/Pentair%20plc%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $18 billion, Pentair plc (PNR) delivers smart, sustainable water solutions that serve homes, businesses, and industries worldwide. The company operates through three segments: Flow; Water Solutions; and Pool, offering advanced technologies for water treatment, reuse, and efficient management.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Pentair fits this criterion perfectly. Its portfolio spans residential and commercial pool equipment, filtration systems, pumps, and water treatment products, enabling clean, safe water access while supporting conservation and reuse.

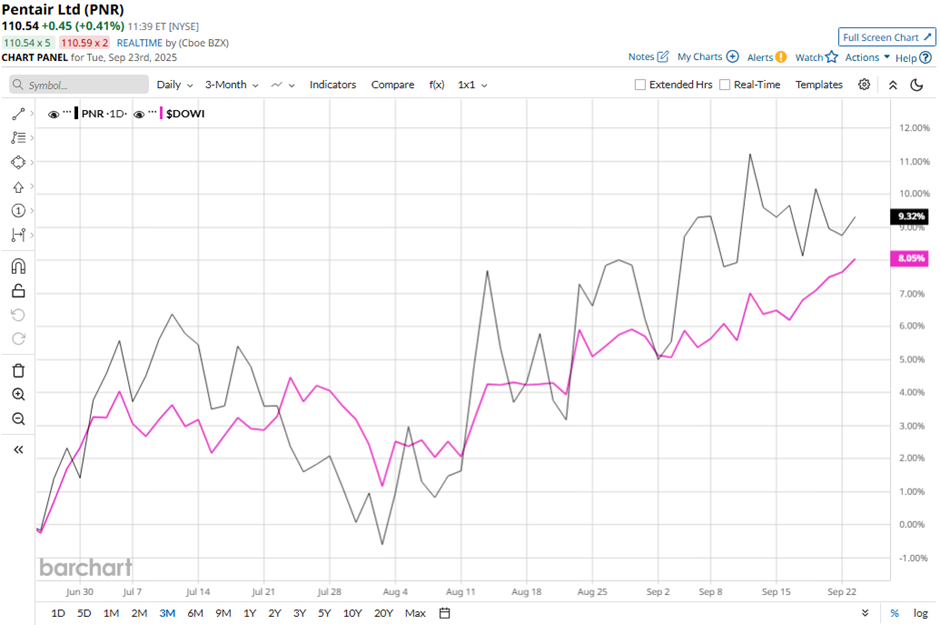

Shares of the London, the United Kingdom-based company have dropped 1.8% from its 52-week high of $112.91. Over the past three months, its shares have increased 11.3%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 9.4% rise during the same period.

Longer term, PNR stock is up 10.1% on a YTD basis, outpacing DOWI's 9.5% gain. Moreover, shares of the company have gained 15.5% over the past 52 weeks, compared to DOWI’s 10.6% return over the same time frame.

Yet, the stock has been in a bullish trend, consistently trading above its 50-day moving average since late April. Also, it has moved above its 200-day moving average since early May.

Shares of Pentair rose marginally on Jul. 22 as the company delivered strong Q2 2025 results, with adjusted EPS of $1.39 beating the consensus estimate and exceeding its guidance, marking a 14% year-over-year increase. Net sales grew 2% year-over-year to $1.123 billion, topping expectations, while adjusted segment operating margin expanded 170 basis points to 26.4%. Additionally, management raised full-year adjusted EPS guidance to $4.75 - $4.85 and lifted 2025 sales growth outlook to 1% - 2%.

In comparison, rival Illinois Tool Works Inc. (ITW) has lagged behind PNR stock. ITW stock has risen 3.1% YTD and 1.9% over the past 52 weeks.

Despite the stock’s outperformance, analysts remain cautiously optimistic about its prospects. PNR stock has a consensus rating of “Moderate Buy” from 20 analysts in coverage, and the mean price target of $115.83 is a premium of 4.8% to current levels.