Danish pharmaceutical giant Novo Nordisk A/S (NVO) is facing serious headwinds. After enjoying a strong run fueled by demand for its obesity treatments, the obesity drug pioneer is now under pressure from rising competition, particularly from Eli Lilly’s (LLY) weight-loss drugs, as well as trial setbacks for its next-generation therapies. In fact, things took a sharp turn on July 29, when the company cut its full-year sales growth guidance for the second time in just three months and named a new CEO.

The market response was swift and brutal, with NVO shares plunging over 21% in a single day. Now, with second-quarter earnings just around the corner on Aug. 6, does Novo Nordisk’s recent plunge present a golden buying opportunity, or is it a clear signal to keep your distance?

About Novo Nordisk Stock

Best known for its blockbuster weight-loss drugs Ozempic and Wegovy, Novo Nordisk is a global healthcare leader with a long-standing focus on chronic disease. Founded in 1923 and headquartered in Denmark, the company has built a strong foundation in diabetes care while expanding its reach into obesity and other severe health conditions. The company commands a market capitalization of about $217.9 billion.

While Novo Nordisk has been a trailblazer in the obesity drug market, its stock has hit a rough patch. Softer demand for its blockbuster drugs, combined with intensifying competition in the weight-loss space, has taken a toll on investor sentiment. The stock has tumbled a staggering 66% from its 52-week high of $139.74 reached in August 2024, and it's currently down 44.7% year-to-date (YTD).

In stark contrast, the broader S&P 500 Index ($SPX) has managed to notch a gain of approximately 7.1% over the same period, while its rival Eli Lilly has seen only a marginal drop so far this year, highlighting just how far Novo has fallen out of favor with the market.

Given its underwhelming price action, Novo Nordisk stock is starting to look like a value play. Currently trading at just 12.5 times forward earnings, it’s priced well below the sector median of 16.87x, and dramatically lower than its own five-year average of 30.92x.

Novo Nordisk’s Q1 Earnings Snapshot

In early May, Novo Nordisk posted a solid first-quarter earnings report for fiscal 2025, but the shine was dulled by a cautious outlook. Total revenue climbed 19% year-over-year (YOY) to 78.1 billion Danish kroner, powered by a massive 85% surge in Wegovy sales, which hit 17.4 billion Danish kroner. Ozempic also continued to perform, with sales rising 18% to 32.7 billion Danish kroner.

Profits also impressed, with net profit climbing 14% to 29 billion Danish kroner, while operating profit increased 22% to 38.8 billion Danish kroner. But despite these promising numbers, Novo trimmed its full-year sales growth and operating profit growth guidance, citing “lower-than-planned penetration of branded GLP-1 treatments in the US.”

The company pointed to the growing presence of U.S. compounding pharmacies, which have been legally producing copycat versions of Wegovy and Ozempic under an FDA-approved exemption for addressing drug shortages. That growing parallel market has begun to chip away at Novo’s momentum.

On a more promising note, the company completed its REDEFINE 2 trial during the quarter, with its next-generation drug CagriSema delivering an impressive 15.7% weight loss in patients with obesity or overweight conditions and type 2 diabetes. Novo plans to file for its first regulatory approval in early 2026, potentially marking the next significant chapter in its obesity pipeline.

Novo Nordisk Slashes Guidance Again and Names New CEO

On July 29, Novo Nordisk held a conference call that left investors rattled, as it unveiled major leadership changes and another sharp downgrade to its 2025 financial outlook. The company slashed its full-year sales growth guidance to 8%-14%, down from the previously expected 13%-21%. Operating profit growth was also revised lower, now projected at 10%-16% compared to May’s forecast of 16%-24%.

The revised outlook sent a strong signal that Novo is bracing for a more challenging year ahead. A big part of the pressure comes from its obesity blockbuster, Wegovy. In its update, Novo pointed to several headwinds weighing on U.S. sales, including the continued rise of compounded GLP-1 knockoffs, slower-than-expected market expansion, and increasing competition.

These challenges have clouded the outlook for one of Novo’s key growth drivers, sparking concerns about whether the company can maintain its dominance in the rapidly growing weight-loss market. Adding to the uncertainty, Novo also announced a leadership shake-up. Maziar Mike Doustdar, the current EVP of international operations, will take over as CEO on Aug. 7, succeeding Lars Fruergaard Jørgensen, whose surprise resignation was announced in May.

The transition comes at a pivotal moment, with the company under pressure to protect market share and reignite growth amid shifting dynamics in the obesity drug landscape.

What Do Analysts Think About Novo Nordisk Stock?

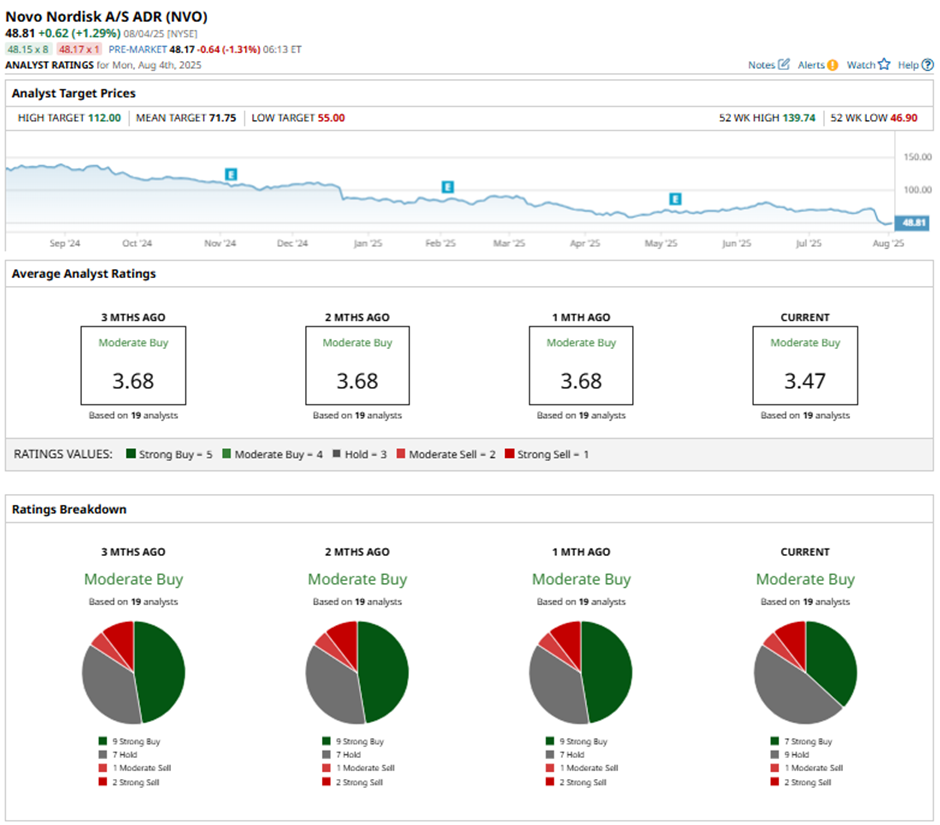

Despite all the swirling uncertainty, there’s still a hint of optimism in the air. With Novo Nordisk set to unveil its Q2 earnings on Aug. 6 and a new CEO stepping in shortly after, Wall Street hasn’t lost faith, with analysts leaning cautiously bullish, giving the stock a consensus rating of “Moderate Buy” overall.

Of the 19 analysts offering recommendations, seven advise a “Strong Buy,” nine suggest a “Hold,” one advocates a “Moderate Sell,” and the remaining two maintain a “Strong Sell.” NVO’s average analyst price target of $71.75 suggests 47% potential upside from current levels. However, the Street-high target of $112 implies that shares can rally as much as 129.5% from current price levels.