/Paychex%20Inc_%20office-by%20Eric%20Glenn%20via%20Shutterstock.jpg)

Rochester, New York-based Paychex, Inc. (PAYX) provides integrated human capital management solutions (HCM) for payroll, benefits, human resources (HR), and insurance services for small to medium-sized businesses. With a market cap of $48.7 billion, Paychex's operations span the United States, Europe, and internationally.

Companies worth $10 billion or more are generally described as "large-cap stocks." Paychex fits this bill perfectly. Given the company’s extensive clientele, its valuation above this mark is not surprising. The company serves hundreds of thousands of customers worldwide, helping them manage their human resources, payroll, and benefits.

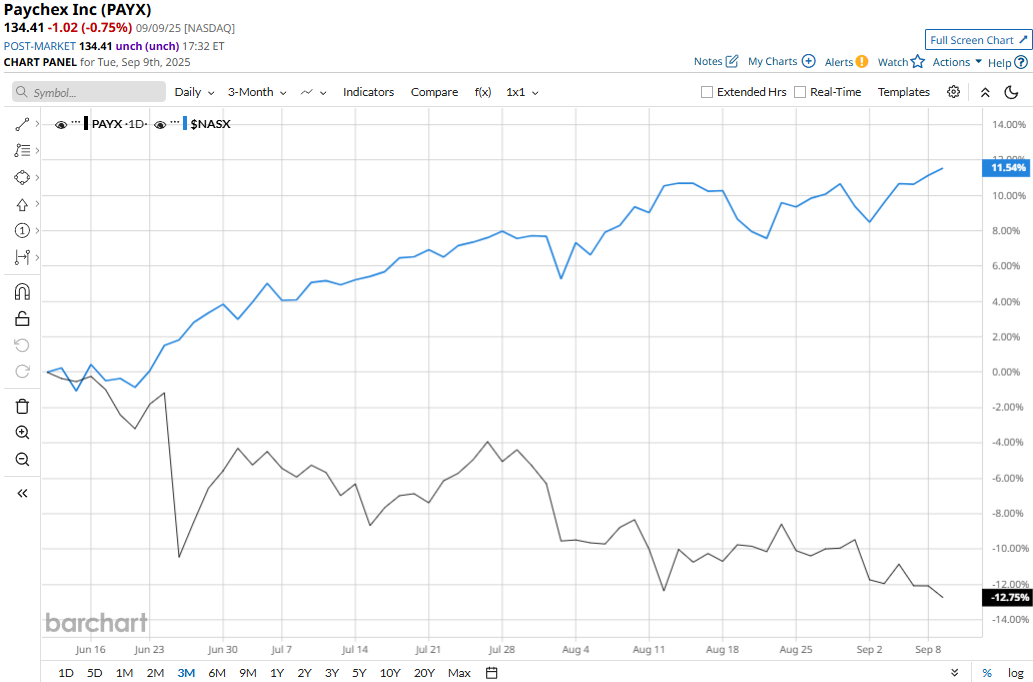

Despite its notable strengths, Paychex’s stock prices have declined 16.5% from its all-time high of $161.24 touched on Jun. 6. Meanwhile, the stock has plunged 14.4% over the past three months, notably underperforming the Nasdaq Composite’s ($NASX) 11.7% surge during the same time frame.

Paychex’s performance has remained grim over the longer term as well. PAYX stock has declined 4.1% on a YTD basis and gained 1.7% over the past 52 weeks, lagging behind Nasdaq’s 13.3% gains in 2025 and 29.6% surge over the past year.

To confirm the recent downturn, PAYX stock has traded below its 200-day and 50-day moving averages since late June.

Despite delivering better-than-expected results, Paychex’s stock prices tanked 9.4% in a single trading session following the release of its Q4 results on Jun. 25. The company’s Q4 results demonstrated its resilience and ability to navigate through an uncertain macro environment. Its topline for the quarter surged 10.2% year-over-year to $1.4 billion, surpassing Street expectations. Meanwhile, its adjusted EPS for the quarter increased 6.3% year-over-year to $1.19, exceeding the consensus estimates by 85 bps.

However, the company’s full-year guidance for 2026 remained mixed and unsettled investor confidence, leading to a sharp dip in stock prices.

On a more positive note, Paychex has notably outperformed its peer, Workday, Inc.’s (WDAY) 10.6% decline on a YTD basis and 9% drop over the past 52 weeks.

Among the 16 analysts covering the PAYX stock, the consensus rating is a “Hold.” As of writing, its mean price target of $149.42 suggests an 11.2% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.