/Packaging%20Corp%20Of%20America%20phone%20and%20data%20by-Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $19 billion, Packaging Corporation of America (PKG) is the third-largest producer of containerboard and a leading producer of uncoated freesheet paper in North America. The company operates through two main segments: Packaging and Paper, offering a wide range of corrugated packaging products, commodity and specialty papers, and communication papers.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Packaging Corporation fits this criterion perfectly. With a strong manufacturing and sales network, PCA serves diverse industries including food, beverages, retail, and industrial markets across the United States.

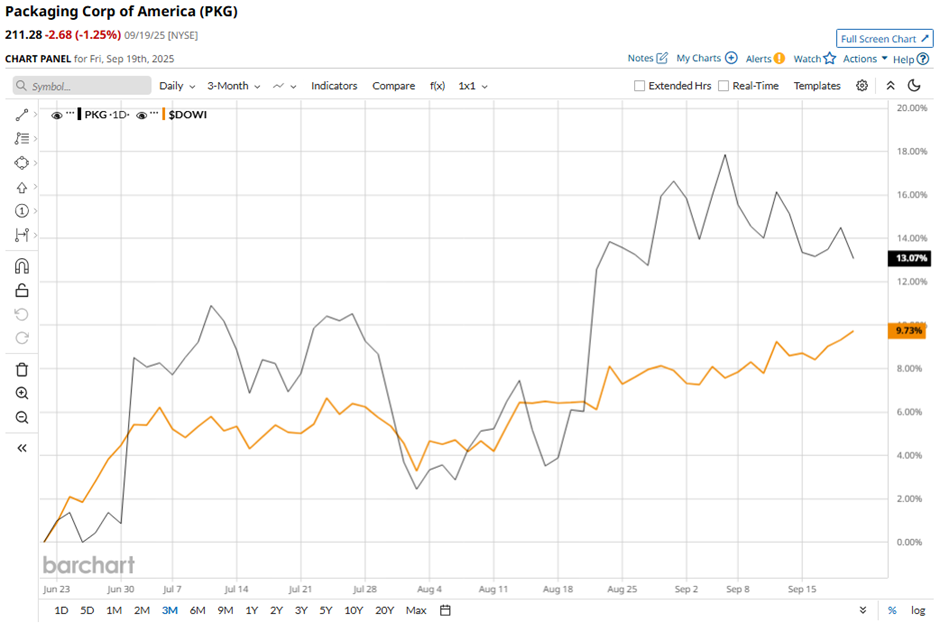

Shares of the Lake Forest, Illinois-based company have declined 15.8% from its 52-week high of $250.82. Over the past three months, its shares have increased 13.5%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 9.8% return during the same period.

Longer term, PKG stock is down 6.2% on a YTD basis, lagging behind DOWI's 8.9% rise. Moreover, shares of the company have decreased over 2% over the past 52 weeks, compared to DOWI’s 10.2% gain over the same time frame.

Yet, the stock has been trading mostly above its 50-day moving average since mid-May.

Shares of PKG rose marginally following its Q2 2025 results on Jul. 23 as adjusted EPS of $2.48 topped both guidance and the consensus estimate, reflecting a 13% year-over-year increase. Revenue grew 4.6% to $2.2 billion, ahead of the estimate, driven by stronger pricing and mix across both Packaging and Paper segments, which also lifted gross margin to 22.2%. Investors were further encouraged by the company’s Q3 EPS guidance of $2.80.

In contrast, rival International Paper Company (IP) has lagged behind PKG stock. IP stock has dropped 13.7% YTD and 7.1% over the past 52 weeks.

Despite the stock’s underperformance relative to the Dow over the past year, analysts remain moderately optimistic about its prospects. PKG stock has a consensus rating of “Moderate Buy” from 10 analysts in coverage, and the mean price target of $223.67 is a premium of 5.9% to current levels.