/Mohawk%20Industries%2C%20Inc_%20magnified%20by-%20Casimiro%20PT%20via%20Shutterstock.jpg)

Calhoun, Georgia-based Mohawk Industries, Inc. (MHK) designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels. With a market cap of $7.9 billion, Mohawk Industries’ operations span the Americas, Europe, and Indo-Pacific.

Companies worth between $2 billion and $10 billion are generally described as "mid-cap stocks." MHK fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the furnishings, fixtures & appliances industry.

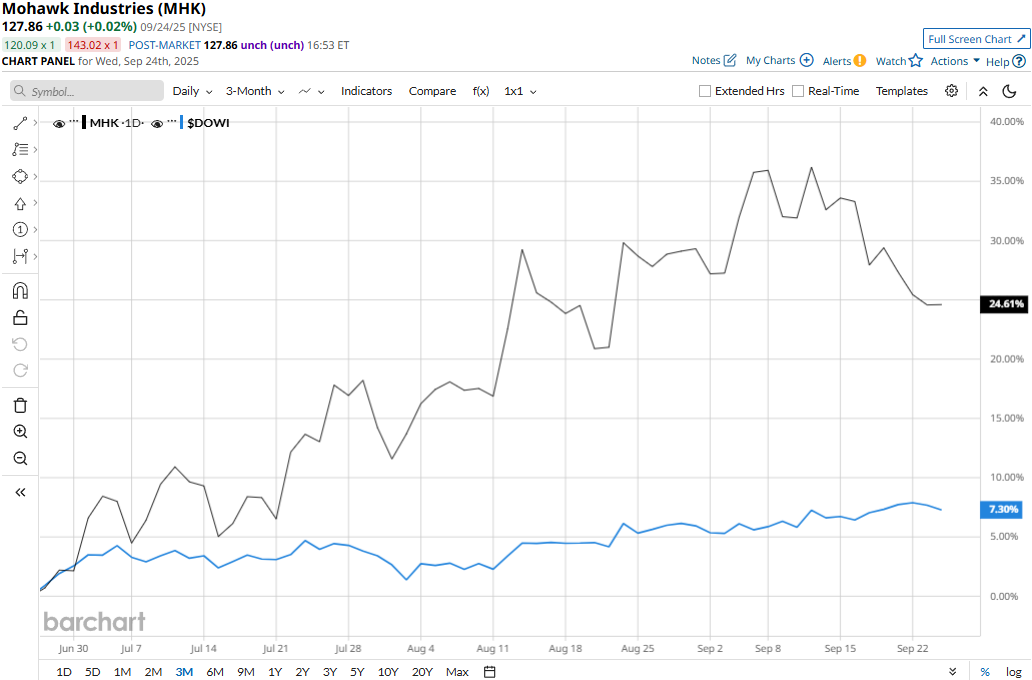

MHK touched its three-year high of $164.29 on Oct. 21, 2024, and is currently trading 22.2% below that peak. However, the stock has soared 23.1% over the past three months, notably outperforming the Dow Jones Industrial Average’s ($DOWI) 7% uptick during the same time frame.

Meanwhile, MHK’s performance has remained much grimmer over the longer term. The stock has gained 7.3% in 2025 but plunged 18.6% over the past 52 weeks, notably underperforming the Dow’s 8.4% gains in 2025 and 9.3% returns over the past year.

The stock traded below its 200-day moving average between December 2024 and July 2025, but climbed above its 50-day moving average in late June, underscoring its previous bearish movement and recent upsurge.

Mohawk Industries’ stock prices gained 4.2% in the trading session following the release of its better-than-expected Q2 results on Jul. 24. The company’s ongoing operational improvements, cost containment actions, and market development initiative have helped it to outperform street estimates. Its net sales for the quarter inched up by a marginal 3 bps year-over-year to $2.8 billion, but surpassed the expectations by 37 bps. Further, its adjusted EPS dropped 7.7% year-over-year to $2.77, but surpassed the consensus estimates by 5.7%, boosting investor confidence.

Nonetheless, when compared to its peer, Mohawk Industries’ performance looks even more concerning. Patrick Industries, Inc. (PATK) has gained 25.3% in 2025 and returned 9.2% over the past 52 weeks, notably outperforming MHK.

Among the 16 analysts covering the MHK stock, the consensus rating is a “Moderate Buy.” Its mean price target of $135.50 suggests a modest 6% upside potential from current price levels.