Pinnacle West Capital Corporation (PNW), headquartered in Phoenix, Arizona, provides retail and wholesale electric services to its customers. Valued at $10.4 billion by market cap, the company provides retail and wholesale electric service to most of the State of Arizona. PNW is also involved in real estate development activities in the western U.S.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and PNW perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the utilities - regulated electric industry.

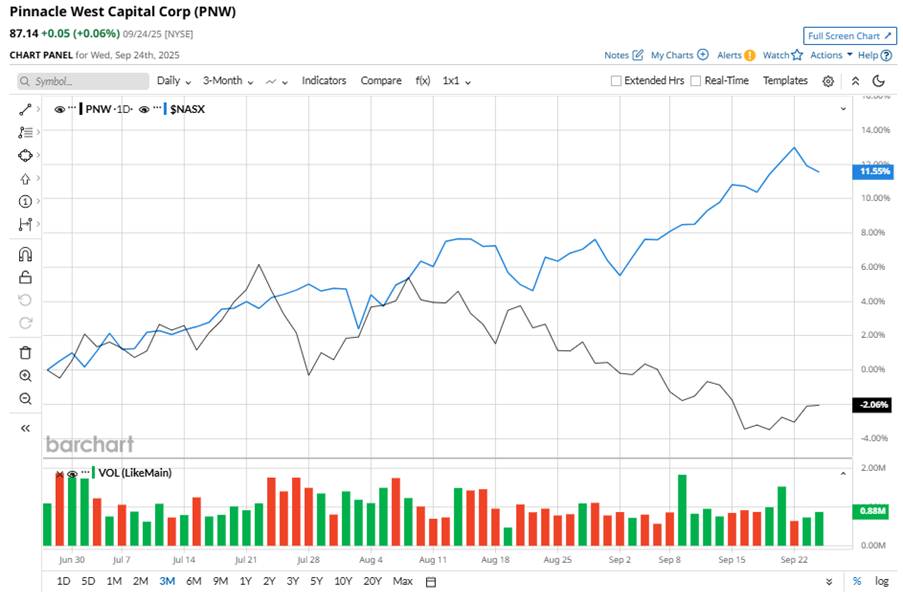

Despite its notable strength, PNW slipped 9.7% from its 52-week high of $96.50, achieved on Apr. 3. Over the past three months, PNW stock declined 3.4%, underperforming the Nasdaq Composite’s ($NASX) 13% gains during the same time frame.

In the longer term, shares of PNW rose 2.8% on a YTD basis but dipped 2.4% over the past 52 weeks, underperforming NASX’s YTD gains of 16.5% and 24.5% returns over the last year.

To confirm the bearish trend, PNW has been trading below its 50-day and 200-day moving averages since late August.

On Aug. 6, PNW shares closed up marginally after reporting its Q2 results. Its EPS declined 10.2% from the year-ago quarter to $1.58.The company’s revenue totaled $1.4 billion, representing a 3.8% year-over-year increase. PNW expects full-year EPS to be between $4.40 and $4.60.

In the competitive arena of utilities - regulated electric, Evergy, Inc. (EVRG) has taken the lead over PNW, showing resilience with 19.8% gains on a YTD basis and 19.5% returns over the past 52 weeks.

Wall Street analysts are reasonably bullish on PNW’s prospects. The stock has a consensus “Moderate Buy” rating from the 14 analysts covering it, and the mean price target of $96.50 suggests a potential upside of 10.7% from current price levels.