/Old%20Dominion%20Freight%20Line%2C%20Inc_%20outside%20sign-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Thomasville, North Carolina-based Old Dominion Freight Line, Inc. (ODFL) is one of the largest North American less-than-truckload (LTL) motor carriers and provides regional, inter-regional, and national LTL services. With a market cap of $31.2 billion, Old Dominion’s offerings also include various value-added services, including container drayage, truckload brokerage, and supply chain consulting.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Old Dominion fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the logistics industry.

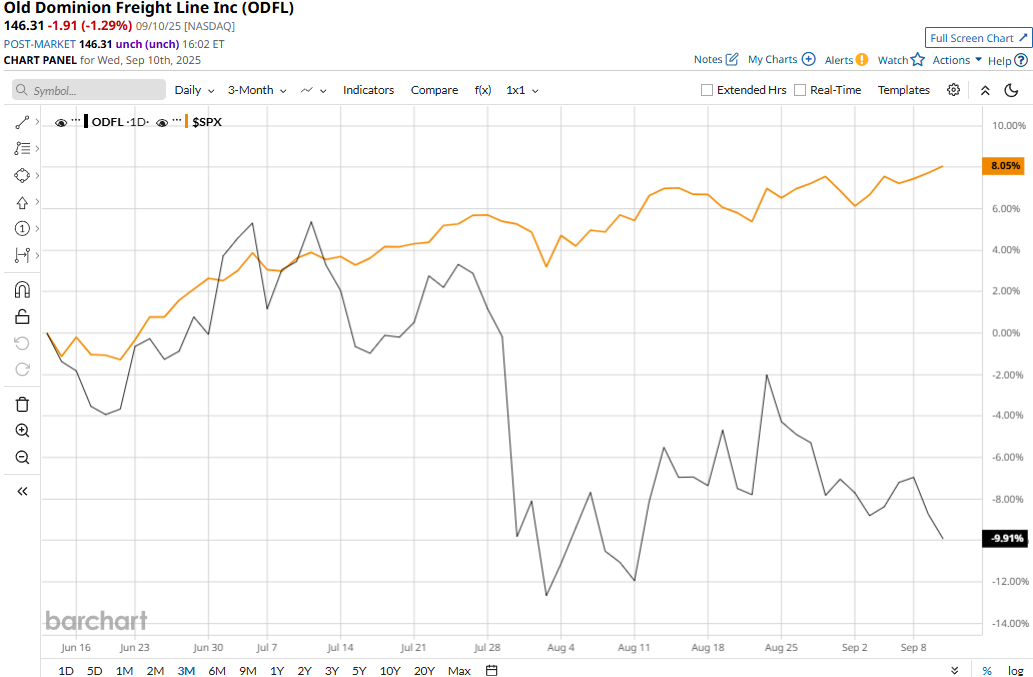

Despite its notable strengths, ODFL stock has plunged 37.3% from its all-time high of $233.26 touched on Nov. 11, 2024. Meanwhile, ODFL has dropped 12.9% over the past three months, notably underperforming the S&P 500 Index’s ($SPX) 8.2% gains during the same time frame.

Old Dominion’s performance has remained grim over the longer term as well. ODFL stock has plunged 17.1% on a YTD basis and 23.5% over the past 52 weeks, outperforming SPX’s 11.1% surge in 2025 and 18.9% returns over the past 52 weeks.

ODFL stock has traded consistently below its 200-day moving average since late February and below its 50-day moving average since late July, highlighting its bearish trend.

Old Dominion’s stock prices plunged nearly 9.7% in a single trading session following the release of its lackluster Q2 results on Jul. 30. Due to continued macroeconomic headwinds and softness in the broader economy, the company’s LTL tons per day decreased by 9.3% during the quarter. This resulted in a 6.1% year-over-year drop in total revenues to $1.4 billion, missing the consensus estimates by 55 bps. Further, the drop in revenues led to deleveraging effects on margin. ODFL’s EPS for the quarter plunged 14.2% year-over-year to $1.27, missing the consensus estimates by 1.6%.

Meanwhile, ODFL has significantly underperformed its peer, XPO, Inc.’s (XPO) 66 bps decline on a YTD basis and 28.7% surge over the past 52 weeks.

Among the 23 analysts covering the ODFL stock, the consensus rating is a “Hold.” Its mean price target of $162.19 suggests a 10.9% upside potential from current price levels.

.jpg?w=600)