/Northrop%20Grumman%20Corp_%20phone%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $83 billion, Northrop Grumman Corporation (NOC) is a leading global aerospace and defense technology company. The company delivers advanced systems and solutions across air, land, sea, space, and cyberspace, supporting government and commercial customers worldwide.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Northrop Grumman fits this criterion perfectly, exceeding the mark. Its diverse portfolio spans autonomous systems, cyber, C4ISR, strike, space, and logistics and modernization.

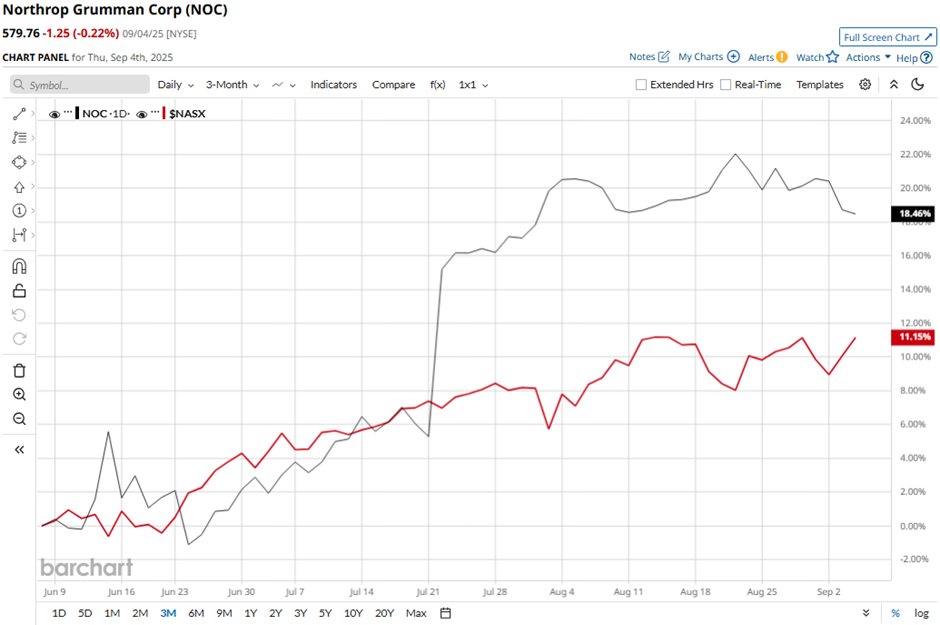

Despite this, shares of the Falls Church, Virginia-based company have declined 3.5% from its 52-week high of $600.99. NOC stock has soared over 18% over the past three months, outpacing the Nasdaq Composite’s ($NASX) 11.6% increase over the same time frame.

In the longer term, NOC stock is up 23.5% on a YTD basis, outperforming NASX’s 12.4% gain. However, shares of the defense contractor have increased 10.7% over the past 52 weeks, lagging behind NASX’s 27.1% return over the same time frame.

Yet, NOC stock has been trading above its 50-day and 200-day moving averages since July.

Shares of Northrop Grumman climbed 9.4% on Jul. 22 after the company posted stronger-than-expected Q2 2025 adjusted EPS of $7.11 and revenue of $10.4 billion. Net income also surged to $1.17 billion, or $8.15 per share. Additionally, the company raised its 2025 annual profit forecast to $25 per share - $25.40 per share, signaling strong demand for its military aircraft and defense systems amid ongoing geopolitical tensions.

Nevertheless, rival Howmet Aerospace Inc. (HWM) has outpaced NOC stock. HWM stock has climbed 64.2% on a YTD basis and 90.3% over the past 52 weeks.

Despite the stock’s underperformance over the past year, analysts remain moderately optimistic on Northrop Grumman. NOC stock has a consensus rating of “Moderate Buy” from 22 analysts in coverage, and the mean price target of $598.54 is a premium of 3.2% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.