With a market cap of $14.7 billion, Omnicom Group Inc. (OMC) is one of the world’s largest advertising, marketing, and corporate communications companies. Operating across North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific, it serves clients through a global network of leading agencies.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Omnicom Group fits this criterion perfectly. The company offers a broad portfolio of services, including advertising, branding, digital transformation, public relations, healthcare communications, data analytics, and experiential marketing, competing with both traditional agencies and emerging technology and media firms.

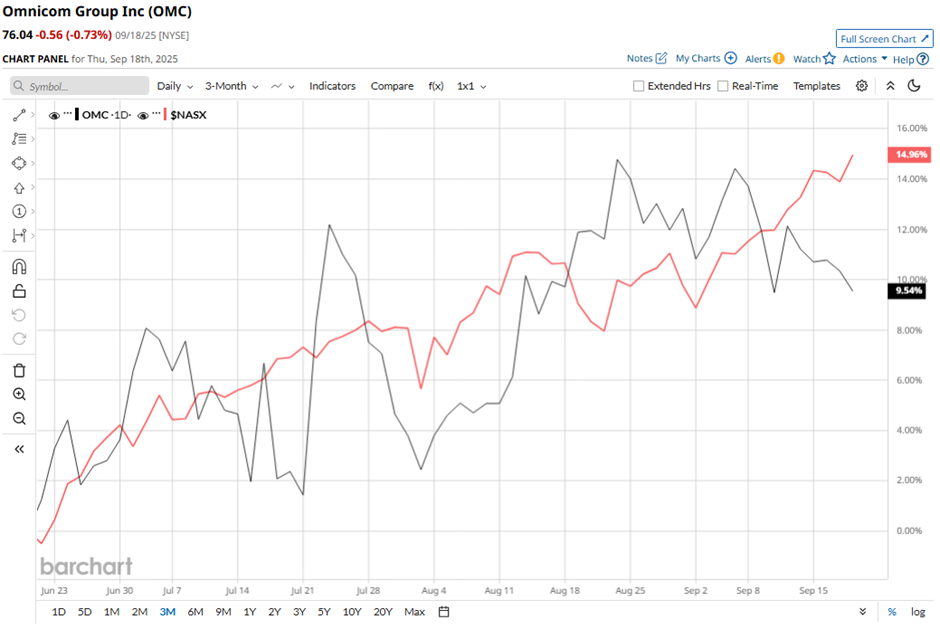

Despite this, shares of the New York-based company have declined 28.9% from its 52-week high of $107. OMC stock has increased 9.5% over the past three months, underperforming the Nasdaq Composite’s ($NASX) nearly 15% return over the same time frame.

In the longer term, OMC stock is down 11.6% on a YTD basis, lagging behind NASX’s 16.4% gain. Moreover, shares of the advertising firm have dropped 25.9% over the past 52 weeks, compared to NASX’s 27.9% surge over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since early December last year. However, it has moved above its 50-day moving average since August.

Shares of Omnicom climbed 4.6% following its Q2 2025 results on Jul. 15 as the company reported adjusted EPS of $2.05 per share, topping estimates. Revenue came in at $4.02 billion, exceeding analysts’ forecast, driven by an 8.2% growth in its largest segment, media and advertising. Investor optimism was further boosted by news that its planned acquisition of Interpublic Group cleared U.S. antitrust review, paving the way for completion in the second half of the year.

Nevertheless, rival The Interpublic Group of Companies, Inc. (IPG) has shown a less pronounced decline than OMC stock. IPG stock has dipped 7.1% on a YTD basis and 16.3% over the past 52 weeks.

Despite the stock’s weak performance, analysts remain moderately optimistic on OMC. The stock has a consensus rating of “Moderate Buy” from the 11 analysts in coverage, and the mean price target of $90.75 is a premium of 19.3% to current levels.