/Old%20Dominion%20Freight%20Line%2C%20Inc_%20outside%20sign-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $31.6 billion, Old Dominion Freight Line, Inc. (ODFL) is a leading less-than-truckload (LTL) motor carrier serving customers across the United States and North America. The company provides regional, inter-regional, and national LTL services, along with expedited transportation options.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Old Dominion Freight Line fits this criterion perfectly. It also offers value-added solutions such as container drayage, truckload brokerage, supply chain consulting, and operates extensive service and fleet maintenance centers.

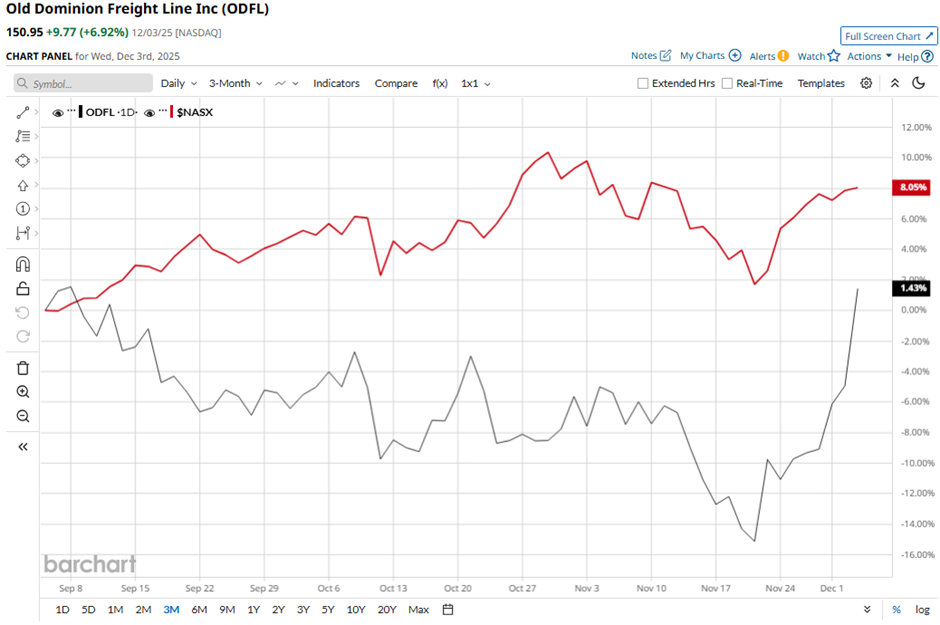

Despite this, shares of the Thomasville, North Carolina-based company have declined 30.8% from its 52-week high of $218.01. ODFL stock has risen 1.9% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 9.1% increase over the same time frame.

In the longer term, the stock is down 14.4% on a YTD basis, lagging behind NASX’s 21.5% gain. Moreover, shares of the trucking company have decreased nearly 31% over the past 52 weeks, compared to NASX’s 20.4% return over the same time frame.

Despite a few fluctuations, ODFL stock has been trading mostly below its 50-day and 200-day moving averages since last year.

Shares of ODFL recovered marginally on Oct. 29 after the company reported Q3 2025 EPS of $1.28 and revenue of $1.41 billion, surpassing forecasts. Despite year-over-year declines, investors responded positively to the company’s ability to maintain strong operating metrics, such as 99% on-time service, and solid cash generation of $437.5 million.

In contrast, rival XPO, Inc. (XPO) has outpaced ODFL stock. Shares of XPO have risen 6.6% on a YTD basis and declined 8.9% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on Old Dominion. The stock has a consensus rating of “Moderate Buy” from 24 analysts in coverage, and the mean price target of $155.23 is a premium of 2.8% to current levels.