/MSCI%20Inc%20magnified%20website-by%20Mehaniq%20via%20Shutterstock.jpg)

New York-based MSCI Inc. (MSCI) is a leading provider of investment decision support tools, best known for its global indexes, risk and portfolio analytics, and ESG/climate solutions. With a market cap of $44 billion, the company operates under four segments: Index, Analytics, ESG and Climate, and All other- Private Assets.

Companies worth $10 billion or more are typically referred to as "large-cap stocks." MSCI fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the Financial Data & Stock Exchanges industry.

The company benefits from high margins and sticky clients, despite risks from market volatility, rising costs, and competition from other index and data providers.

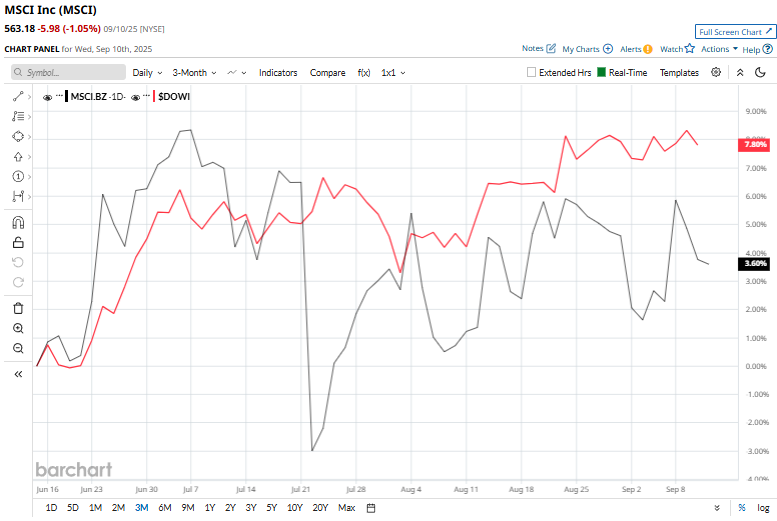

However, the stock has retreated 12.3% from its 52-week high of $642.45 touched on Dec. 12, 2024. Shares of MSCI have grown marginally over the past three months, trailing the broader Dow Jones Industrial Average’s ($DOWI) 6.1% rise during the same time frame.

Shares of MSCI have risen marginally over the past 52 weeks, underperforming $DOWI’s 11.7% returns over the same time frame. Moreover, MSCI stock is down 6.1% on a YTD basis, compared to $DOWI’s 6.9% uptick.

MSCI has been predominantly trading below its 50-day and 200-day moving averages since mid-July, reinforcing a bearish trend.

On July 22, MSCI posted strong Q2 2025 results, with revenue climbing nearly 9% to $772.7 million and adjusted EPS rising 15% to $4.17, both topping analyst expectations. However, shares fell about 8.9% as investors focused on weaker net new subscriptions and headwinds in ESG-related growth.

Its peer, Coinbase Global, Inc. (COIN), has grown 27% in 2025 and 99% over the past year, outpacing the stock.

Analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 20 analysts covering it, and the mean price target of $631.81 implies a premium of 12.2% from the current market prices.