/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Palantir Technologies (PLTR) is set to report its fourth-quarter earnings report on Monday, Feb. 2. The data analytics and enterprise AI software company has recently faced a notable pullback, with shares down more than 11% over the past month. Much of this decline reflects growing concern about a potential AI-driven market bubble, which has pressured sentiment across the sector.

Another factor weighing on PLTR stock has been its extremely high valuation. As PLTR stock trades at a significant premium to peers, investors may have chosen to lock in profits or reduce exposure, contributing to the recent selloff.

Heading into the Q4 report, investors should note that Palantir has a mixed track record of surprising after earnings release. Over the past four quarters, the stock has reacted positively to earnings results twice, with post-report moves averaging around 13%. This suggests that investors should be prepared for volatility depending on whether results meet expectations.

Palantir’s U.S. Business to Drive Q4 Financials

Palantir could once again deliver solid revenue and earnings growth in the fourth quarter, driven by the rapid growth in its U.S. business. The solid demand for the firm’s Artificial Intelligence Platform (AIP) and an expanding footprint across both government and commercial markets position it well to outperform top-line estimates.

In Q3, Palantir’s revenue climbed 63% year-over-year (YOY) and 18% sequentially to $1.18 billion. This growth largely came from the U.S. segment, where overall revenue surged 77% YOY. Further, the company’s U.S. commercial business is growing at an accelerated pace, recording a 121% increase in the top line compared with the prior year. At the same time, U.S. government revenue also remained robust, growing by 52% YOY.

This acceleration reflects the growing adoption of Palantir’s AI-driven software solutions. Demand for AIP continues to expand across industries, enabling the company to strengthen relationships with existing customers while also bringing in new clients at an unprecedented pace.

Contract activity in Q3 further highlights Palantir’s strong trajectory. The company reported a record total contract value of $2.8 billion, supported by a surge in large-scale deals. Palantir closed 204 contracts worth at least $1 million, including 91 deals above $5 million and 53 deals exceeding $10 million.

Within its U.S. commercial segment, which now represents 34% of total revenue, the company secured $1.3 billion in contract value. These figures suggest that customers are moving quickly toward larger enterprise agreements.

Palantir’s customer base is also expanding at a solid pace, with the number of customers rising 45% YOY to 911. At the same time, existing clients are increasing their spending.

Looking ahead, management has guided Q4 revenue to be between $1.327 billion and $1.331 billion. Given the exceptional momentum in the U.S. commercial business, Palantir could outperform expectations. The government segment is also expected to remain stable, supported by ongoing programs and a solid pipeline of new contracts.

With strong revenue growth translating into improved operating leverage, profitability is also expected to rise. Analysts are forecasting earnings of $0.17 per share, reflecting a significant YOY improvement as margins expand and efficiency gains continue.

Overall, Palantir’s Q4 will likely reflect accelerating demand, record contract momentum, and strengthening profitability.

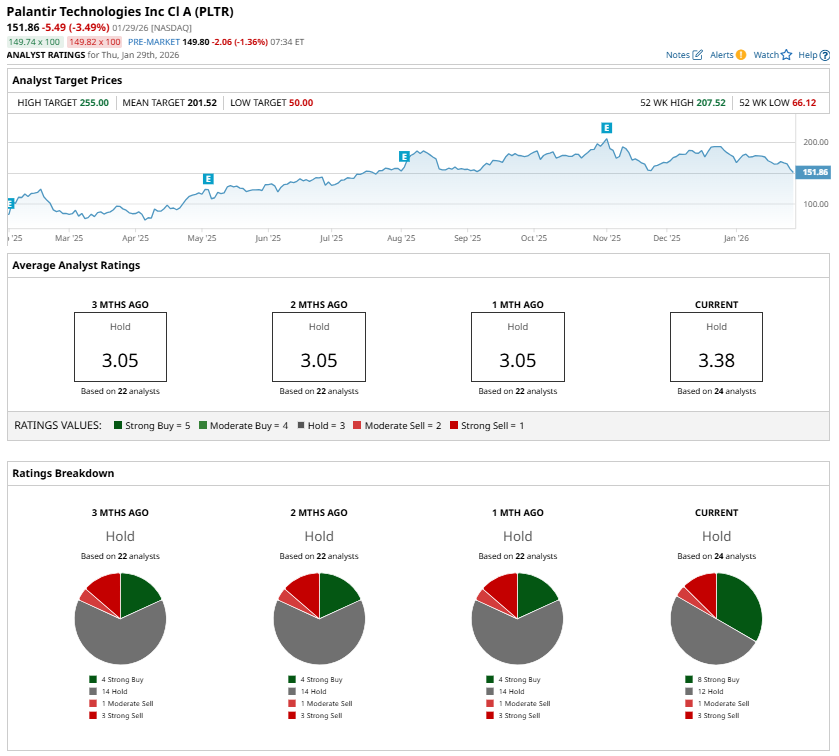

Is Palantir Stock a Buy, Sell, or Hold?

Palantir is set to deliver strong financial numbers in Q4. Demand for its AIP is accelerating, supported by a growing customer base and an expanding pipeline of contracts. This positioning could allow Palantir to deliver impressive growth over the next several quarters, making it a compelling bet in the enterprise AI software space.

Despite its solid growth prospects, Wall Street remains cautious ahead of the company’s Q4 earnings report due to its valuation. While shares have pulled back, Palantir trades at an extremely elevated price-to-sales (P/S) ratio of roughly 96 times, well above most industry peers. Such a premium valuation raises concerns that much of the company’s future growth may already be priced into the stock.

As a result, most analysts recommend a “Hold” rating for PLTR stock. Palantir’s long-term story remains compelling, especially given the rapid adoption of its AI platform, but the stock’s steep valuation makes it difficult to justify a buy ahead of earnings.