Nvidia’s shares soared recently after the company shared better-than-expected first-quarter results along with rosy guidance for the second quarter. Analysts were hoping for sales of $6.5 billion and $0.92 in earnings per share in Q1. Instead, Nvidia (NVDA) reported $7.2 billion and $1.09 because of solid demand for its fast GPU semiconductor chips and software from data centers.

The first-quarter numbers were solid, but not nearly as striking as the company’s guidance second-quarter outlook. Nvidia expects to deliver revenue of $11 billion, far higher than Wall Street analysts’ $7.2 billion projection.

It’s rare to see such a big spread between guidance and expectations, so unsurprisingly, investors flocked to the stock. Optimism may be warranted. However, stocks don’t go up or down in a straight line, and shares are arguably a bit pricey after their meteoric rise.

Wu Jun/VCG via Getty Images

ChatGPT Sparked an AI frenzy

When OpenAI's ChatGPT launched in November, it woke Main Street up to the potential associated with generative AI, or the process of computers creating text, photos, videos, code, data, art, or other content based on AI training on large language models.

The rapid adoption of ChatGPT – over 1 million users signed up in the first week it was available – sparked an AI frenzy. Microsoft (MSFT) quickly announced the incorporation of ChatGPT into its Bing search engine to win more share in the $300 billion global search market. Shortly after, Alphabet (GOOG) responded by releasing its generative AI bot, Bard.

It's not just big-cap technology companies rushing to invest in AI either. For example, JP Morgan (JPM) is reportedly developing its own AI service for personal finance. I suspect companies across most industries are evaluating possible use cases.

As a result, soaring interest in AI means a lot of money will flow to the technology suppliers necessary for training AI programs, including Nvidia. On the company's earnings conference call, Nvidia’s CEO Jensen Huang pointed out that most of the investment in cloud computing infrastructure has focused on CPUs, rather than GPUs (like those it produces) that can accelerate AI development.

The potential to replace old technology with faster chips and software specially designed for the heavy computing needs of AI represents a massive opportunity. So, it's unsurprising that investors rushed to buy Nvidia's shares, as well as shares in other companies touting AI’s possibilities, including Marvell Technology (MRVL). Marvell Technology shares jumped over 20% last week after it reported its AI sales will double in the coming year.

Nvidia’s valuation raises eyebrows

There’s little argument that Nvidia is positioned to benefit from rising spending on AI. Its chips and software are specifically designed to handle the heavy workloads associated with training and operating AI systems. However, investor optimism may have already priced in a good chunk of the upside opportunity for profit.

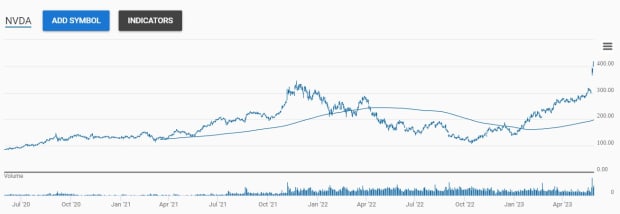

The spike in Nvidia’s share price means the stock is trading 61 times Wall Street’s earnings estimate for fiscal 2024 and 44 times its outlook for 2025. That’s not cheap, considering its 5-year P/E low is 18.

Nvidia’s AI opportunity deserves a premium valuation, but how much of a premium is questionable. After all, if AI experiences any hiccups, including the passage of regulation that slows development, shares could drop. For perspective, applying a 30 multiple to 2024 earnings estimates (a still relatively rich valuation) nets a share price below $200 – half of where it sits today.

One Stock We Believe Will Win in The AI Race (It's not Nvidia!).

Nvidia isn’t cheap relative to sales, either. The price-to-sales ratio using trailing 12-month revenue exceeds 35, double the level it traded at in April 2022 and triple levels from late last October when shares traded below $120.

For comparison’s sake, Google and Microsoft boast price-to-sales ratios of five and 11, respectively. Software giant Salesforce (CRM), which has long commanded a high price-to-sales ratio, trades at six times sales, while cloud-software giant Snowflake (SNOW) trades at 22 times sales.

Nvidia’s shares are extended based on technical analysis too. The company’s shares are trading about 100% higher than its 200-day moving average. Although it traded at a new 52-week high on Tuesday, it closed at the low of the day, suggesting sellers are lurking above current prices.

Nvidia may be a long-term opportunity with short-term risk

The valuation and technical concerns could mean that, at a minimum, shares are due for a breather. Stocks don’t go up or down in a straight line, and vertical moves higher, as we witnessed with Nvidia, are usually followed by some sideways digestion or a retreat back toward key moving averages. As a result, short-term investors may want to put some profit in their pocket in case shares slide.

However, long-term investors may want to focus less on the short-term possibility that shares have pulled forward optimism and more on the long-term potential Nvidia thrives because of the need to upgrade legacy equipment to handle the requirements of AI.

This potential is why analysts' EPS estimates have increased to $10.37 from $6.05 in the past month alone. If Nvidia over-delivers again next quarter, further increases to estimates will make shares appear a lot less expensive than they are today.