/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

Microsoft (MSFT) stock has climbed over 45% in six months. The momentum behind this surge stems from its solid financial performance, driven by robust demand for its cloud and artificial intelligence (AI) solutions. Both these areas have become key growth engines for Microsoft’s business and are likely to drive MSFT’s long-term growth.

Microsoft Cloud generated over $168 billion in annual revenue in fiscal 2025, marking a 23% year-over-year increase. Within that, Azure generated more than $75 billion, representing a 34% increase. This growth reflects the expanding adoption of enterprises and rising demand across all types of workloads, from data storage to AI-powered computing.

The tech giant is rapidly building one of the most comprehensive AI product suites and infrastructure stacks in the industry, integrating AI across its platforms. It now operates more than 400 data centers in 70 regions worldwide, strengthening its ability to meet the increasing global demand for cloud and AI services.

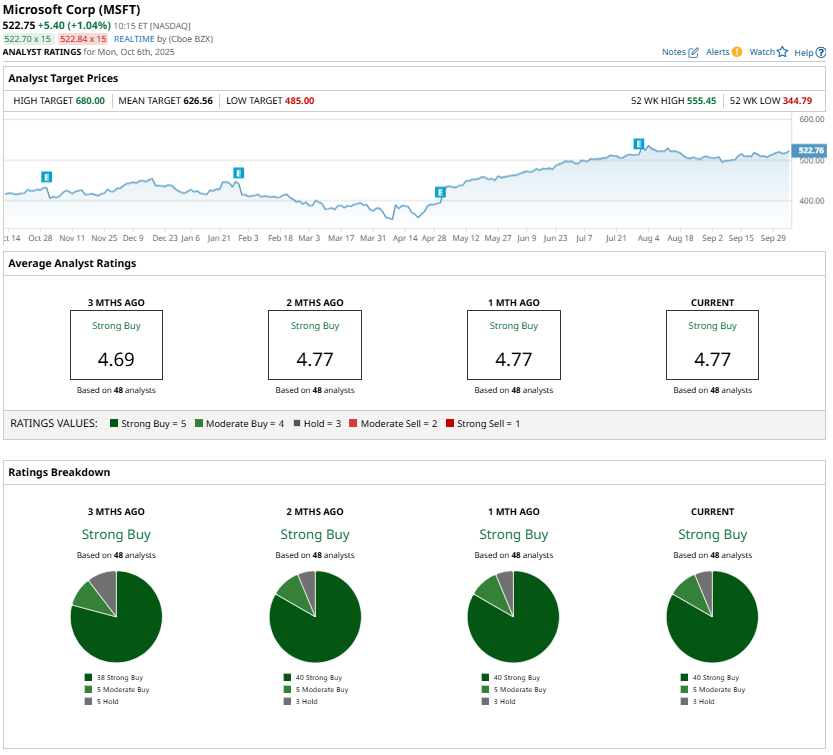

With its dominant commercial cloud business, accelerating demand for cloud and AI-driven solutions, and a robust pipeline of long-term contracts, Wall Street’s sentiment toward the stock remains positive. Meanwhile, the highest price target for Microsoft stock is $680, suggesting potential upside of roughly 31% from its closing price of $517.35 on Oct. 3.

Microsoft’s Growth Trajectory Shows Strong Momentum

Microsoft’s growth trajectory remains solid as the tech giant continues to see solid demand for its cloud computing and AI solutions. Its commercial bookings surpassed the $100 billion mark during the last reported quarter, driven by robust contract renewals and an increase in multiple large-value deals, including several exceeding $10 million and even $100 million across Azure and Microsoft 365.

MSFT’s commercial remaining performance obligation (RPO), a forward-looking indicator of revenue, climbed to $368 billion in the last reported quarter, reflecting a 37% year-over-year increase. Notably, approximately 35% of this RPO is expected to translate into revenue over the next 12 months. Furthermore, the remainder is expected to be recognized in subsequent periods, indicating a stable revenue runway extending well into the future.

The company’s Productivity and Business Processes segment continues to show solid growth, and this momentum will likely be sustained, driven by the ongoing adoption of M365 commercial and consumer products. Looking ahead, the average revenue per user (ARPU) is expected to grow, driven by premium offerings. Paid M365 commercial seats will likely benefit from broad-based adoption. On the consumer side, cloud revenue is expected to continue benefiting from earlier price adjustments and anticipated subscriber growth, highlighting Microsoft’s ability to monetize its ecosystem across multiple markets.

Meanwhile, the Intelligent Cloud segment, led by Azure, will continue to be the key growth catalyst for the company. Large enterprise clients continue to demand Microsoft’s core infrastructure services at a pace that outstrips supply, even as the company steadily expands data center capacity. MSFT’s massive cloud scale and AI capabilities position Azure as a crucial contributor to Microsoft’s growth story.

Microsoft expects Intelligent Cloud revenue to range between $30.1 billion and $30.4 billion in the first quarter of fiscal 2026, with Azure projected to grow roughly 37% in constant currency. This growth is driven by strong demand across a broad portfolio of services, supported by the ongoing expansion of data center capacity.

MSFT’s Road to $680

Microsoft is set to benefit from soaring demand for its cloud and AI solutions. Its cloud platform, Azure, is expected to witness an acceleration in growth as the company ramps up capacity to meet increasing demand. At the same time, Microsoft’s commercial RPO points to a robust revenue pipeline, signaling strong future earnings.

Analysts on Wall Street remain bullish, maintaining a “Strong Buy” consensus rating on MSFT stock.

In short, Microsoft’s large-scale, growing high-value customer deals, focus on innovation, and dominant position in the cloud and AI space position it well to maintain its upward trajectory. Thus, the Street's highest price target of $680 seems well within reach over the next 12 months.