Valued at roughly $40.9 billion by market cap, California-based PG&E Corporation (PCG) stands as one of the most prominent utility providers in the United States. The company delivers both electricity and natural gas to millions of households and businesses across northern and central California, ensuring reliable access to energy in one of the country’s most economically vital regions. Its diverse power generation portfolio spans nuclear, hydroelectric, fossil fuel, fuel cell, and solar photovoltaic sources.

Companies valued at $10 billion or more are generally categorized as "large-cap" stocks, and PG&E firmly belongs in this group with a market capitalization well above that threshold. As the parent company of Pacific Gas and Electric, it plays a critical role in powering 16 million Californians across a massive 70,000-square-mile service area, positioning itself as a cornerstone of California’s energy infrastructure and a key player in the ongoing transition to cleaner energy.

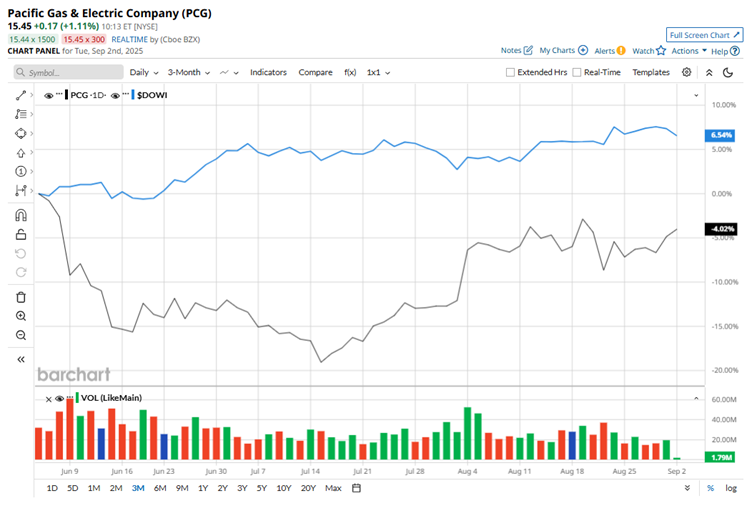

After hitting a 52-week high of $21.72 in November 2024, PCG stock has retreated 29.6% from that level. Moreover, the stock has crashed nearly 8.2% over the past three months, heavily lagging behind the Dow Jones Industrial Average’s ($DOWI) 6.4% return during the same period.

The longer-term performance paints an even bleaker picture for PCG. Over the past year, the stock has shed nearly 22.4% and has continued to slide in 2025, falling roughly 24.3% year-to-date. By comparison, DOWI has climbed 8.3% over the past year and is up 5.8% so far in 2025.

To highlight the bearish pressure on the stock, it’s worth noting that shares have been stuck below their 200-day moving average since early January this year, a clear sign of prolonged weakness.

PG&E Corporation is currently sailing through choppy waters, weighed down by regulatory pressures as well as ongoing operational and financial challenges. The turbulence was further underscored on Jul. 31, when the company posted disappointing fiscal 2025 second-quarter results that fell short of both revenue and earnings expectations. In addition, revenue came in at $5.90 billion, marking a slight decline from $5.99 billion recorded in the same quarter last year.

Furthermore, the comparison with rival Dominion Energy, Inc. (D) only magnifies PG&E’s lagging performance. Over the past 52 weeks, Dominion’s stock has advanced 5.7%, with additional gains of nearly 9.7% year-to-date.

On the brighter side, Wall Street still appears to be waving a green flag for PG&E, despite its lackluster long-term price performance. Among the 17 analysts covering the stock, the consensus rating sits at a “Moderate Buy.” The average price target of $20.57 implies almost 33.8% upside from the current level.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.