/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $129.2 billion, Palo Alto Networks, Inc. (PANW) is a leading global cybersecurity provider offering advanced security solutions across the Americas, EMEA, and the Asia-Pacific regions. The company delivers a broad portfolio that includes secure access, cloud-native protection, AI-driven security operations, and threat intelligence services.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Palo Alto Networks fits this criterion perfectly. The company’s platforms such as Prisma, Strata, and Cortex, help organizations protect networks, applications, and data across multi-cloud and hybrid environments. Serving industries from government and healthcare to finance and telecommunications, it offers its products through channel partners and direct enterprise sales worldwide.

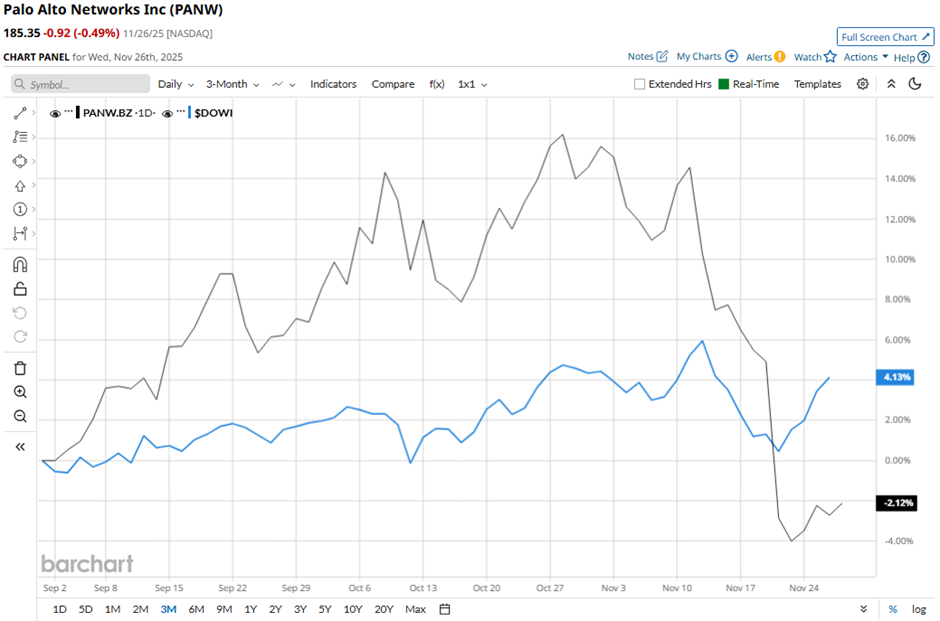

Shares of the Santa Clara, California-based company have declined 17.1% from its 52-week high of $223.61. Over the past three months, its shares have risen marginally, underperforming the broader Dow Jones Industrials Average's ($DOWI) 4.4% return during the same period.

Longer term, PANW stock is up 1.9% on a YTD basis, lagging behind DOWI's 11.5% gain. Moreover, shares of the security software maker have dipped 6.5% over the past 52 weeks, compared to DOWI’s 5.7% increase over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day and 200-day moving averages since September.

Despite reporting stronger-than-expected Q1 2026 adjusted EPS of $0.93 and revenue of $2.47 billion on Nov. 19, shares of PANW fell 7.4% the next day because investors reacted negatively to the company’s plan to acquire Chronosphere, viewed as a costly and high-risk move. The worry was that the pricey acquisition could pressure profitability even though total revenue grew 16% year-over-year to $2.5 billion and Next-Generation Security ARR rose 29% to $5.9 billion.

In comparison, rival Broadcom Inc. (AVGO) has outpaced PANW stock. AVGO stock has climbed 71.5% on a YTD basis and 141.3% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. PANW stock has a consensus rating of “Moderate Buy” from 48 analysts in coverage, and the mean price target of $224.72 is a premium of 21.2% to current levels.