Valued at a market cap of $83.2 billion, Newmont Corporation (NEM) is one of the world’s largest gold producers. The company operates across North America, South America, Australia, and Africa, with fully owned mines such as Tanami in Australia and Ahafo and Akyem in Ghana.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Newmont fits this criterion perfectly. In addition to gold, Newmont explores for copper, silver, zinc, lead, and other metals, with a global presence spanning the U.S., Canada, Mexico, Peru, Argentina, Chile, and beyond.

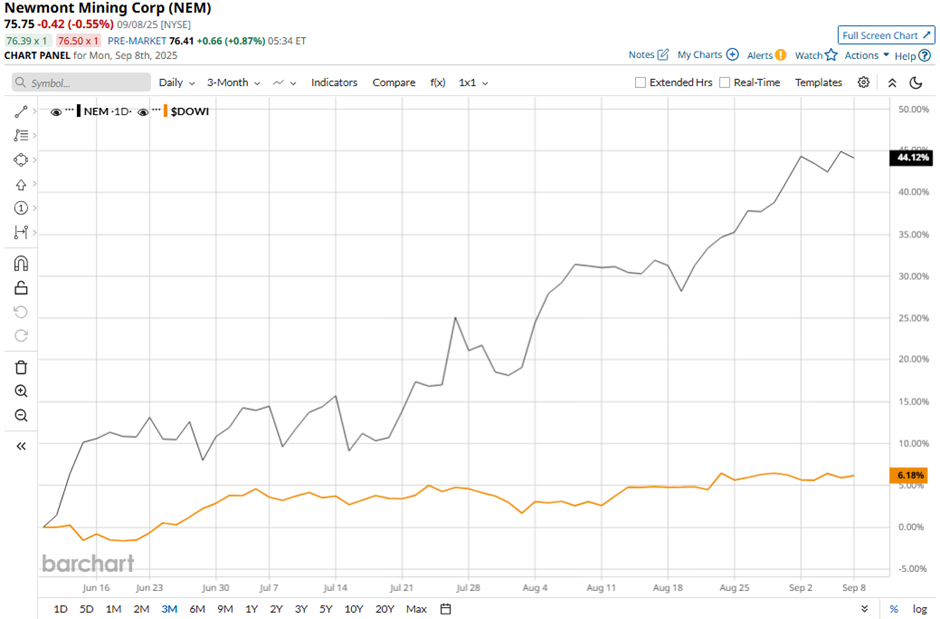

Shares of the Denver, Colorado-based company have declined over 2% from its 52-week high of $77.30. Over the past three months, Newmont's shares have surged 44.7%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 6.4% rise during the same period.

Longer term, NEM stock has climbed 103.5% on a YTD basis, significantly outpacing DOWI's nearly 7% gain. Moreover, shares of the gold and copper miner have soared 50.5% over the past 52 weeks, compared to DOWI’s 12.8% increase over the same time frame.

NEM stock has been in a bullish trend, consistently trading above its 50-day moving average since January. Also, the stock has remained above its 200-day moving average since early February despite a few fluctuations.

Shares of Newmont jumped 6.9% after Q2 2025 results on Jul. 24 as adjusted EPS of $1.43 topped expectations, driven by higher realized gold prices. The company reported revenue of $5.32 billion, supported by an average realized gold price of $3,320/oz, up from $2,347/oz a year earlier, which more than offset an 8% decline in production to 1.48 million ounces and a 2% rise in all-in sustaining costs to $1,593/oz.

However, NEM stock has lagged behind its rival, AngloGold Ashanti plc (AU). AU stock has jumped 169.5% YTD and 118.1% over the past 52 weeks.

Despite the stock’s strong performance relative to the Dow, analysts remain cautiously optimistic about its prospects. NEM stock has a consensus rating of “Moderate Buy” from 22 analysts in coverage, and as of writing, the stock is trading above the mean price target of $74.17.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.