Historically, October has been a volatile month for US stock indexes, with 8 of the 15 largest moves registered during the month.

-

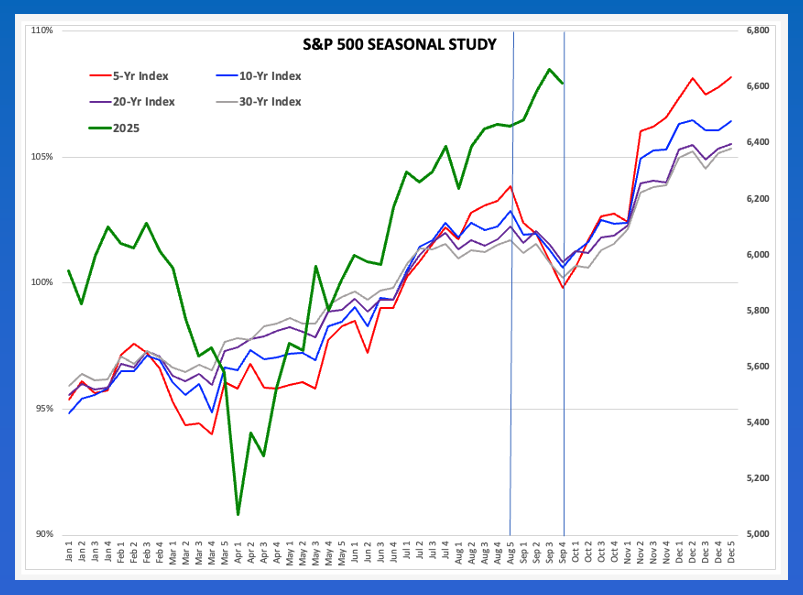

From a seasonal analysis point of view, the S&P 500 tends to trend up during October and Q4 of the financial year.

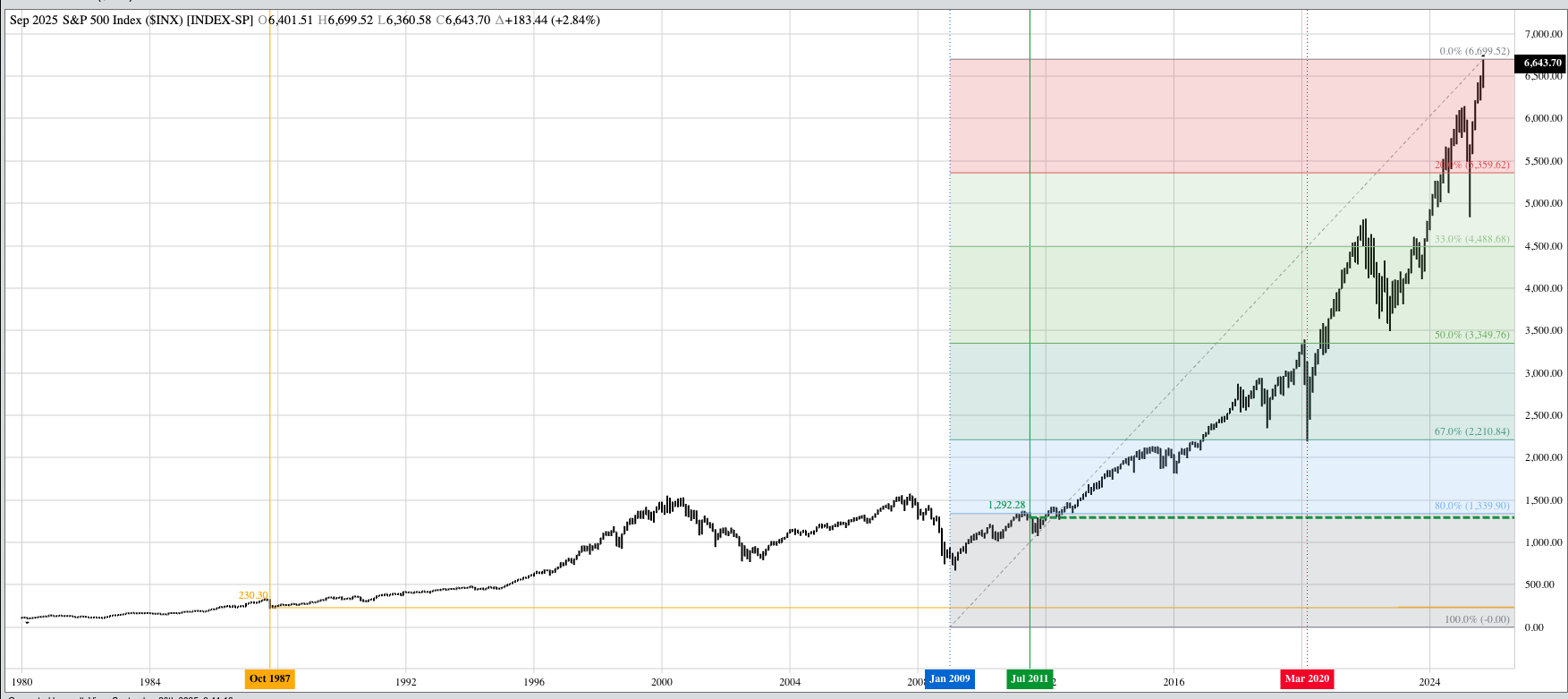

More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter. The bottom line is, as Rule #7 states, “Stock markets go up over time”.

There’s a long-held belief that October is a “scary” month for the US stock indexes. This idea implies, particularly with those folks stupid enough to equate stock markets with the economy in general, that October is a bearish month. A quick trip down memory lane brings to mind two key dates (or series of dates): October 1929, the Wall Street Crash of 1929, aka the Great Crash that included Black Thursday (October 24) and Black Tuesday (October 29); and of course Black Monday (or Black Tuesday, depending on where one was in the world) on October 19, 1987[i].

However, a quick search of the phrase “biggest stock market moves” provides interesting results. If we narrow our lists down to days when the Dow Jones Industrial Average ($DOWI), our grandparent’s stock market, move 10% or more the list has 9 up days:

- March 15, 1933, 15%

- October 6, 1931, 15%

- October 30, 1929, 12% (Note the year)

- March 24, 2020, 11%

- September 21, 1932, 11%

- October 13, 2008, 11%

- October 28, 2008, 11%

- October 21, 1987, 10% (again, the year)

- August 3, 1932, 10% (rounded up from 9.5%)

And 6 down days:

- October 19, 1987, 22.6% (still the record large one day change by percent for the DJIA)

- March 16, 2020, 13% (Covid-19)

- October 28, 1929, 13%

- October 29, 1929, 12% (a rough 2-day total)

- March 12, 2020, 10% (Covid-19, again)

- November 6, 1929, 10%

To summarize:

- Of the 15 days showing a change of 10% or more, 8 of them occurred during October with 5 to the upside and 3 to the downside.

Therefore, in regard to the term “scary”, if we equate it to “Volatile”, then the answer to the question is, “Yes, October is a ‘scary’ month for US stock indexes”.

Shifting our focus to the S&P 500 ($INX), from a seasonal analysis point of view, what should we expect to see from the end of September through Halloween? Keep in mind my brand of seasonal analysis is based on weekly closes-only, with these closing prices compared to average percent change per week, creating index values, over a variety of years. For example, my study of the S&P 500 compares the current[ii] year, in this case 2025, to the previous 5-year index, 10-year index, 20-year index, and 30-year index. As the last full week of September ended:

- The S&P 500 closed at 6,615.18, up 2% from the last weekly close of August at 6,460.26

- Note this was a contra-seasonal move as the S&P tends to move lower during September

- The 5-year seasonal index shows an average loss of 4%

- The 10-year index an average loss of 2%

- The 20-year index an average loss of 1%

- The 30-year index an average loss of 2%

- Once the calendar page turns to October

- The 5-year index shows an average gain of 3%

- The 10-year index shows an average gain of 1%

- The 20-year index shows an average gain of 1%

- The 30-year index shows an average gain of 2%

This study also shows Q4 of the financial year tends to be bullish as well.

- During Q4 (October-November-December)

- The 5-year index shows an average gain of 8%

- The 10-year index shows an average gain of 5%

- The 20-year index shows an average gain of 5%

- The 30-year index shows an average gain of 5%

- Setting aside the outlier 5-year index, and based on the last Friday’s close of 6,615.18, the seasonal target for the a the close the last week of December would be near 6,945.00.

Last, but certainly not least, we can see the rationale behind Newsom’s Market Rule #7 (out of 7): Stock markets go up over time. Again, if we take the foolish notion of “stock markets are the economy” to heart, the long-term monthly chart for the S&P 500 would tell us the economy has done nothing but improve since the dawn of time. That is if one believes in the concept of “economy” to begin with, a subject for another day.

[i] This is also the event that brought me into the business of market analysis.

[ii] Sorry Tony D., but this time “accurate” is the correct word.