Thanks to a series of government initiatives, the rare earth minerals industry is finally getting its time in the spotlight.

That has been great news for MP Materials (MP), the only company that has an operational rare earth mine within the U.S. Government deals and a recently announced partnership with Apple (AAPL) are juicing shares, which are now up more than 300% in 2025.

Is there still gas left in the tank for MP stock? Or is the current wave of rare earth excitement already priced in?

Let’s dive into these recent developments, and whether this recent stock surge is one that investors should still try to play.

What to Know About MP’s Pentagon, Apple Deals

The first major catalyst for MP Materials is its deal to supply Apple with $500 million in rare earth magnets. This will also cover the development of a recycling facility to help strengthen Apple’s rare earth supply chain.

This deal led to a 20% surge in MP stock as it indicates a long-term agreement with Apple, one of the largest and most important companies in the world. This deal should secure years of revenue and earnings growth for the company as Apple works to secure a more stable supply chain.

Now, I’m not expecting Apple to on-shore much of its device production, if any, to the U.S. market given the much lower cost of producing its hardware overseas. But I also think that this supply chain diversification should be a net positive for Apple, a company that’s felt the brunt of the geopolitical headwinds we’ve seen materialize lately. Plus, with much of the world’s rare earth minerals supply coming from China, securing some U.S. production provides a safety net if trade tensions escalate again.

For MP Materials, this deal is undoubtedly a signal that major tech players are starting to take these minerals more seriously, and are looking to lock in supply where they can. If Apple’s Magnificent 7 peers jump aboard this bandwagon, MP stock could continue to soar.

The second catalyst for MP is news that the U.S. Department of Defense has become the largest shareholder of MP Materials. The Pentagon is investing $400 million in hopes of boosting U.S. production of these minerals. The reason the government is so keen on this arrangement is that rare earth minerals are key components of everything from electric vehicles to fighter jets.

MP Materials’ Fundamentals Set to Improve

Looking at MP Materials’ current state, it is clear this is a difficult stock to value. For one, MP Materials is not yet profitable, and analysts expect it to report a loss per share of $0.19 in the current quarter.

The company also trades at a steep 49 times sales, and MP Materials has a -9.8% return on assets and a -4.5% return on equity.

Of course, as a relatively early stage company in an industry set to explode, investors are looking much further down the road. And given the recent run-up in MP stock, it’s clear that many investors think the light at the end of the tunnel may be just ahead. The consensus is for the company to report its first first per-share profit in 2026.

Does Wall Street Like MP Stock?

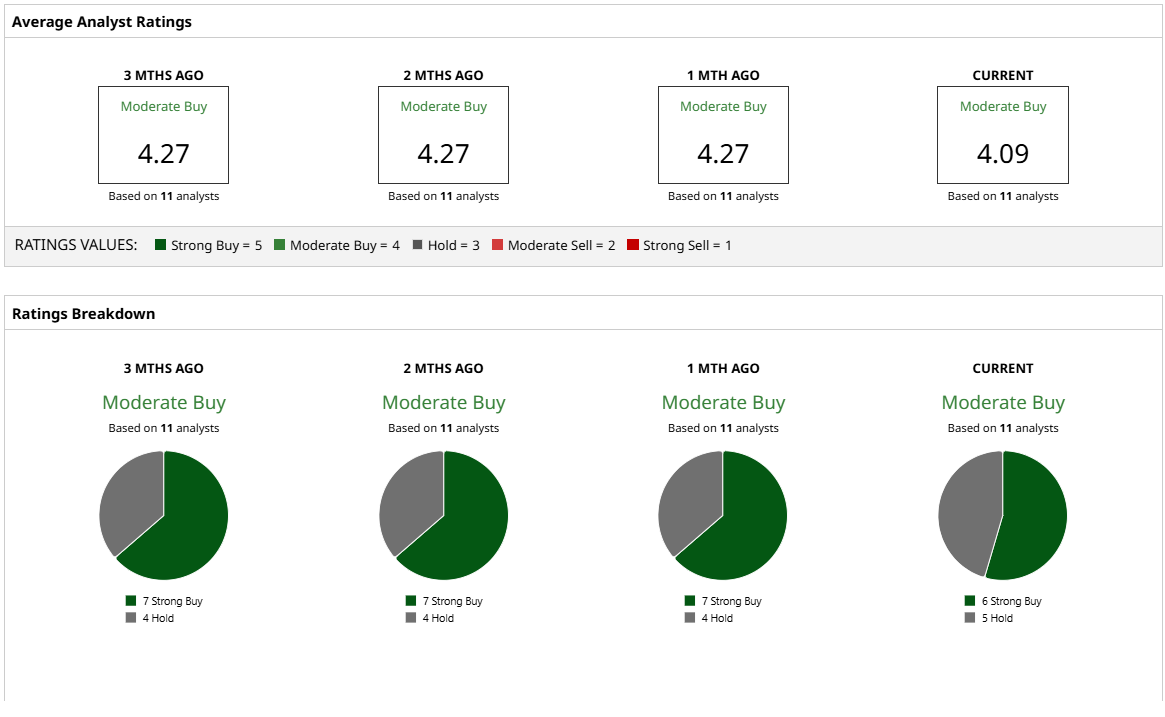

However, the analyst consensus on its current price is less than encouraging. The current consensus price target for MP stock is $46.18, more than 25% below its current price.

What’s interesting is that there are currently six “Strong Buys” and five “Holds” on this stock, suggesting that many of these price targets were likely put in place back when MP stock was trading around the $20 level. Its recent surge has been absolutely massive, and it may be hard for new investors to step in front of it here. Of course, we’ll have to see if this momentum can continue.

Personally, I tend to think that moves that take place in such rapid fashion are ones that investors ought to view with some level of skepticism. If the company can indeed show a viable pathway to profitability over the next year, perhaps this valuation bump is more than warranted. Until then, I’m going to watch this one from the sidelines.