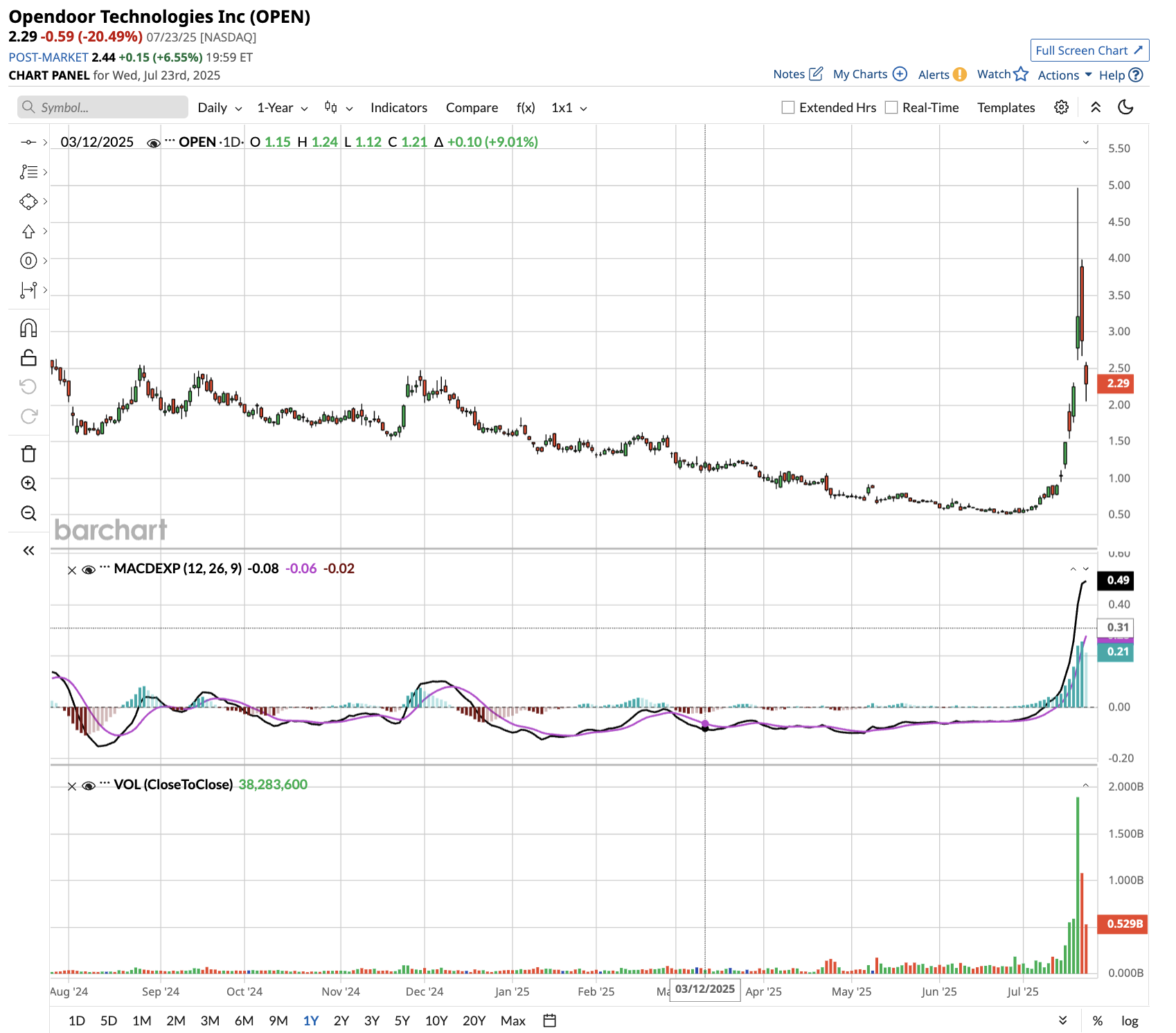

Opendoor (OPEN) has become the latest meme stock phenomenon, surging 350% in the past month and 100% since hedge fund manager Eric Jackson began promoting it on social media as a potential “100-bagger.” The stock rocketed from $0.50 to highs above $4.90 before falling to the $2.40 level.

This explosive rally appears to be driven primarily by retail speculation and social media hype, rather than by fundamental improvements. High short interest at 20.7% of its float has created a classic short squeeze scenario, amplified by social media momentum and Jackson’s bullish calls, which cite expense optimization efforts.

However, OPEN stock remains more than 90% below its 2021 peak of $39.24, reflecting underlying business challenges in the capital-intensive iBuying model. No meaningful catalysts for news or operational improvements have justified the parabolic move.

While Jackson points to profitability optimization, Opendoor still faces structural headwinds from higher interest rates, reduced housing turnover, and persistent cash burn. The current rally exhibits classic characteristics of meme stocks: massive volatility, retail-driven momentum, and a disconnection from fundamentals.

Is Opendoor Stock a Good Buy Right Now?

Opendoor Technologies delivered mixed first-quarter results, demonstrating operational progress despite ongoing challenges in the housing market. The iBuying platform reported $1.2 billion in revenue, roughly flat year-over-year, while making strides toward profitability through aggressive cost reduction and strategic pivots. Opendoor’s adjusted EBITDA loss narrowed dramatically to $30 million from $50 million in the prior year, primarily driven by a 33% reduction in fixed operating expenses.

Opendoor cut $19 million in costs year-over-year while maintaining contribution margins of 4.7%. Management projects positive quarterly adjusted EBITDA of $10 million to $20 million for Q2, marking the first profitable quarter in three years.

CEO Carrie Wheeler outlined an ambitious expansion of Opendoor's agent partnership model, flipping from agents bringing customers to Opendoor to the company referring high-intent sellers to vetted agent partners.

This channel strategy aims to improve conversion rates while generating asset-light revenue through commission sharing on listings. The pilot program operates across 11 markets, with agents conducting in-home assessments and providing local expertise to enhance the customer experience.

Opendoor is maintaining pricing discipline with higher spreads while reducing acquisition volumes. It expects to purchase approximately 1,700 homes in Q2, down from 3,609 in Q1, following a more seasonal approach that concentrates activity in Q1 and Q4.

Opendoor ended the quarter with $1 billion in total capital and successfully renewed multiple credit facilities, demonstrating continued lender confidence. The company holds 7,080 homes worth $2.4 billion in net inventory.

While management expects contribution margin improvements in the second half of 2025, revenue is projected to decline year-over-year in Q3 and Q4 due to reduced acquisition volumes. The strategy prioritizes margin protection and cost discipline over growth until market conditions improve.

Opendoor’s focus on operational efficiency and strategic pivots positions it for sustained profitability, though execution remains critical in an uncertain housing environment.

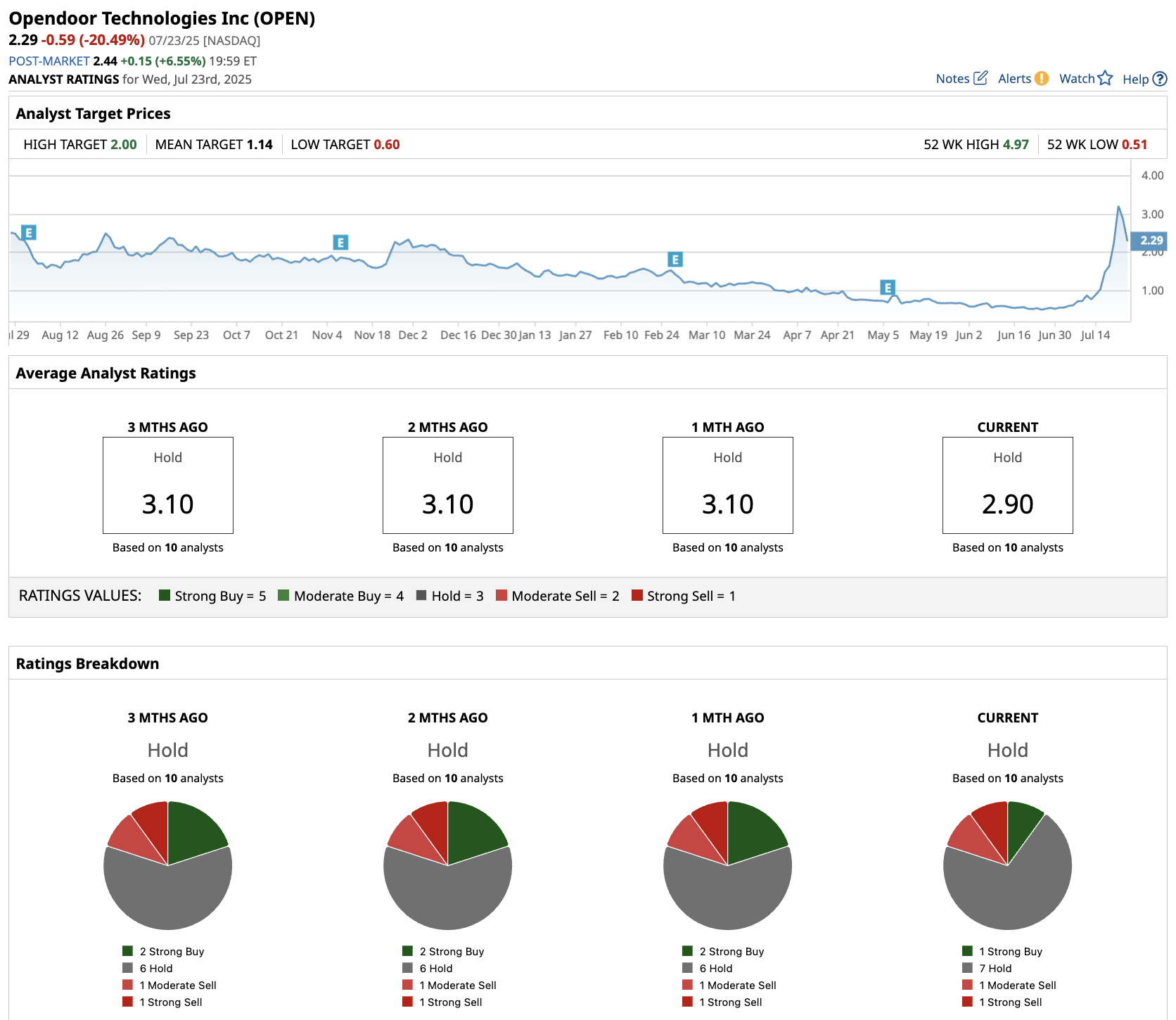

What Is the Target Price for Opendoor stock?

Analysts expect Opendoor to increase revenue from $5.15 billion in 2024 to $9 billion in 2029. Wall Street estimates its free cash flow to improve to $180 million in 2029, compared to an outflow of $620 million last year.

If OPEN stock trades at 15x forward FCF, it could gain close to 70% over the next four years. Of the 10 analysts covering OPEN stock, one recommends “Strong Buy,” seven recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average OPEN stock price target is $1.14, more than 50% below the current price.

The ongoing rally in Opendoor stock appears to be a speculative bubble driven by social media promotion rather than genuine business improvement. The extreme volatility and lack of fundamental catalysts suggest significant downside risk when the momentum inevitably reverses.