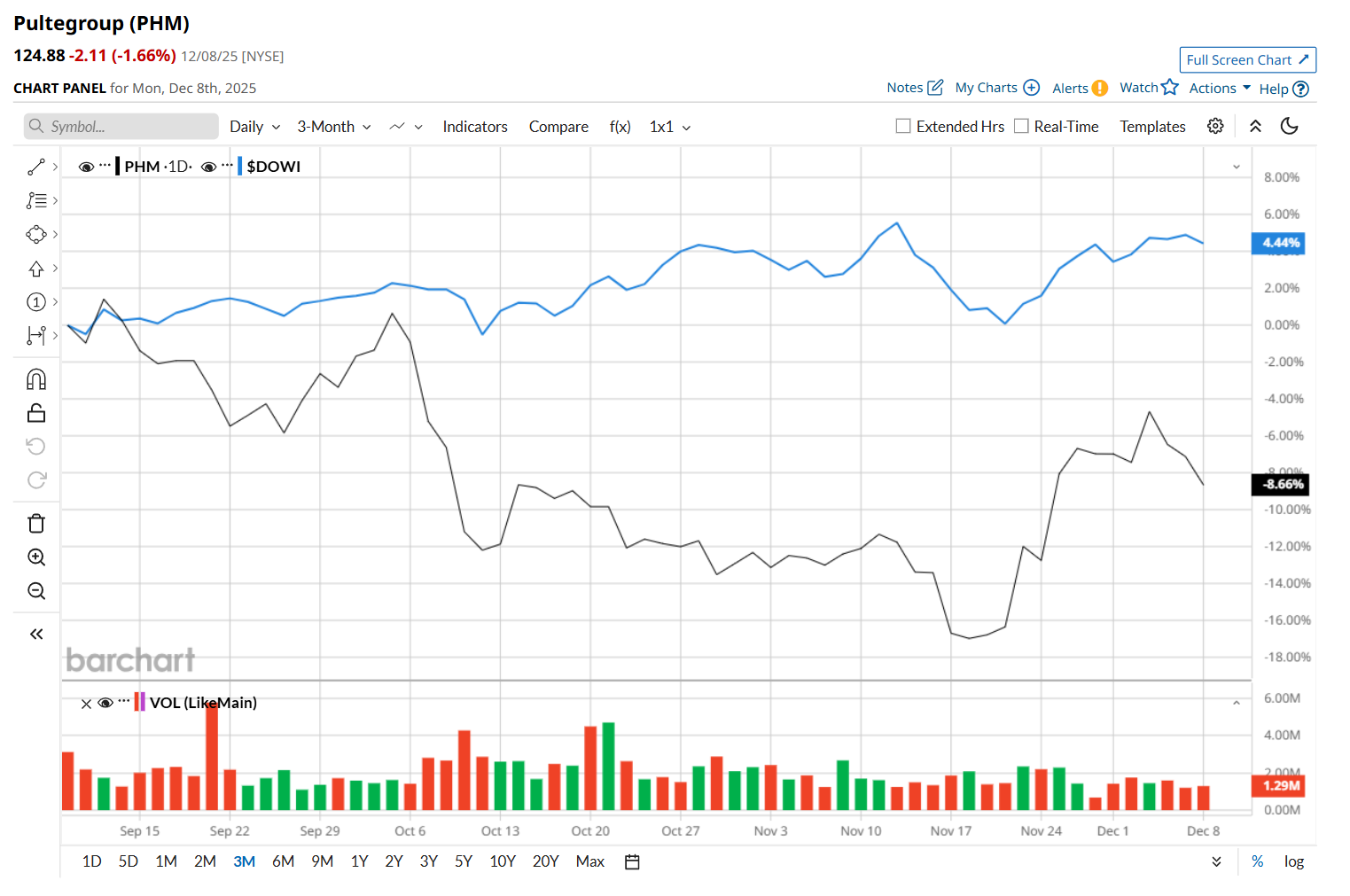

This homebuilder has slipped 12.1% below its 52-week high of $142.11, reached on Sep. 5. Shares of PHM have declined 11.7% over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 4.9% rise during the same time frame.

Moreover, in the longer term, PHM has fallen 1.5% over the past 52 weeks, lagging behind DOWI’s 6.9% uptick over the same time frame. However, on a YTD basis, shares of PHM are up 14.7%, outpacing DOWI’s 12.2% return.

To confirm its bullish trend, PHM has been trading above its 200-day moving average since late July, and has remained above its 50-day moving average since late November.

On Oct. 21, PHM delivered better-than-expected Q3 earnings results, and its shares remained unchanged after the release. While the company’s total revenue declined 1.6% year-over-year to $4.4 billion, it topped analyst expectations by 2.3%. Moreover, its EPS also fell 11.6% from the year-ago quarter to $2.96, but surpassed consensus estimates by 3.5%. Its net new orders dropped by 5.6% from the same period last year to 6,638 homes in the quarter.

PHM has outpaced its rival, D.R. Horton, Inc. (DHI), which declined 3.8% over the past 52 weeks and gained 9% on a YTD basis.

Despite PHM’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 17 analysts covering it, and the mean price target of $138 suggests a 10.5% premium to its current price levels.

.png?w=600)